In the ever-evolving world of cryptocurrency, the security of your digital assets has become paramount. As more individuals seek to capitalize on the vast potential of this burgeoning market, the need for a robust and reliable wallet has never been more pressing. This comprehensive guide will delve into the nuances of crypto wallets, empowering you to make an informed decision that aligns with your investment strategy and risk tolerance. This guide will help you understand the features and benefits of a crypto now wallet and choose the best option for your needs.

Understanding the Crypto Wallet Ecosystem

At the heart of the cryptocurrency ecosystem lies the “crypto now” wallet, a digital tool that serves as the gateway to your digital assets. These wallets enable you to store, manage, and interact with your cryptocurrencies, facilitating secure transactions and safeguarding your investments.

The foundation of a “crypto now” wallet lies in the interplay between your public and private keys. The public key, akin to a bank account number, is used to receive funds, while the private key, similar to a personal identification number (PIN), grants you exclusive access to your digital holdings. Protecting your private key is of utmost importance, as it is the sole means of proving ownership and conducting transactions on the blockchain.

Navigating the Hot and Cold Crypto Now Wallet Landscape

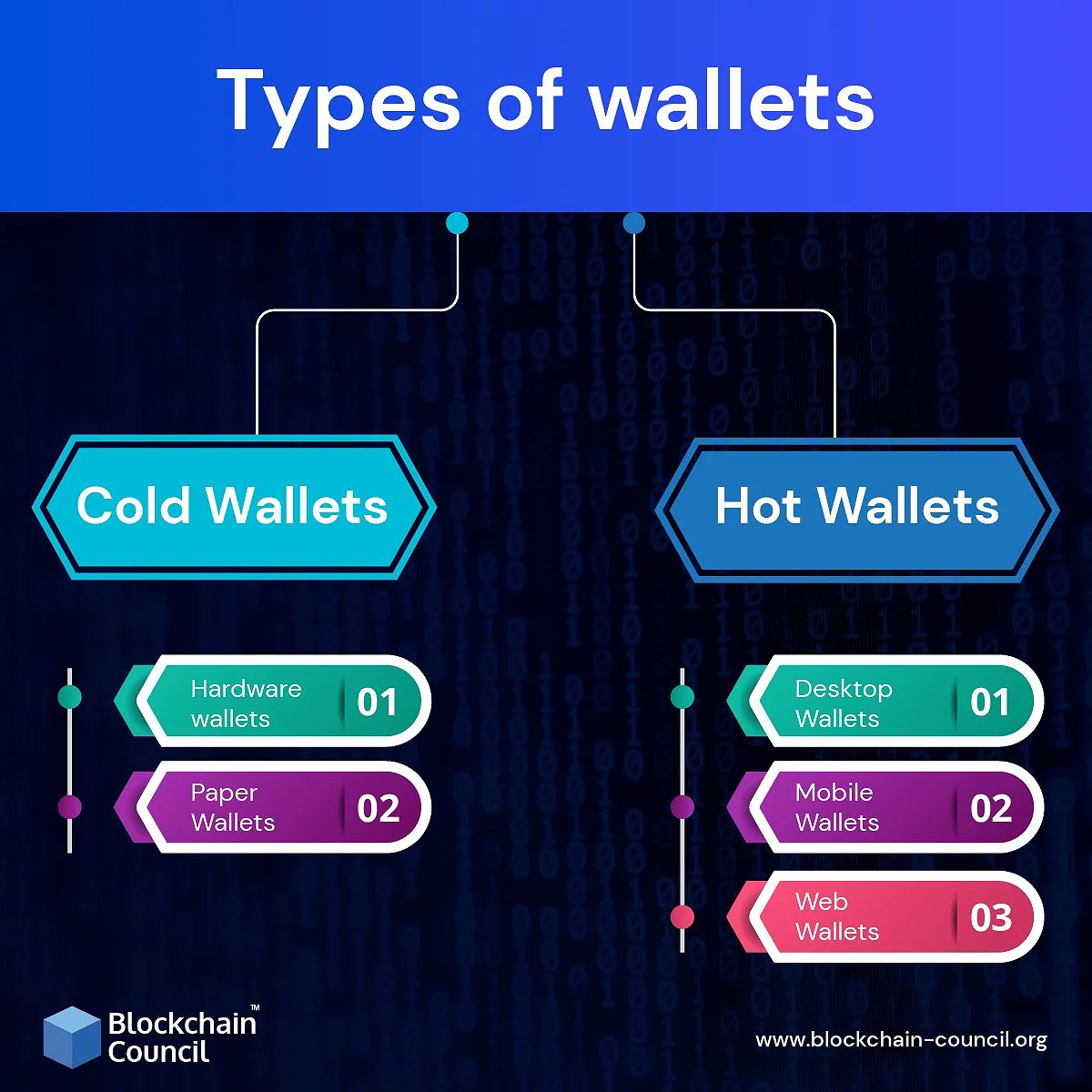

The crypto wallet landscape can be broadly divided into two categories: hot wallets and cold wallets. Understanding the nuances of these wallet types is crucial in determining the best fit for your investment needs.

Hot Wallets: Convenience at a Price

Hot wallets are “crypto now” wallets that are connected to the internet, offering users a user-friendly and readily accessible way to manage their digital assets. Platforms like Coinbase, Binance, and MetaMask fall under this category, providing the convenience of quick access to your funds, making them suitable for frequent transactions and smaller investments.

However, the very nature of their internet connectivity also exposes hot wallets to potential security risks. These online wallets are more vulnerable to hacking attempts and malware infections, putting your cryptocurrency holdings at risk. While hot wallets offer a level of convenience, it is essential to understand the trade-off between accessibility and security.

Cold Wallets: The Fortress for Your Crypto

In contrast to hot wallets, cold wallets are offline devices that store your private keys, effectively disconnecting your cryptocurrencies from the internet. This offline storage makes cold wallets highly resistant to hacking and malware attacks, providing a robust layer of security for your long-term crypto holdings.

Hardware wallets, such as Ledger Nano S and Trezor, are the most popular form of cold wallets. These physical devices resemble a USB drive and require a PIN or passphrase to access your cryptocurrencies. Paper wallets, which are simply printed QR codes or private keys, offer an even more basic offline storage solution.

By opting for a cold wallet, you can enjoy the peace of mind that comes with knowing your digital assets are safeguarded against online threats, making them the preferred choice for investors seeking to protect their long-term crypto investments.

Aligning Your Crypto Wallet with Your Investment Strategy

When selecting the right “crypto now” wallet for your needs, it is crucial to consider factors such as your investment size, transaction frequency, and overall risk tolerance.

For smaller, more frequent transactions, a hot wallet can provide the necessary convenience and accessibility. However, if you’re looking to store larger amounts of cryptocurrencies for the long term, a cold wallet offers a superior level of security and protection.

Regardless of your chosen wallet, always prioritize security features like two-factor authentication (2FA), strong passwords, and regular software updates. Additionally, be sure to research the reputation and track record of the wallet provider to ensure the safety of your crypto assets.

Establishing Best Practices for Crypto Now Wallet Security

Maintaining the security of your “crypto now” wallet is paramount, as the consequences of a breach can be devastating. To safeguard your digital wealth, consider the following best practices:

- Leverage Two-Factor Authentication (2FA): Enable 2FA on your “crypto now” wallet to add an extra layer of protection against unauthorized access.

- Embrace Multi-Signature Wallets: For shared accounts or business use, consider using multi-signature wallets, which require multiple private keys to authorize a transaction, reducing the risk of a single point of failure.

- Keep Software Up-to-Date: Regularly update your “crypto now” wallet software to ensure you have the latest security patches and bug fixes.

- Secure Your Seed Phrase: Your seed phrase is the key to recovering your wallet. Store it securely offline, and consider splitting it into multiple locations for added protection.

- Diversify Your Wallets: Spread your cryptocurrency holdings across multiple wallets, both hot and cold, to minimize the impact of a potential breach.

By incorporating these best practices into your “crypto now” wallet management, you can significantly enhance the security and long-term protection of your digital assets.

The Evolving Crypto Wallet Landscape: Trends and Innovations

As the cryptocurrency market continues to mature, the “crypto now” wallet landscape is also witnessing exciting advancements and innovations. One notable trend is the growing popularity of custodial wallets, where a trusted third-party service provider manages the security and storage of your private keys.

While custodial wallets offer the convenience of easy management and recovery options, they also introduce a reliance on the service provider’s security measures. In contrast, non-custodial wallets, where you maintain full control over your private keys, are gaining traction among crypto enthusiasts who prioritize self-sovereignty and security.

Another emerging trend is the integration of decentralized finance (DeFi) protocols with “crypto now” wallets. This allows users to seamlessly access and interact with DeFi applications, such as lending, borrowing, and staking, directly from their wallet interface. This convergence of wallets and DeFi opens up new opportunities for crypto investors to maximize their earning potential.

Furthermore, the development of multi-chain wallets, capable of supporting various blockchain networks, is simplifying the user experience for those holding diverse digital assets. This trend towards interoperability and cross-chain compatibility is making it easier for investors to manage their entire crypto portfolio from a single wallet.

The Future of Crypto Now Wallet Security: Innovations and Emerging Trends

As the cryptocurrency market continues to evolve, the “crypto now” wallet landscape is also witnessing exciting advancements and innovations that promise to enhance the security and usability of digital asset management.

One emerging trend is the integration of advanced cryptographic techniques, such as homomorphic encryption and zero-knowledge proofs, into “crypto now” wallets. These technologies enable users to perform transactions and interact with blockchain networks without exposing their private keys or other sensitive information, further strengthening the privacy and security of their crypto holdings.

Another promising development is the rise of decentralized identity (DID) solutions within the “crypto now” wallet ecosystem. DID frameworks allow users to create and control their own digital identities, reducing reliance on centralized authorities and increasing the overall autonomy and self-sovereignty of crypto investors.

The convergence of hardware wallets and smart contract-based multisig functionality is another area of innovation. By leveraging the security of physical devices and the programmability of smart contracts, these advanced “crypto now” wallets can offer enhanced transaction authorization, collaborative access control, and disaster recovery capabilities.

As the “crypto now” wallet industry continues to evolve, we can expect to see further advancements in biometric authentication, quantum-resistant encryption, and seamless cross-chain interoperability. These innovations will undoubtedly shape the future of secure and user-friendly crypto asset management, empowering investors to navigate the dynamic cryptocurrency landscape with confidence.

FAQ

What are the risks associated with using a hot wallet? Hot wallets, while convenient, are more susceptible to online threats such as hacking and malware. They are connected to the internet, making them vulnerable to potential security breaches.

How can I protect my “crypto now” wallet from hacking? To protect your “crypto now” wallet from hacking, utilize strong passwords, enable two-factor authentication, regularly update your software, and consider using a hardware (cold) wallet for long-term storage of your digital assets.

What is a seed phrase, and why is it so important? A seed phrase, also known as a recovery phrase, is a set of words that allows you to recover your “crypto now” wallet if you lose access to it. Protecting your seed phrase is crucial, as it is the only way to regain access to your cryptocurrencies if your wallet is lost or compromised.

How do I choose a reputable “crypto now” wallet provider? When selecting a “crypto now” wallet provider, research their security practices, user reviews, and overall reputation in the cryptocurrency community. Opt for providers that have a strong track record of safeguarding user funds and prioritize security features.

What are the best practices for storing my seed phrase securely? The best practices for storing your seed phrase include keeping it offline, never sharing it with anyone, and considering splitting it into multiple secure locations. Avoid storing it in digital formats or on devices connected to the internet.

Conclusion

As the cryptocurrency market continues to evolve and grow, the importance of securing your digital assets has never been more critical. By understanding the different types of “crypto now” wallets and their respective security features, you can make an informed decision on the right wallet for your investment strategy.

Remember, the security of your “crypto now” wallet is in your hands. Embrace best practices, stay vigilant, and take the necessary steps to protect your crypto future. With the right “crypto now” wallet, you can confidently navigate the exciting world of digital assets and safeguard your investments for years to come.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON