Is Solana a safe bet for institutional investors? This question looms large as the blockchain ecosystem continues to evolve. The answer is not straightforward and requires a meticulous evaluation of the network’s performance, decentralization, and overall risk profile. This article delves into these critical factors to provide a thorough analysis of Solana’s investment landscape.

Solana’s Network Performance: Assessing Scalability and Reliability

The architecture of Solana is designed to achieve high transaction throughput, which is a primary draw for institutional investors in search of efficient blockchain solutions. However, the network has not been without its challenges. Historical incidents of network congestion and outages have raised concerns about its reliability. Nevertheless, the commitment to improvement is evident, with significant upgrades made to transaction processing and the introduction of new validator clients aimed at bolstering network resilience.

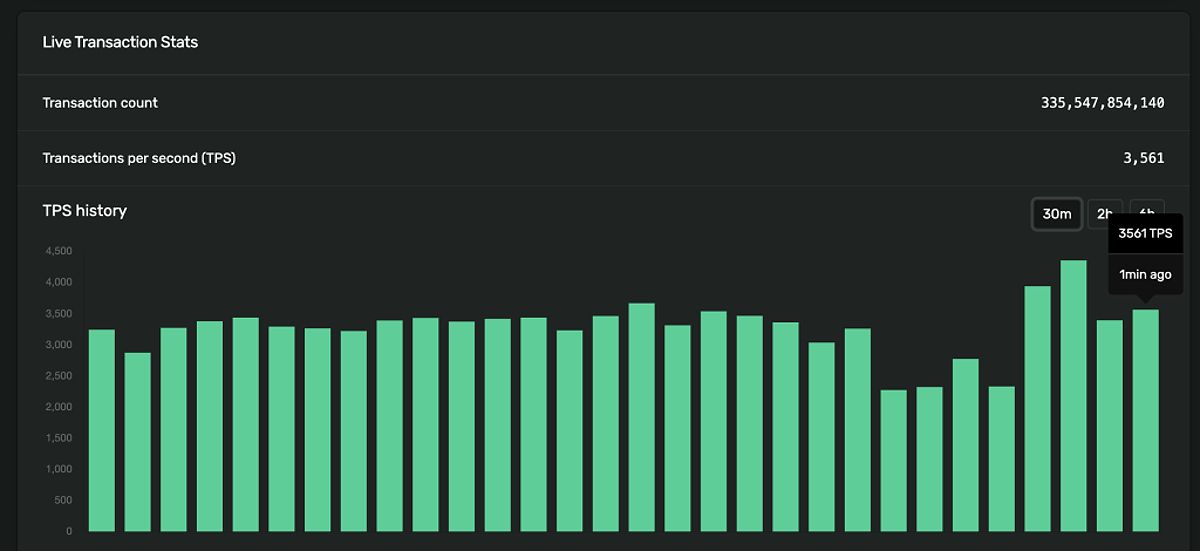

Evaluating Solana’s performance metrics—such as transactions per second (TPS) and uptime—is essential for discerning its viability for large-scale applications. The advancements in network performance have been notable, pointing to a trajectory toward improved stability and broader adoption. It’s crucial for institutional investors to keep a close eye on these performance indicators, as they play a pivotal role in building trust.

Moreover, the implementation of enhanced consensus mechanisms and infrastructure improvements is integral to Solana’s ongoing performance enhancement efforts. These initiatives focus on increasing throughput, minimizing latency, and elevating the overall user experience. The success of these enhancements will ultimately influence Solana’s long-term appeal to institutional investors.

Decentralization and Security: Evaluating Centralization Risks in Solana

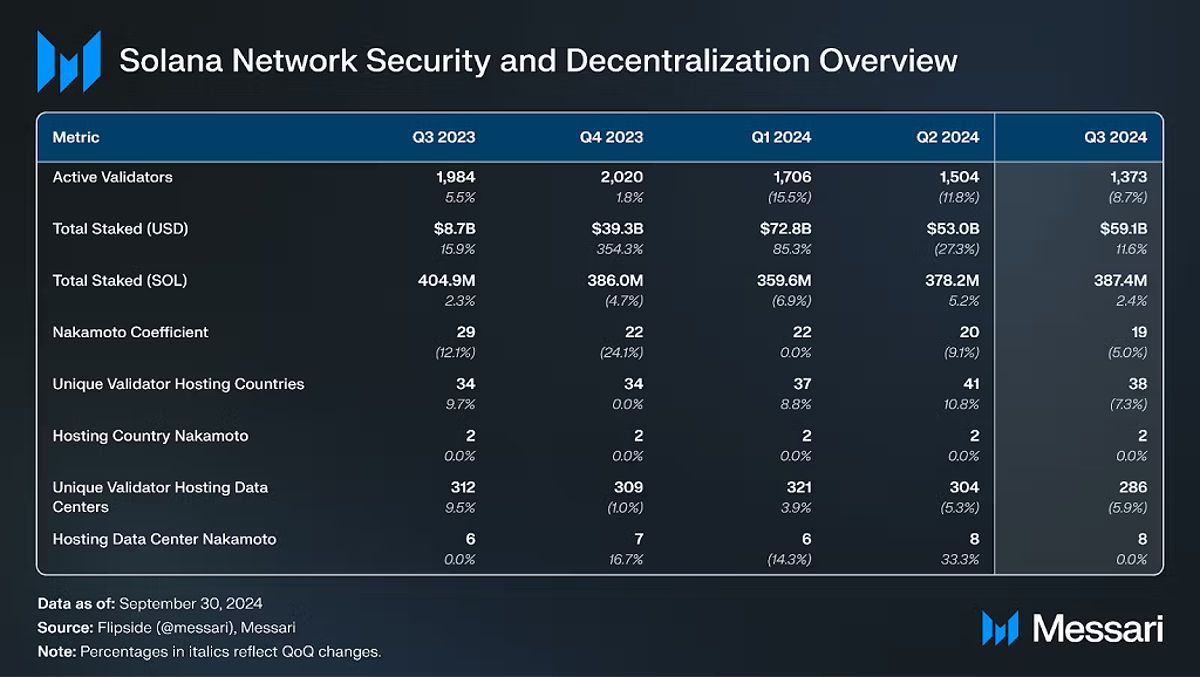

Decentralization is a cornerstone principle for any blockchain aspiring to widespread adoption. Solana employs a delegated proof-of-stake (DPoS) consensus mechanism, which, while efficient, raises questions regarding centralization. The concentration of validator nodes and the influence of certain stakeholders in governance highlight potential vulnerabilities, prompting a thorough assessment of these risks by institutional investors.

Transparency and independent audits are essential tools for addressing these centralization concerns. Ongoing initiatives aimed at enhancing decentralization—such as increasing the number of active validators and diversifying client software—are critical to distributing power more evenly throughout the network. This distribution reduces the risk of single points of failure and fortifies the ecosystem’s security and resilience.

For institutional investors, the success of these decentralization efforts will be a significant factor in determining Solana’s attractiveness as a truly decentralized blockchain platform. Progress in this domain is vital for fostering confidence and trust among institutional participants.

Solana’s Ecosystem and Investment Opportunities for Institutions

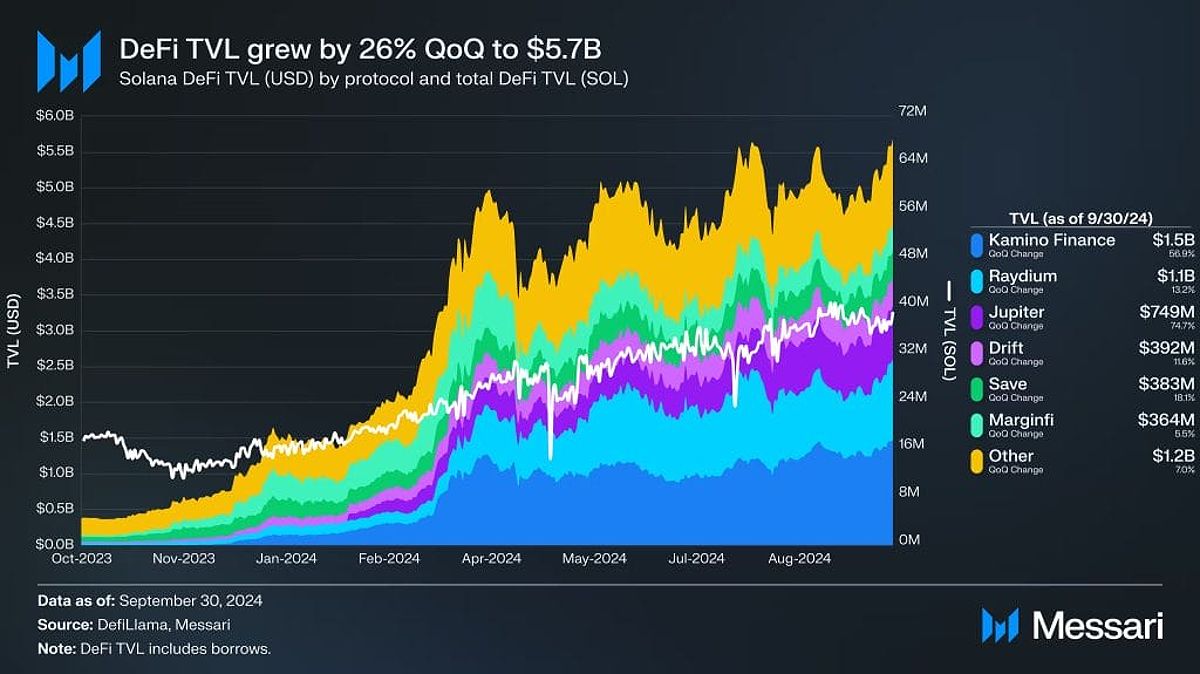

The Solana ecosystem boasts a rapidly expanding array of decentralized applications (dApps), creating diverse opportunities for institutional investors. The swift growth of the decentralized finance (DeFi) sector on Solana, highlighted by a notable increase in total value locked (TVL), presents compelling investment avenues for those seeking exposure to the burgeoning DeFi landscape. However, conducting thorough due diligence on individual projects is paramount to assess their viability and associated risks.

The development of innovative solutions within the Solana ecosystem, including new validator clients and enhanced consensus mechanisms, further bolsters the network’s long-term potential. These advancements contribute to improved scalability, security, and overall performance, making Solana an increasingly appealing platform for developers and users alike. For institutional investors, strategically investing in promising projects within this ecosystem can yield substantial returns, provided that risks and rewards are carefully evaluated.

Navigating the Risks and Rewards of Solana Investment

Investing in Solana carries its share of inherent risks. Market volatility stands out as a significant concern, with price fluctuations capable of resulting in considerable losses. Furthermore, the evolving regulatory landscape surrounding cryptocurrencies adds another layer of complexity. Institutional investors must also consider technological risks, such as potential network vulnerabilities or unforeseen scalability challenges. Additionally, competition from other blockchain networks adds to the landscape’s challenges.

Despite these risks, the potential rewards associated with investing in Solana are substantial. The network’s impressive transaction throughput and the growth of its dApp ecosystem offer significant growth potential. However, a prudent approach is essential—one that emphasizes risk mitigation and diversification to reduce potential losses. A comprehensive understanding of Solana’s technological advancements and its market positioning is crucial for institutional investors navigating the opportunities and challenges presented by this dynamic blockchain platform.

Conclusion

The landscape of institutional investment in Solana is marked by both significant opportunities and considerable risks. A detailed analysis of network performance, decentralization efforts, and the broader ecosystem is vital for informed decision-making. Institutional investors must weigh potential rewards against the inherent risks associated with investing in this evolving blockchain technology. A strategic approach—characterized by thorough due diligence and robust risk management strategies—is essential for maximizing potential returns while minimizing losses. As the blockchain space continues to evolve, careful monitoring of network developments and market trends will be pivotal in navigating the complexities of this dynamic investment environment.

As you consider your next steps in the world of blockchain investments, I challenge you to delve deeper into Solana’s ecosystem. Explore its dApps, assess individual projects, and weigh their potential against the backdrop of the broader market. The journey may be complex, but the insights you gain will be invaluable as you navigate this evolving landscape.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON