As a veteran in the crypto and blockchain space, I’ve witnessed the remarkable rise and fall of the digital asset markets. The recent crypto and NFT crash has left many investors, including myself, reeling from the shockwaves that have rippled through the industry. In this technical analysis, I’ll dive deep into the underlying causes of this market turmoil and explore the potential paths forward for these ever-evolving digital assets.

The Crypto and NFT Market Rollercoaster

In the summer of 2021, the world witnessed a meteoric surge in the value of digital currencies and non-fungible tokens (NFTs). Bitcoin reached an all-time high of over $68,000, and the NFT market exploded to a staggering $25 billion in sales, captivating the attention of both seasoned investors and newcomers alike. The hype was palpable, and the promise of the metaverse and the utility of these digital assets fueled a frenzy of speculation and investment.

However, the tides turned in early 2022, as the crypto market began to show signs of weakness. The collapse of the TerraUSD stablecoin and its associated token, LUNA, sent shockwaves through the industry, leading to a broader crypto downturn. This was further exacerbated by the high-profile bankruptcy of the FTX cryptocurrency exchange, one of the largest and most prominent players in the market.

As the crypto market plunged, the NFT sector also felt the ripple effects. Blue-chip NFT collections, such as Bored Ape Yacht Club and CryptoPunks, saw their prices tumble, with some high-profile sales losing over 90% of their value. By the end of 2022, the crypto and NFT markets were in a state of turmoil, leaving investors nursing significant losses and the future of these assets in question.

A person walks by a “Toxic Skulls Club” NFT billboard in Times Square while a taxi drives by.

A person walks by a “Toxic Skulls Club” NFT billboard in Times Square while a taxi drives by.

Unraveling the Causes of the Crypto and NFT Crash

The collapse of the crypto and NFT markets can be attributed to a confluence of factors, each playing a critical role in the overall market decline.

Market Saturation

One of the primary drivers of the crash was the rapid growth of the NFT market in 2021. The surge in the number of NFT projects and collections led to a state of market saturation, where the demand failed to keep pace with the influx of new offerings. This oversaturation, coupled with the declining interest from investors, resulted in a significant decline in prices and trading volume.

Crypto Scams and Fraud

The lack of regulation in the crypto and NFT space enabled a proliferation of scams and fraudulent activities, further eroding investor confidence. The collapse of FTX and the TerraUSD/LUNA fiasco were stark reminders of the vulnerability of the industry to bad actors, and the cascading effect of these failures destabilized the entire market.

Global Economic Factors

The broader economic climate, including rising inflation, interest rate hikes, and the threat of a recession, played a significant role in the crypto and NFT crash. As investors became more risk-averse, they began to pull back from speculative assets like cryptocurrencies and NFTs, seeking safer havens for their capital.

Collapse of Big Systems

The downfall of major crypto exchanges and platforms, such as FTX, had a cascading effect on the entire industry. The interconnectedness of these systems meant that their failures had a domino effect, further exacerbating the market’s instability and leaving investors with significant losses.

People take photos by a Bored Ape Yacht Club NFT billboard in Times Square in June 2022.

People take photos by a Bored Ape Yacht Club NFT billboard in Times Square in June 2022.

Navigating the Crypto and NFT Landscape After the Crash

As a Cryptonaut, I understand the challenges and opportunities that lie ahead in the post-crash crypto and NFT market. Navigating this landscape requires a well-informed and disciplined approach.

Embrace Cautious Optimism

While the current market conditions may appear bleak, there are signs of resilience and potential for recovery. The NFT market has shown some stability, with blue-chip collections maintaining their value, and the emergence of new platforms, such as Blur, has helped drive trading volume and investor interest.

Focus on Due Diligence

As an experienced crypto and blockchain enthusiast, I cannot emphasize enough the importance of thorough research and due diligence. Before investing in any crypto or NFT project, it is crucial to evaluate the team, the roadmap, and the overall viability of the offering. Ignoring this crucial step can lead to significant losses.

Nine people look at a wall displaying five abstract, colorful paintings above five TVs displaying NFTs similar to the art above.

Nine people look at a wall displaying five abstract, colorful paintings above five TVs displaying NFTs similar to the art above.

Diversify and Manage Risk

In the volatile crypto and NFT markets, diversification is key. By spreading your investments across different cryptocurrencies, NFT projects, and asset classes, you can mitigate the risks associated with these markets. Additionally, establishing realistic expectations and implementing robust risk management strategies, such as stop-loss orders, can help you navigate the inevitable ups and downs.

Embrace the Long-Term Perspective

The crypto and NFT markets are still relatively young, and the industry will continue to experience significant volatility. Adopting a long-term perspective and weathering the turbulence may be the key to achieving success in these rapidly evolving digital asset markets.

The Regulatory Landscape: Challenges and Opportunities

As the crypto and NFT markets continue to evolve, the regulatory landscape has become increasingly complex. While increased regulation can bring more stability and legitimacy to the industry, it also presents challenges for investors and project developers.

One of the primary regulatory concerns is the lack of clear guidelines and frameworks. Policymakers have struggled to keep up with the rapid pace of technological advancements, leading to a patchwork of rules and regulations that can be confusing and burdensome for market participants.

However, the growing regulatory attention also presents opportunities for the industry. As regulators work to establish clearer guidelines, it can help address the issues of scams, fraud, and other illicit activities that have plagued the crypto and NFT markets. This, in turn, can build greater trust and confidence among investors, fostering a more sustainable and healthy ecosystem.

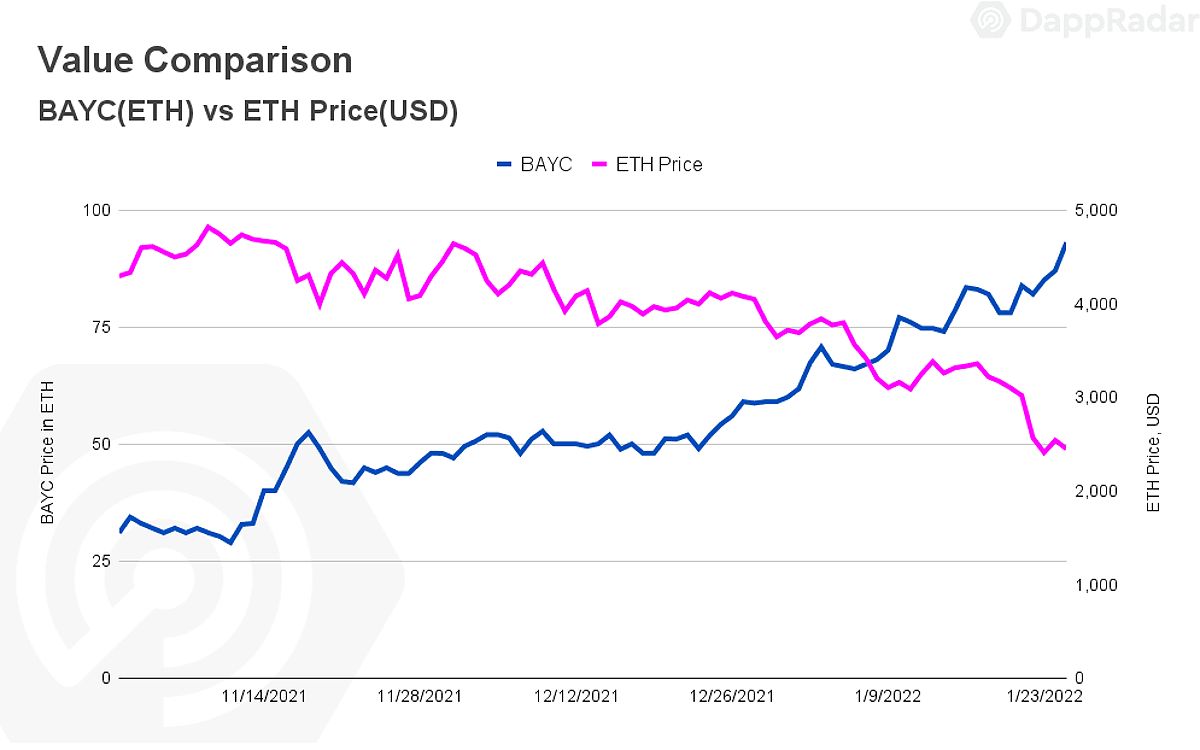

Negative correlation between ether and BAYC’s floor price. Source: DappRadar

Negative correlation between ether and BAYC’s floor price. Source: DappRadar

The Future of Crypto and NFTs: Cautiously Optimistic

Despite the tumultuous events of the past year, the long-term prospects for the crypto and NFT markets remain promising. As a Cryptonaut, I believe that the ongoing development of layer-2 solutions and Layer-1 blockchain networks may help address some of the scalability and efficiency issues that have plagued the industry.

Additionally, the integration of crypto and NFTs into the metaverse presents exciting possibilities. As virtual worlds and digital economies gain traction, the utility and value of these digital assets could become increasingly important. Brands, artists, and creators may find new ways to leverage crypto and NFTs to engage with their audiences and create unique experiences.

FAQ

Q: Is the NFT market dead? A: No, the NFT market is still alive, but it has entered a period of consolidation. Many investors are taking a cautious approach, but the long-term potential of NFTs remains.

Q: What should I do with my existing NFT investments? A: It’s important to assess the value and potential of your existing NFT investments. If you believe in the long-term potential of the project, you may want to hold onto your NFTs. If you’re concerned about their value, you may want to consider selling them.

Q: How can I protect myself from scams in the NFT market? A: Conduct thorough research on any NFT project before investing. Be wary of projects that promise unrealistic returns or have a lack of transparency.

Conclusion

As a Cryptonaut, I’ve witnessed the remarkable rise and fall of the crypto and NFT markets, and I believe that the future of these digital assets remains promising, albeit with a more cautious outlook. By understanding the underlying causes of the crash, embracing a long-term perspective, and adopting a disciplined investment approach, investors can navigate the current market conditions and potentially emerge stronger on the other side.

The regulatory landscape continues to evolve, presenting both challenges and opportunities for the industry. As policymakers work to establish clearer guidelines, the crypto and NFT markets may gain more stability and legitimacy, ultimately benefiting the ecosystem as a whole.

While the path forward may not be without its obstacles, the potential of crypto and NFTs to transform various industries, from gaming and art to digital identity and the metaverse, remains compelling. As a Cryptonaut, I remain cautiously optimistic about the future of these digital assets and the innovations they will continue to drive in the years to come.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON