As a cryptocurrency enthusiast, I find myself captivated by the unique and limited nature of Bitcoin. With approximately 19.7 million bitcoins already in circulation as of June 2024, representing over 90% of the total supply that will ever exist, the implications for investors like myself are profound. This article will examine the fundamentals of Bitcoin’s limited supply, including the impact of the cryptocurrency’s halving events and the potential consequences of reaching the 21 million coin cap. By understanding how many bitcoins are there and the implications of this finite supply, investors can make more informed decisions about their strategies.

The Scarcity at the Heart of Bitcoin

One of the core principles that sets Bitcoin apart from traditional fiat currencies is its fixed and predetermined supply. When the anonymous creator(s) Satoshi Nakamoto introduced the cryptocurrency in 2008, they specified that there would only ever be a maximum of 21 million bitcoins. This hard cap is a deliberate design choice that creates a sense of scarcity, much like the limited supply of precious metals like gold.

As new bitcoins are gradually mined and added to the circulating supply, the rate at which additional coins are created decreases over time. This controlled release of bitcoins helps maintain their value and serves as a hedge against inflation, as the total number of bitcoins will never exceed 21 million.

How Many Bitcoins Are There in the Current Supply?

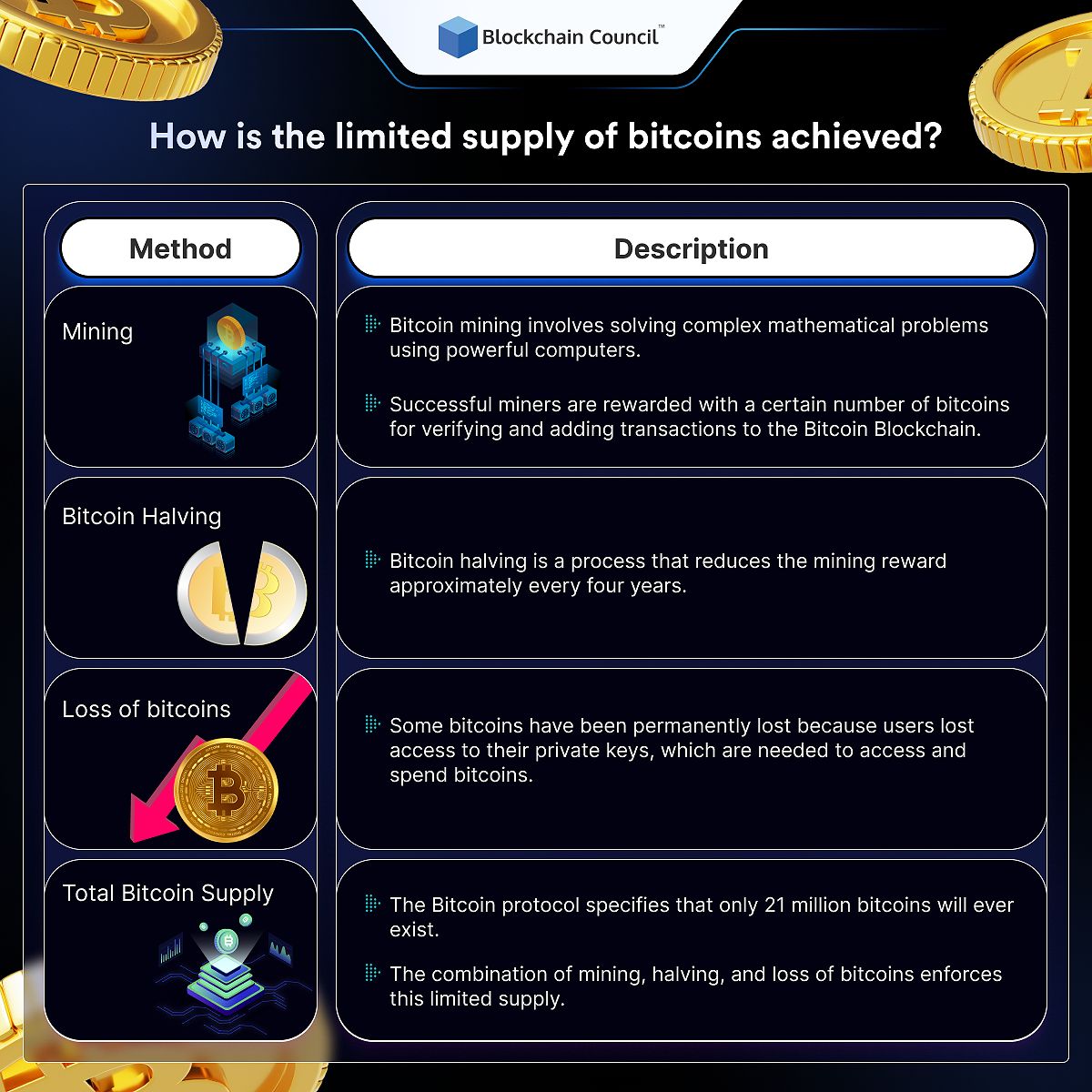

The process of creating new bitcoins, known as mining, involves the use of powerful computers to solve complex mathematical problems. Miners who successfully verify and add new transactions to the Bitcoin Blockchain are rewarded with newly minted bitcoins.

At the inception of Bitcoin in 2009, the block reward, or the number of new bitcoins generated per block, was set at 50 BTC. However, this reward is halved approximately every four years, a process known as the “Bitcoin halving.” The most recent halving event occurred in April 2024, reducing the block reward to 6.25 BTC.

As of June 2024, an estimated 19.7 million bitcoins have been mined, leaving roughly 1.3 million bitcoins yet to be discovered. Based on the current halving schedule, it is projected that the final bitcoin will be mined around the year 2140, marking the completion of the 21 million BTC supply.

The Impact of Halving Events on Bitcoins Value

The scheduled halving of block rewards has had a significant impact on the price of Bitcoin. Each time the block reward is reduced, it creates a scarcity effect, potentially driving up the value of the cryptocurrency.

For example, in the year following the first halving event in 2012, the price of Bitcoin surged by over 1,000%. The second halving in 2016 was followed by a 1,500% increase in the BTC price within a year. Most recently, the 2024 halving coincided with Bitcoin reaching a new all-time high of over $72,000.

This pattern suggests that the limited supply of bitcoins, combined with the halving events, can contribute to significant price appreciation over time. As the mining reward continues to decrease, the incentive for miners to maintain the network may shift more towards transaction fees, potentially impacting the overall dynamics of the Bitcoin ecosystem.

The Concentration of Bitcoin Wealth and the Influence of Whales

While Bitcoin was designed to be a decentralized cryptocurrency, the distribution of bitcoins among holders is not entirely even. A relatively small group of investors, referred to as “whales,” hold a significant portion of the total Bitcoin supply.

Approximately 1,600 entities currently own around 5 million bitcoins, or 28% of the total circulating supply. The influence of these whale investors can have a profound impact on the Bitcoin market. When whales make large buy or sell orders, it can lead to significant price volatility, as their transactions can sway the market sentiment.

The concentration of Bitcoin ownership among a few large holders raises concerns about the long-term decentralization and stability of the cryptocurrency. If these whales were to collectively sell a substantial portion of their holdings, it could create a ripple effect that destabilizes the Bitcoin market.

Navigating the Finite Future of Bitcoin

As Bitcoin approaches its maximum supply of 21 million coins, the implications for the cryptocurrency’s future become increasingly relevant. Once all bitcoins have been mined, the network will continue to operate, but the mining rewards will cease. Instead, miners will rely solely on transaction fees to maintain the network’s security and integrity.

This transition could have significant consequences for the Bitcoin ecosystem. If transaction fees do not provide sufficient incentive for miners to continue their operations, the network’s security and stability may be compromised. Additionally, the lack of new bitcoins entering the market could impact the cryptocurrency’s liquidity and overall adoption.

Nonetheless, Bitcoin’s role as a potential store of value and its growing institutional adoption suggest that the cryptocurrency may continue to be a relevant and influential asset in the financial landscape. However, the long-term implications of reaching the 21 million supply limit remain a subject of ongoing debate and speculation.

Regulatory Landscapes and the Future of Bitcoin

As the popularity of Bitcoin and other cryptocurrencies continues to grow, governments around the world are grappling with how to regulate the digital asset space. The classification of Bitcoin, whether as a currency, property, or commodity, can have significant implications for investors and users.

Regulations surrounding anti-money laundering (AML) and know-your-customer (KYC) requirements can impact the privacy and accessibility of Bitcoin transactions. Licensing requirements for exchanges and wallet providers can also shape the adoption and usage of the cryptocurrency.

The evolving regulatory landscape is a crucial factor to consider when evaluating the future of Bitcoin. Favorable regulations that provide clarity and support for the cryptocurrency industry could help drive mainstream adoption. Conversely, restrictive regulations could hinder the growth and development of the Bitcoin ecosystem.

FAQ

Q: How many bitcoins have been lost forever?

A: It’s estimated that around 4 million bitcoins have been permanently lost due to reasons such as lost private keys, unrecoverable wallets, and deceased owners. These lost bitcoins are effectively removed from the circulating supply, contributing to Bitcoin’s overall scarcity.

Q: What happens to Bitcoin mining after all bitcoins are mined?

A: Once all 21 million bitcoins have been mined, approximately by the year 2140, miners will no longer receive block rewards. Instead, they will rely on transaction fees as their primary source of income for maintaining the network’s security and processing transactions.

Q: Is Bitcoin’s supply limit subject to change?

A: No, Bitcoin’s supply limit of 21 million coins is hard-coded into the cryptocurrency’s protocol and cannot be changed. This fixed supply is a fundamental design feature that distinguishes Bitcoin from traditional fiat currencies and contributes to its scarcity.

Q: What is the impact of Bitcoin’s limited supply on its value?

A: Bitcoin’s limited supply is a key factor that can contribute to its value appreciation over time. As the rate of new bitcoins entering the market decreases due to the halving events, the scarcity of the cryptocurrency can drive up its price, assuming demand continues to grow. This scarcity is a crucial element of Bitcoin’s value proposition as a potential store of value.

Conclusion: Embracing the Finite Future of Bitcoin

As a cryptocurrency enthusiast, I’m fascinated by the finite nature of Bitcoin and the implications it holds for the future of digital assets. The hard cap of 21 million bitcoins, combined with the scheduled halving events, creates a unique scarcity that sets Bitcoin apart from traditional currencies.

By understanding the current state of Bitcoin’s supply, the impact of halving events, and the influence of whale investors, I believe we can better navigate the dynamic cryptocurrency landscape and make informed investment decisions. While the long-term consequences of reaching the 21 million supply limit remain uncertain, the continued growth of institutional adoption and Bitcoin’s potential as a store of value suggest that the cryptocurrency will likely maintain its relevance in the years to come.

As we delve deeper into the finite future of Bitcoin, I encourage you to stay informed, engage with the latest trends and developments, and explore the role of this groundbreaking technology in shaping the financial landscape of the future.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON