In the ever-evolving world of decentralized finance (DeFi), crypto defi wallets have become an indispensable tool for investors. These wallets provide a secure and convenient way to manage and grow your DeFi investments.

As a seasoned crypto enthusiast, I’ve had the privilege of navigating the ever-changing landscape of decentralized finance (DeFi) for quite some time now. Let me tell you, the crypto defi wallet has become an essential part of my investment arsenal. In this comprehensive guide, I’m excited to share my insights and experiences to help you, fellow investor, unlock the full potential of crypto defi wallets.

As a seasoned crypto enthusiast, I’ve had the privilege of navigating the ever-changing landscape of decentralized finance (DeFi) for quite some time now. Let me tell you, the crypto defi wallet has become an essential part of my investment arsenal. In this comprehensive guide, I’m excited to share my insights and experiences to help you, fellow investor, unlock the full potential of crypto defi wallets.

Unraveling The Crypto Defi Wallet Landscape

The crypto defi wallet landscape is truly a diverse tapestry, offering a wide range of options to cater to the unique needs and preferences of investors like ourselves. From the fortress-like security of hardware wallets to the seamless integration of software wallets, the choices can be overwhelming at first glance. But fear not, I’m here to guide you through the key types of crypto defi wallets and their distinct features.

Hardware Wallets: Fortress Of Security

If you’re a crypto defi investor who prioritizes the safety of your digital assets above all else, then hardware wallets like Ledger and Trezor are your best friends. These offline devices keep your private keys safely tucked away from the prying eyes of hackers, providing unparalleled security for your investments. While they may require a bit more technical know-how, I can assure you that the peace of mind they offer is well worth the effort.

Ledger Wallet A visual representation of a Ledger Wallet, a popular hardware wallet for crypto defi investors.

Ledger Wallet A visual representation of a Ledger Wallet, a popular hardware wallet for crypto defi investors.

Software Wallets: Versatility And Accessibility

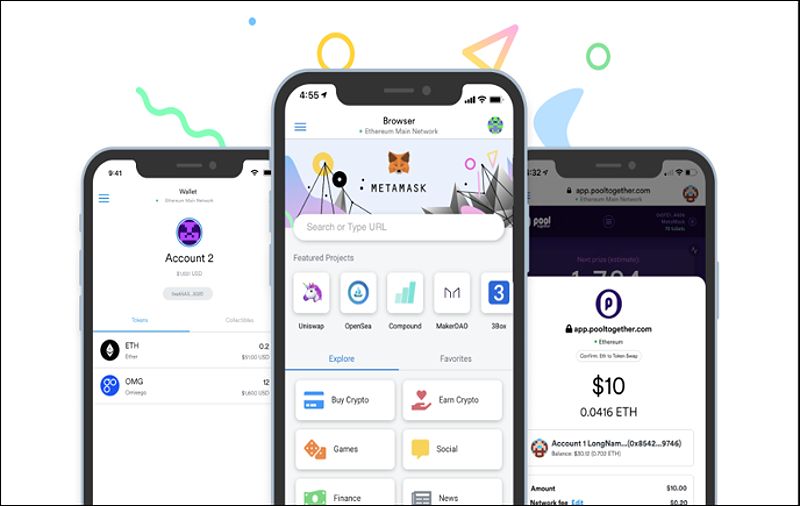

On the other hand, if you value the convenience of managing your crypto defi portfolio from your desktop or mobile device, software wallets like MetaMask and Trust Wallet are an excellent choice. These user-friendly interfaces allow you to effortlessly navigate the ever-expanding DeFi ecosystem, seamlessly connecting you to a wide range of decentralized applications and services.

MetaMask A screenshot of the MetaMask software wallet, showcasing its user-friendly interface for managing crypto defi investments.

MetaMask A screenshot of the MetaMask software wallet, showcasing its user-friendly interface for managing crypto defi investments.

Mobile Wallets: Convenience And Mobility

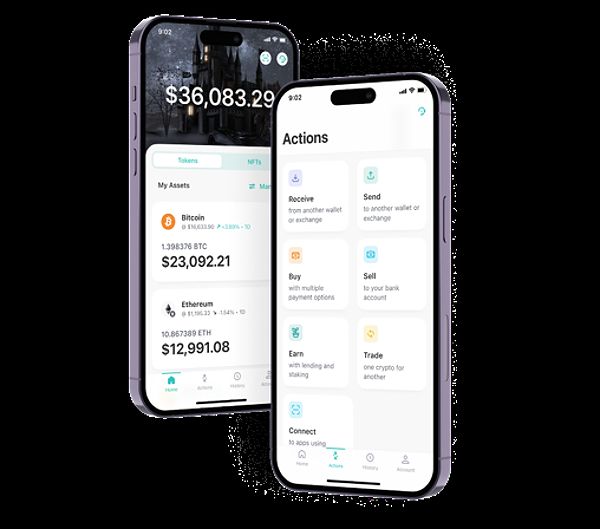

And for those of us who are constantly on the go, mobile wallets like Crypto.com Wallet and Argent Wallet offer a compelling solution. These compact, portable powerhouses enable you to manage your crypto defi assets right from your smartphone, ensuring that you can stay on top of your investments no matter where life takes you.

Crypto.com Wallet An image of the Crypto.com Wallet, a mobile wallet that provides convenience and mobility for managing crypto defi assets.

Crypto.com Wallet An image of the Crypto.com Wallet, a mobile wallet that provides convenience and mobility for managing crypto defi assets.

Choosing The Best Crypto Defi Wallet For Your Needs

Now, with a deeper understanding of the different crypto defi wallet options, the next step is to determine which one is the best fit for your investment goals and risk tolerance. As a seasoned crypto defi enthusiast, I can share the key factors I consider when making this important decision.

Security: Safeguarding Your Crypto Assets

When it comes to crypto defi wallets, security should always be the top priority. After all, we’re talking about the safekeeping of your hard-earned digital assets. I personally gravitate towards wallets that offer robust security features, such as multi-factor authentication, offline storage of private keys, and regular security audits. Hardware wallets, in particular, excel in this regard, providing an additional layer of protection that gives me peace of mind.

Compatibility: Connecting To The Defi Ecosystem

Another crucial factor is the compatibility of the crypto defi wallet with the blockchains, tokens, and DeFi protocols I plan to interact with. It’s essential that the wallet seamlessly integrates with the broader DeFi ecosystem, allowing me to access the full range of services, from lending and borrowing to yield farming and staking.

User Experience: Navigating With Ease

As someone who values efficiency and simplicity, the user experience of a crypto defi wallet is also a top consideration for me. I look for wallets that offer a clean, intuitive design and provide clear instructions for common tasks, making it effortless for me to manage my DeFi investments on a day-to-day basis.

Supported Features: Unlocking Defi Opportunities

Depending on my investment strategy and risk appetite, I also prioritize crypto defi wallets that offer specific features tailored to my needs. For instance, if I’m interested in generating passive income through staking or lending, I’ll ensure that the wallet I choose has robust support for these DeFi services.

ZenGo An image of ZenGo, a crypto defi wallet known for its user-friendly design and robust security features.

ZenGo An image of ZenGo, a crypto defi wallet known for its user-friendly design and robust security features.

Trust Wallet A screenshot of Trust Wallet, a software wallet that offers a seamless user experience for managing crypto defi investments.

Trust Wallet A screenshot of Trust Wallet, a software wallet that offers a seamless user experience for managing crypto defi investments.

Now armed with this knowledge and visual representation of different crypto defi wallets, you can confidently choose the best one that aligns with your investment goals and preferences. Remember to prioritize security, compatibility, user experience, and supported features when making your decision. Happy investing!

Securing Your Crypto Defi Wallet: Best Practices

In the dynamic world of DeFi, where innovation and opportunity abound, maintaining the security of your crypto assets is paramount. As a seasoned crypto defi investor, I’ve adopted a set of best practices to protect my investments and ensure the long-term safety of my digital wealth.

Prioritize Private Key Management

The cornerstone of any crypto defi wallet’s security is the proper management of your private keys. I cannot stress enough the importance of storing your private keys securely, whether that’s using a hardware wallet or a tamper-proof storage solution. Sharing your private keys with anyone is a surefire way to compromise the integrity of your wallet, so I make sure to keep this information under lock and key.

Enable Multi-factor Authentication

Another crucial step in securing your crypto defi wallet is enabling multi-factor authentication (MFA). This additional layer of protection, such as biometric identification or a one-time code from an authenticator app, helps safeguard your wallet against unauthorized access, even if your login credentials are compromised.

Stay Vigilant Against Phishing Attacks

Crypto defi investors are prime targets for phishing scams, where malicious actors attempt to steal your login credentials or private keys. I always exercise extreme caution when it comes to any unsolicited communications, whether it’s an email, message, or link, and I double-check the legitimacy of the source before taking any action.

Keep Your Wallet Software Up To Date

Regularly updating your crypto defi wallet software is also essential for maintaining its security and compatibility with the ever-evolving DeFi ecosystem. By ensuring that your wallet is running the latest version, you can benefit from the latest security patches and bug fixes, helping to protect your investments against emerging threats.

Maximizing Returns With Crypto Defi Wallets

Now, let’s talk about how crypto defi wallets can help you unlock new opportunities for generating passive income and enhancing your investment returns. As a seasoned crypto defi investor, I’ve leveraged the unique features and integrations offered by these wallets to amplify the growth of my portfolio.

Staking And Earning Rewards

One of the most compelling aspects of crypto defi wallets is their seamless integration with staking platforms. By locking up my cryptocurrencies and contributing to blockchain validation, I’ve been able to earn substantial rewards, passively growing my crypto defi holdings over time. It’s a fantastic way to generate a steady stream of income without having to actively trade or manage my investments.

Lending And Borrowing

Crypto defi wallets also provide me with easy access to decentralized lending and borrowing platforms, where I can earn interest by providing liquidity or take out collateralized loans. This has allowed me to diversify my investment strategy and explore new ways to optimize the returns on my crypto defi portfolio.

Yield Farming And Liquidity Provision

For the more experienced DeFi investors like myself, crypto defi wallets have unlocked the world of yield farming and liquidity provision. By depositing my cryptocurrencies into various liquidity pools, I’ve been able to earn a share of the trading fees generated by these pools, further bolstering the growth of my DeFi investments.

Faq

Q: What is the most secure type of crypto defi wallet?

Hardware wallets are generally considered the most secure type of crypto defi wallet due to their offline storage of private keys, providing an additional layer of protection against online threats.

Q: Can I use a crypto defi wallet with multiple devices?

Yes, many crypto defi wallets offer mobile and desktop versions, allowing users to access their funds from different devices, ensuring convenience and accessibility.

Q: How do I recover my crypto defi wallet if I lose my private keys?

Most crypto defi wallets provide a recovery phrase or seed phrase that can be used to restore access to the wallet in case of key loss. It’s crucial to securely store this recovery information to ensure you can regain control of your assets.

Q: What are the key factors to consider when choosing a crypto defi wallet?

When choosing a crypto defi wallet, key factors to consider include security features, supported cryptocurrencies and DeFi protocols, user interface, and overall compatibility with your investment goals and risk appetite.

Conclusion

As a seasoned crypto defi enthusiast, I can attest to the transformative power of crypto defi wallets in the world of decentralized finance. By understanding the diverse wallet options, prioritizing security, and leveraging the unique features of these wallets, I’ve been able to unlock new avenues for growth, passive income, and financial empowerment.

Embrace the future of DeFi, my fellow investors, and let your crypto defi wallet be your guide to a more decentralized financial future. The possibilities are endless, and the rewards are there for the taking. So, let’s embark on this exciting journey together and seize the opportunities that the crypto defi landscape has to offer.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON