As the Crypto Sage, I’ve witnessed the meteoric rise of non-fungible tokens (NFTs) in recent years, captivating the attention of both seasoned investors and newcomers to the digital asset landscape. The allure of these unique digital collectibles is undeniable, offering the promise of diversification and the potential for remarkable returns. However, the NFT crypto realm is not without its risks and complexities.

In this balanced and insightful guide, I’ll take you on a journey through the captivating world of NFT investments, equipping you with the knowledge and tools needed to navigate this dynamic market with prudence and purpose. Whether you’re a newcomer or a seasoned cryptocurrency enthusiast, you’ll gain a deeper understanding of the fundamentals, the step-by-step process for investing, and the key considerations to keep in mind.

Unraveling the NFT Enigma

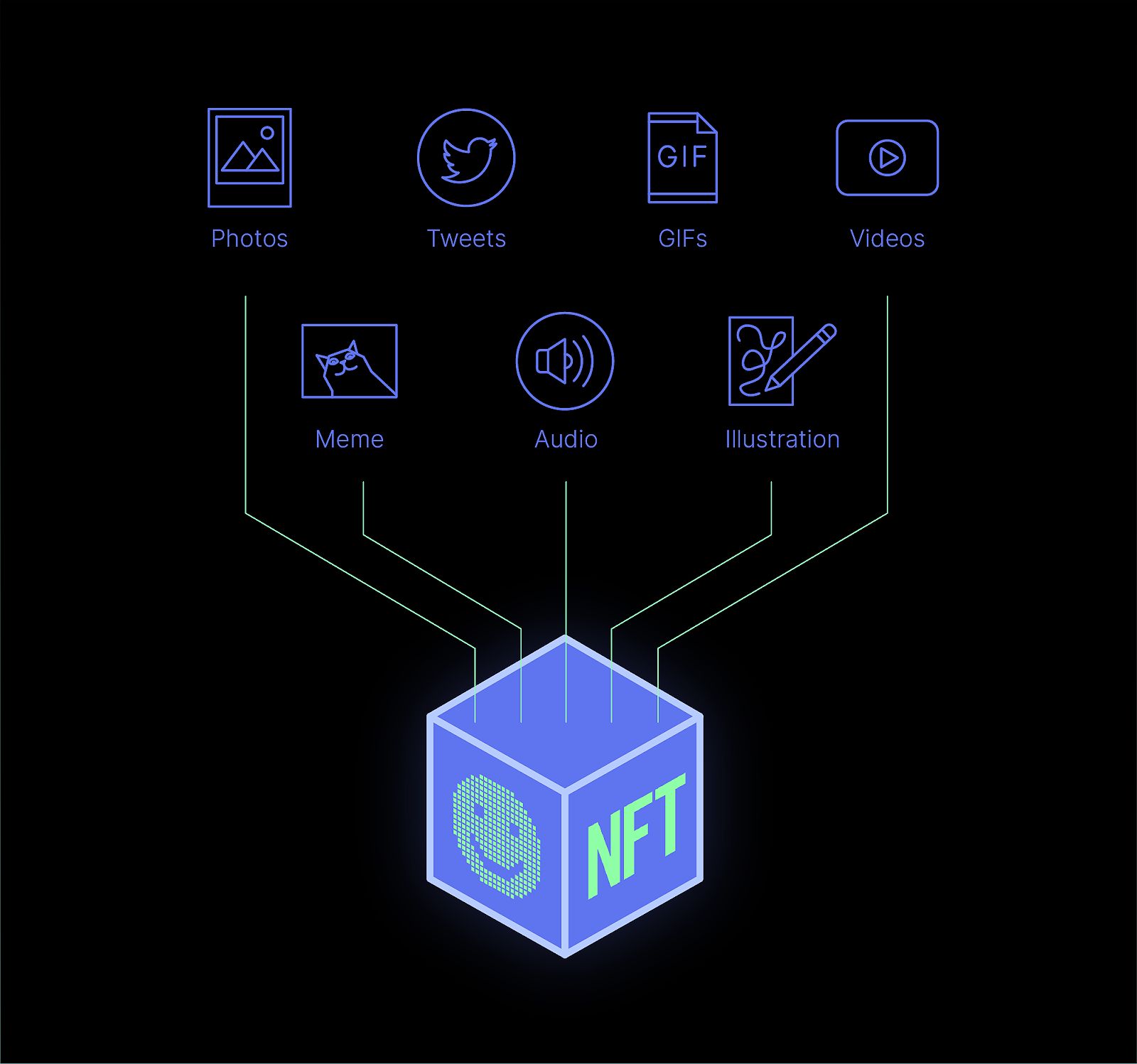

Non-fungible tokens, or NFTs, are digital assets that leverage the power of blockchain technology to establish verifiable ownership and scarcity. Unlike traditional cryptocurrencies, which are interchangeable, each NFT is a one-of-a-kind digital creation, imbuing them with inherent value and the potential for remarkable returns.

The NFT ecosystem encompasses a diverse array of digital items, ranging from captivating works of digital art and music to virtual real estate and in-game assets. The unique nature of these digital creations has ignited a fervent demand, with some high-profile NFTs fetching jaw-dropping prices in the secondary market.

As you delve into the world of NFT crypto, it’s crucial to understand the underlying blockchain technology and the various cryptocurrencies used to facilitate these transactions. Ethereum (ETH), Solana (SOL), and Polygon (MATIC) are just a few of the popular blockchain networks that have embraced the NFT revolution, each offering its own unique advantages and use cases.

Your Step-by-Step Guide to Investing in NFT Crypto

Ready to begin your NFT crypto investment journey? Follow these step-by-step instructions to get started:

- Establish a Secure Crypto Wallet

The first step in your NFT investment odyssey is to set up a secure cryptocurrency wallet. This digital storage solution will serve as the gateway to your NFT purchases and holdings. Consider user-friendly options like MetaMask, Trust Wallet, or the Ledger Nano S hardware wallet, which offer robust security features to protect your digital assets.

Defining Non-Fungible Tokens: The Next Big Thing in Cryptocurrency

Defining Non-Fungible Tokens: The Next Big Thing in Cryptocurrency

- Acquire Cryptocurrency

Next, you’ll need to acquire the necessary cryptocurrency to facilitate your NFT transactions. Depending on the marketplace you choose, you may need Ethereum (ETH), Solana (SOL), or other digital currencies. Reputable cryptocurrency exchanges like Coinbase, Binance, and Kraken can provide a convenient way to buy and store your desired cryptocurrencies.

- Explore NFT Marketplaces

With your crypto wallet set up and funded, it’s time to venture into the vibrant world of NFT marketplaces. OpenSea, Rarible, and Nifty Gateway are just a few of the leading platforms that offer a diverse selection of NFTs across various categories. Take the time to explore these marketplaces, research project details, and familiarize yourself with the user interface.

- Research and Evaluate NFT Projects

Before making your first NFT purchase, it’s crucial to conduct thorough research on the project and its underlying value proposition. Look for a strong team, a clear roadmap, and an engaged community. Consider factors such as the project’s uniqueness, utility, and growth potential to make an informed decision that aligns with your investment goals.

Rebecca Marsham

Rebecca Marsham

- Complete Your First NFT Purchase

Once you’ve identified an NFT that piques your interest, it’s time to make your first acquisition. Depending on the marketplace, you may have the option to bid on an NFT or buy it outright. Be mindful of the associated fees, such as gas fees, which can significantly impact the overall cost of your transaction.

- Monitor and Manage Your NFT Portfolio

Congratulations on your first NFT investment! However, the journey doesn’t end there. Regularly monitor the performance of your NFT portfolio, stay informed about industry trends, and consider diversifying your holdings to mitigate risk. Utilize portfolio tracking tools to gain a comprehensive understanding of your digital asset investments.

Navigating the Risks and Considerations

While the potential rewards of investing in NFT crypto can be captivating, it’s essential to be aware of the inherent risks and considerations associated with this emerging asset class.

Volatility and Market Fluctuations

The NFT market is renowned for its high volatility, with prices often subject to sudden and significant fluctuations. Market sentiment, hype, and external factors can significantly impact the value of your NFT investments, making it crucial to approach this market with a long-term mindset and a willingness to weather the storms of volatility.

Scams and Fraud

Unfortunately, the NFT space is not immune to fraudulent activities, such as rug pulls, phishing, and the sale of fake or counterfeit NFTs. Thorough research, cross-checking project information, and verifying the authenticity of an NFT are essential to mitigate these risks and protect your investments.

Liquidity and Selling Challenges

The NFT market can be relatively illiquid, making it challenging to sell your assets at the desired price or timeframe. Factors such as demand, market sentiment, and the specific NFT’s popularity can significantly impact its liquidity and your ability to realize your investment gains.

Tax Implications

Investing in NFT crypto can have complex tax implications, as transactions may be subject to capital gains taxes, reporting requirements, and other regulatory considerations. Consulting with a tax professional is advisable to ensure you comply with all applicable laws and regulations.

Tips for Successful NFT Investing

As you embark on your NFT crypto investment journey, consider the following tips to navigate the market with prudence:

- Diversify your portfolio by investing in a variety of NFT projects and asset types to mitigate risk.

- Conduct in-depth research on the team, roadmap, and community behind the NFT projects you’re considering.

- Invest only what you can afford to lose, and manage your risk accordingly.

- Stay informed about the latest trends, news, and developments in the ever-evolving NFT market.

- Utilize portfolio tracking tools to monitor the performance of your NFT investments and make data-driven decisions.

For a refresher on why diverse investments are more important than ever

For a refresher on why diverse investments are more important than ever

The Future of NFT Crypto Investing

As the NFT market continues to evolve and gain mainstream adoption, the potential for this asset class to transform the way we think about digital ownership and value exchange is truly captivating. While the current volatility and risks should not be overlooked, the long-term implications of NFTs are profoundly intriguing.

Imagine a future where NFTs are seamlessly integrated into our daily lives, enabling new forms of digital art, music, and entertainment experiences. The applications of NFT technology extend beyond just collectibles, as they could revolutionize industries like gaming, real estate, and even supply chain management.

As the ecosystem matures and regulatory frameworks are established, the NFT crypto investment landscape is poised to become more stable and accessible to a broader audience. This presents an exciting opportunity for those willing to navigate the nuances of this emerging asset class with prudence and foresight.

FAQ (Optional)

Q: What is the best way to invest in NFT crypto? A: The best approach depends on your investment goals and risk tolerance. Start by thoroughly researching and understanding the NFT market, setting up a secure crypto wallet, and acquiring the necessary cryptocurrency. Then, explore reputable NFT marketplaces, evaluate projects carefully, and make strategic investments that align with your long-term investment strategy.

Q: Is it better to invest in NFTs or cryptocurrencies? A: Both NFTs and cryptocurrencies have their own merits and potential for investment. NFTs offer unique digital ownership and the possibility of high returns, while cryptocurrencies provide diversification and exposure to the underlying blockchain technology. The optimal choice depends on your investment objectives, risk appetite, and the role you wish these digital assets to play in your overall portfolio.

Q: How can I make money from NFTs? A: There are several ways to generate returns from NFT investments, including buying and selling NFTs for profit, creating and selling your own NFTs, participating in play-to-earn games, or staking your NFTs for passive income. The key is to approach these opportunities with a well-informed and prudent mindset, always considering the inherent risks and your long-term financial goals.

Conclusion

As the Crypto Sage, I’ve witnessed the captivating world of NFT crypto investment unfold before our eyes. While the allure of this emerging asset class is undeniable, it’s essential to approach it with a balanced and well-informed perspective.

By understanding the fundamentals, navigating the various steps, and managing the associated risks, you can unlock new avenues for diversification and potentially reap the rewards of this dynamic digital landscape. Remember, the journey of NFT crypto investing is not without its challenges, but those who embrace a strategic mindset and a commitment to continuous learning can unlock a world of financial possibilities.

Embark on your own NFT crypto investment adventure with prudence, research, and a long-term vision. The future of digital ownership and value exchange is unfolding, and you have the power to be a part of it.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON