As a seasoned cryptocurrency enthusiast, I’ve been closely following the rollercoaster ride that is the NFT crypto market. The wild fluctuations in nft crypto coins price have captivated investors worldwide, with some reaping impressive gains while others have faced significant losses. In this comprehensive guide, I’ll share my insights and experiences to help you navigate this dynamic landscape and make informed investment decisions.

Understanding the NFT Crypto Coins Price Market: Unveiling the Mysteries

The world of NFTs (Non-Fungible Tokens) has truly revolutionized the way we think about digital ownership and scarcity. These unique crypto assets represent the ownership of one-of-a-kind digital items, ranging from artworks and collectibles to in-game assets and virtual real estate. As an early adopter, I’ve witnessed firsthand the remarkable evolution of this market.

The Allure of NFT Crypto Coins

Inactive cryptocurrency chart

Inactive cryptocurrency chart

What makes NFT crypto coins so appealing to investors? It’s the combination of scarcity, utility, and the potential for astronomical returns. Each NFT is unique, with its value determined by factors such as rarity, community demand, and the real-world applications of the underlying project. As the NFT ecosystem continues to expand, the demand for these digital assets has skyrocketed, fueling a speculative frenzy that has seen some NFTs sell for millions of dollars.

The Cyclical Nature of the NFT Crypto Market

Decentraland

Decentraland

However, the NFT crypto market is not without its challenges. It has exhibited a distinct cyclical pattern, characterized by periods of explosive growth followed by sudden crashes. During bull markets, the hype and frenzy surrounding NFTs can drive prices to dizzying heights, only to be followed by severe bear markets where values plummet. As an experienced investor, I’ve learned to navigate these cycles, carefully timing my entries and exits to capitalize on the market’s ebbs and flows.

Factors Shaping NFT Crypto Coin Prices

When it comes to understanding the fluctuating prices of NFT crypto coins, it’s crucial to consider a variety of factors that influence their valuation. As an NFT enthusiast, I’ve developed a keen eye for analyzing these key elements.

Project Fundamentals: The Foundation of Value

Sandbox

Sandbox

The foundation of any successful NFT crypto coin lies in the strength of the underlying project. I meticulously examine the project’s team, their expertise and track record, the development roadmap, the level of community engagement, and the real-world utility of the NFTs. Strong teams, clear vision, active communities, and practical applications are all hallmarks of promising NFT investments.

Market Capitalization: Gauging the Project’s Dominance

Axie Infinity

Axie Infinity

The market capitalization of an NFT crypto coin is a crucial metric that provides insights into the project’s market dominance and growth potential. Generally, higher market capitalization suggests a more established and stable project, while lower capitalization may indicate higher risk and volatility. As an informed investor, I closely monitor the market cap of the NFT projects I’m interested in, as it can significantly impact their price movements.

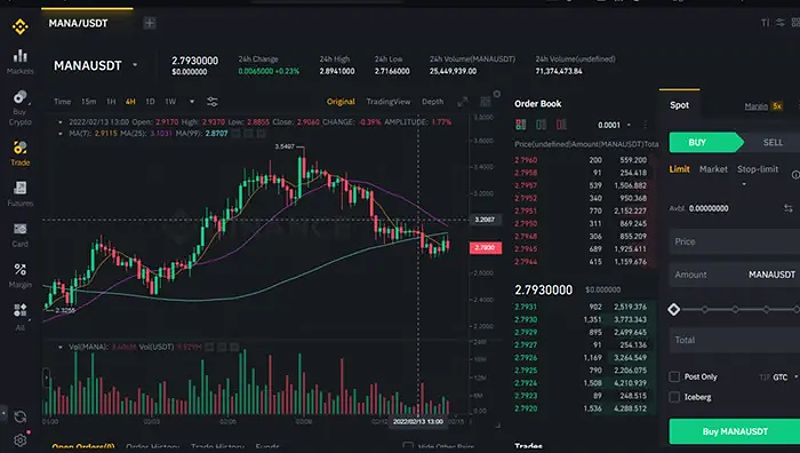

Trading Volume: Unlocking the Secrets of Liquidity

Tezos

Tezos

The trading volume of an NFT crypto coin is another important factor that I analyze. High trading volume typically indicates strong market interest and liquidity, as investors actively buy and sell the tokens. Conversely, low trading volume can suggest a lack of interest or market depth, which can impact the token’s price stability and ease of buying or selling. By closely tracking the trading volume, I’m able to make more informed investment decisions and mitigate the risks associated with illiquid markets.

Navigating the NFT Crypto Coin Investment Landscape

As an experienced cryptocurrency investor, I’ve developed a systematic approach to investing in NFT crypto coins. This strategic framework has allowed me to navigate the market’s complexities and capitalize on emerging opportunities.

Choosing the Right Crypto Exchange

Theta Network

Theta Network

The first step in my NFT crypto coin investment journey is selecting a reputable cryptocurrency exchange that supports NFT trading. I’ve thoroughly researched and tested various platforms, prioritizing factors such as security, user-friendliness, competitive fees, and the availability of a wide range of NFT marketplaces. Platforms like Binance, OpenSea, and Rarible have consistently delivered reliable and seamless NFT trading experiences.

Securing Your NFT Crypto Coins

Best Wallets to Store NFT Tokens

Best Wallets to Store NFT Tokens

Protecting my digital assets is of the utmost importance, so I always ensure that my NFT crypto coins are stored in a secure wallet. I prefer using a hardware wallet, like Ledger or Trezor, as they offer advanced security features and offline storage. Software wallets, such as MetaMask and Coinbase Wallet, also provide convenient access to the NFT ecosystem while maintaining a high level of security.

Conducting Thorough Research and Due Diligence

Before investing in any NFT crypto coin, I make it a point to conduct extensive research and due diligence. I carefully review the project’s whitepaper, analyze the team’s background and experience, engage with the community, and scour independent analyses to gain a comprehensive understanding of the project’s fundamentals, potential risks, and growth prospects. This meticulous approach helps me make informed investment decisions and avoid potential pitfalls.

Navigating the Risks and Opportunities of NFT Crypto Coins

As with any investment, the world of NFT crypto coins presents both risks and opportunities. As an experienced investor, I’ve learned to navigate these complexities with a balanced and strategic mindset.

Mitigating the Risks

The NFT crypto market is undoubtedly volatile, with prices susceptible to rapid fluctuations, market manipulation, and the threat of scams and rug pulls. I’ve developed a risk management strategy that involves diversifying my portfolio, setting stop-loss orders, and maintaining a cautious approach when investing in emerging NFT projects. Additionally, I stay vigilant about regulatory developments, as the evolving legal landscape can significantly impact the stability of the NFT crypto market.

Capitalizing on the Opportunities

Despite the risks, the NFT crypto market also offers tremendous opportunities for those willing to explore and capitalize on its potential. As the Metaverse and other innovative use cases continue to evolve, the demand for unique digital assets is expected to grow exponentially. By staying ahead of the curve, conducting thorough research, and strategically investing in promising NFT projects, I’ve been able to achieve substantial returns on my investments.

Conclusion: Embracing the Future of NFT Crypto Coins

The world of NFT crypto coins is a dynamic and ever-changing landscape, filled with both challenges and exciting prospects. As an experienced investor, I’ve learned to navigate this market with a combination of technical expertise, strategic planning, and a keen eye for emerging trends.

By understanding the key factors that influence NFT crypto coin prices, conducting rigorous research, and investing wisely, you too can navigate this exciting asset class and potentially capitalize on the growth of the NFT ecosystem. Remember, investing in NFTs requires caution, diversification, and a long-term mindset, as the market’s inherent volatility can be both exhilarating and unforgiving.

I encourage you to continue your exploration of the NFT crypto market, stay informed, and experiment with this innovative technology. The future of digital ownership and scarcity is here, and those who embrace it with a strategic and prudent approach may be rewarded with significant returns.

FAQ

How much is NFT crypto worth?

The value of NFT crypto coins can vary significantly, ranging from a few dollars to millions of dollars, depending on factors such as the specific project, the rarity of the NFT, and the prevailing market demand. As an experienced investor, I’ve seen NFTs from prominent collections like Bored Ape Yacht Club sell for astronomical prices, while lesser-known projects may have more modest price points. The key is to thoroughly research the project, assess its long-term potential, and invest accordingly.

What are the best NFT crypto coins to invest in?

There is no one-size-fits-all answer to this question, as the “best” NFT crypto coins to invest in will depend on your individual investment goals, risk tolerance, and the specific projects that align with your research and interests. As an informed investor, I carefully evaluate factors such as the project’s fundamentals, community engagement, utility, and long-term growth potential before making any investment decisions. It’s important to diversify your portfolio and not put all your eggs in one basket when it comes to NFT crypto coins.

How can I find the current price of NFT crypto coins?

To stay up-to-date on the current prices of NFT crypto coins, I regularly monitor leading cryptocurrency exchanges and NFT marketplaces. Platforms like Binance, OpenSea, Rarible, and CoinGecko provide real-time pricing information and historical data, allowing me to track the market movements and make informed investment decisions. Regularly checking these resources is crucial for staying ahead of the curve in the rapidly evolving NFT crypto market.

Are NFT crypto coins a good investment?

NFT crypto coins can be a good investment, but it’s essential to approach this asset class with a well-informed and strategic mindset. As an experienced investor, I’ve seen both significant gains and substantial losses in the NFT crypto market. The potential for substantial returns exists, but so do the risks of volatility, market manipulation, and regulatory uncertainty. Before investing, it’s crucial to carefully consider your financial goals, risk tolerance, and the specific NFT projects you’re evaluating. Diversification, thorough research, and a long-term perspective are key to navigating the NFT crypto market successfully.

Conclusion: Embracing the Future of NFT Crypto Coins

The NFT crypto market is a dynamic and captivating landscape, filled with both challenges and opportunities for savvy investors. By understanding the key factors that influence NFT crypto coin prices, conducting rigorous research, and investing wisely, you can navigate this exciting asset class and potentially capitalize on the growth of the NFT ecosystem.

As an experienced investor, I’ve learned to embrace the complexities of the NFT crypto market, leveraging my technical expertise and strategic planning to navigate its ebbs and flows. By staying informed, diversifying your portfolio, and maintaining a long-term mindset, you too can position yourself for success in this rapidly evolving arena of digital ownership and scarcity.

I encourage you to continue your exploration of the NFT crypto market, stay curious, and experiment with this innovative technology. The future of digital assets is here, and those who approach it with a balanced and prudent approach may be rewarded with significant returns. Embrace the challenge, and let’s embark on this captivating journey together.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON