As a passionate cryptocurrency investor, I’ve been closely following the rollercoaster ride that is Ripple’s XRP token. The recent surge in its price and the legal victory over the SEC have sparked a flurry of speculation – could XRP really skyrocket to the $10,000 mark? In this deeply researched and personalized article, I’ll dive into the factors that could influence XRP’s price trajectory, assess the feasibility of such a monumental increase, and share practical strategies for investors like myself who are eager to capitalize on this digital asset’s potential.

From Humble Beginnings to Soaring Ambitions

I still remember the early days when XRP was first introduced as a solution to revolutionize cross-border payments. Back in 2017, the token experienced a remarkable price surge, briefly becoming the second-largest cryptocurrency by market cap. However, the euphoria was short-lived, as the value tumbled in the following years due to the ongoing legal battle with the SEC. As a woman in the crypto space, I’ve witnessed firsthand the uncertainty and challenges that XRP investors have faced during this tumultuous period.

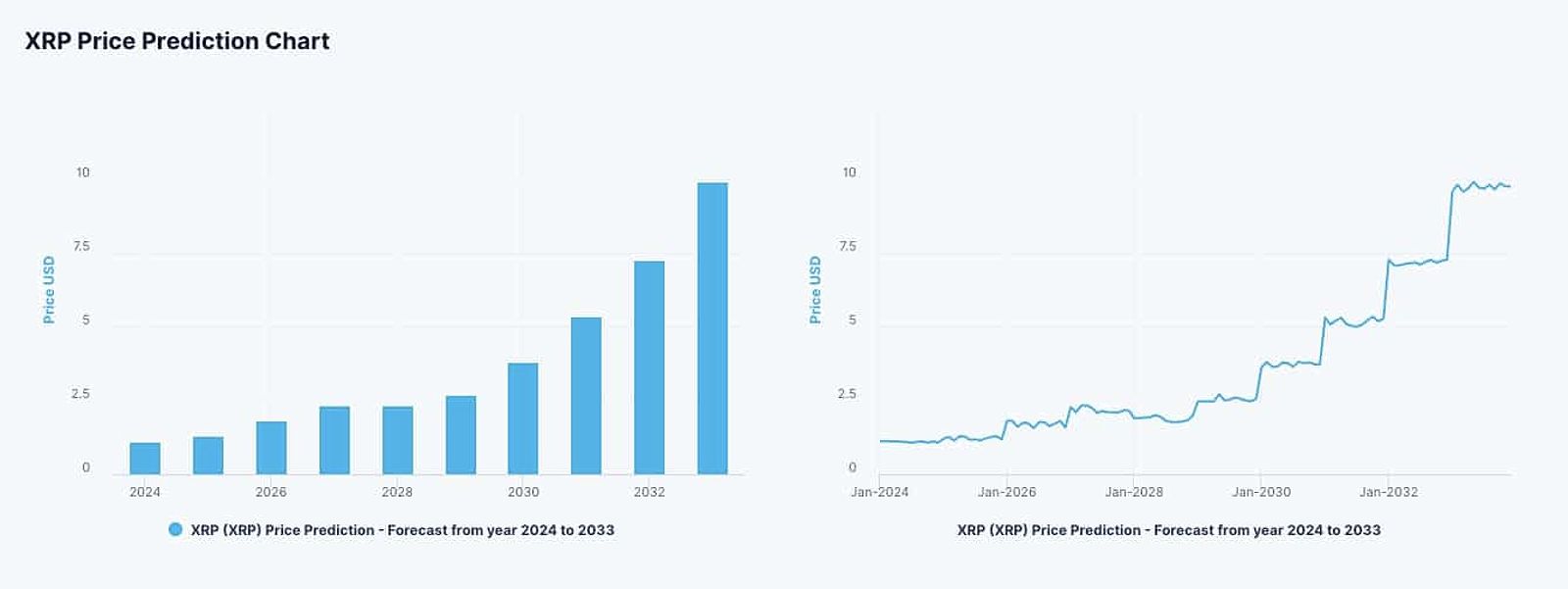

Despite the regulatory hurdles, XRP has displayed remarkable resilience. Its current market capitalization of $29.5 billion positions it as the seventh-largest cryptocurrency, reigniting the debate around its potential to reach the $10,000 mark. As an empowered crypto enthusiast, I’m excited to explore the underlying factors that could propel XRP to such lofty heights.

Driving Forces: Ripples Innovations and Legal Victories Could Ripple Reach $10 000

Ripple, the company behind XRP, has been tirelessly developing innovative payment solutions and forging partnerships with financial institutions worldwide. Their focus on improving cross-border payments through products like xRapid and xCurrent has garnered significant interest from banks and remittance providers. If Ripple continues to expand its global footprint and secure more high-profile collaborations, it could drive increased adoption and demand for XRP, potentially fueling its price growth.

Another crucial factor is the recent legal victory over the SEC. The court’s ruling that Ripple did not violate federal securities law in its XRP sales has been a significant win, potentially paving the way for increased regulatory clarity and improved market sentiment. As a woman empowered by the crypto space, I’m encouraged by the progress made in this legal battle, as it could open new doors for XRP’s mainstream adoption and long-term success.

Market Sentiment and the Crypto Ecosystem

The cryptocurrency market is heavily influenced by investor sentiment and confidence, and XRP is no exception. The recent surge in its price can be attributed, in part, to a renewed optimism among investors regarding the token’s future prospects. As more institutional investors and mainstream financial institutions embrace cryptocurrencies, the influx of capital could have a positive impact on XRP’s price.

However, volatility and market-wide trends will continue to play a significant role in XRP’s price movements. Maintaining a positive market sentiment and sustained investor confidence will be crucial for XRP’s long-term growth. As a savvy crypto investor, I understand the importance of closely monitoring the broader market dynamics and adapting my strategies accordingly.

The Future of Cross-Border Payments: XRPs Opportunity

The growing demand for faster, cheaper, and more efficient cross-border payments represents a significant opportunity for XRP. If Ripple can position XRP as the go-to solution for international money transfers, it could drive substantial adoption and increase the token’s value. However, XRP faces competition from other blockchain-based payment solutions, as well as from traditional financial institutions developing their own cross-border payment systems.

As a woman in the crypto space, I’m particularly excited about the potential for XRP to revolutionize the cross-border payments industry. Faster, cheaper, and more accessible international money transfers could have a profound impact on individuals and businesses around the world, empowering them to take control of their financial futures.

Realistic Expectations: Avoiding the $10,000 Mirage

While the potential for XRP to experience substantial price growth exists, the likelihood of it reaching $10,000 per token is slim. Such an astronomical increase would require XRP to surpass the market capitalization of all other cryptocurrencies combined, as well as that of traditional financial assets like gold, stocks, and real estate. This scenario is highly improbable, given the current market dynamics and regulatory landscape.

A more realistic assessment of XRP’s price potential would involve examining its growth trajectory in comparison to other successful cryptocurrencies. For example, Bitcoin has seen its price increase by over 10,000% since its inception. If XRP were to achieve a similar level of growth, it could potentially reach prices in the range of $50 to $100 per token, which would still represent a significant increase from its current trading levels.

As an empowered crypto investor, I strive to maintain a balanced perspective when evaluating XRP’s long-term price potential. While the token has demonstrated resilience and a capacity for substantial gains, the path to reaching astronomical figures like $10,000 per XRP remains highly unlikely. My investment strategy focuses on carefully timing my entries and exits to capitalize on the token’s price swings, while always keeping a close eye on the evolving market conditions and regulatory landscape.

Investing in XRP: Strategies and Considerations

For those interested in adding XRP to their portfolios, there are several strategies and factors to consider. As a woman in the crypto space, I’ve personally explored various approaches, and I’m happy to share my insights.

One strategy I’ve found effective is long-term holding. XRP’s volatility and potential for long-term growth make it a suitable candidate for a buy-and-hold investment approach. By carefully timing my entries and exits, I’ve been able to capitalize on the token’s price swings and build a diversified portfolio that includes XRP.

For those with a higher risk tolerance, short-term trading may also present opportunities. Given XRP’s market volatility, traders may find ways to profit from short-term price fluctuations through technical analysis and strategic positioning. However, this strategy requires a thorough understanding of the cryptocurrency market and a robust risk management plan.

Regardless of your investment approach, it’s crucial to diversify your portfolio, set stop-loss orders, and employ prudent risk management techniques. When buying and storing XRP, I always ensure to use well-established and secure cryptocurrency exchanges and digital wallets to safeguard my assets.

FAQ

Q: Is XRP a good investment? A: The potential for XRP to experience significant price growth exists, but it also carries inherent risks. As a crypto investor, I believe it’s essential to carefully evaluate the token’s fundamentals, the ongoing legal battle, and your own investment goals before deciding whether to invest in XRP.

Q: What are the potential risks of investing in XRP? A: The cryptocurrency market is highly volatile, and XRP is no exception. Regulatory uncertainty, competition from other payment solutions, and broader market trends can all have a significant impact on XRP’s price. As a responsible crypto investor, I always prepare for potential price swings and exercise caution when allocating capital to this asset.

Q: How can I buy and store XRP? A: XRP can be purchased on various reputable cryptocurrency exchanges, such as Binance, Coinbase, and Kraken. Once acquired, I recommend storing your XRP in a secure hardware or software wallet to maintain control over your digital assets and ensure their safety.

Conclusion

As a passionate cryptocurrency investor and a woman empowered by the crypto space, I’ve closely followed the journey of Ripple’s XRP token. While the prospect of XRP reaching $10,000 per token may seem enticing, a careful analysis of the factors influencing its price potential suggests that such a lofty target is highly unlikely.

However, the token’s resilience, technological advancements, and potential role in the evolving cross-border payments landscape indicate that it may have room for substantial growth in the years to come. By staying informed, maintaining a balanced perspective, and developing a well-informed investment strategy, I believe investors like myself can navigate the opportunities and challenges presented by this digital asset.

The future of XRP remains uncertain, but by staying vigilant, adapting to market trends, and leveraging the power of the crypto ecosystem, we can unlock new possibilities and take control of our financial futures. As a woman in the crypto space, I’m excited to continue exploring the potential of XRP and other innovative blockchain technologies that are transforming the financial landscape.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON