In the rapidly evolving world of decentralized finance (DeFi), the promise of outsized returns has attracted a growing number of cryptocurrency enthusiasts. However, this surge in popularity has also drawn the attention of unscrupulous individuals, leading to a proliferation of scams targeting unsuspecting investors. One such scam that has gained significant traction is the “1inch Giveaway” scam, which specifically targets users of the 1inch DeFi wallet.

As a cryptocurrency investor, it’s crucial to be aware of this emerging threat and take proactive steps to protect your hard-earned digital assets. In this comprehensive guide, we’ll dive deep into the intricacies of the 1inch crypto DeFi wallet scam, equipping you with the knowledge and tools to spot and avoid this insidious scheme.

Unraveling the 1inch Crypto DeFi Wallet Scam

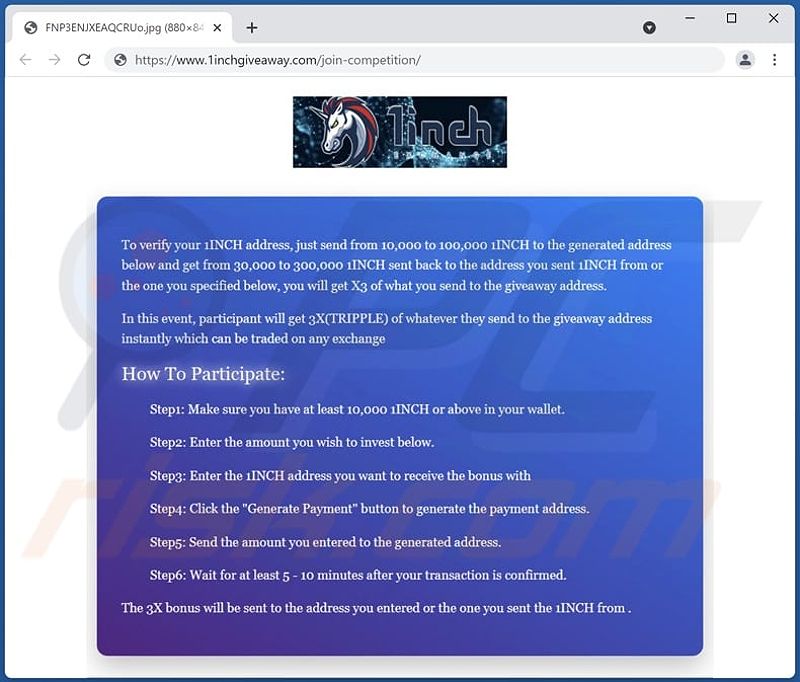

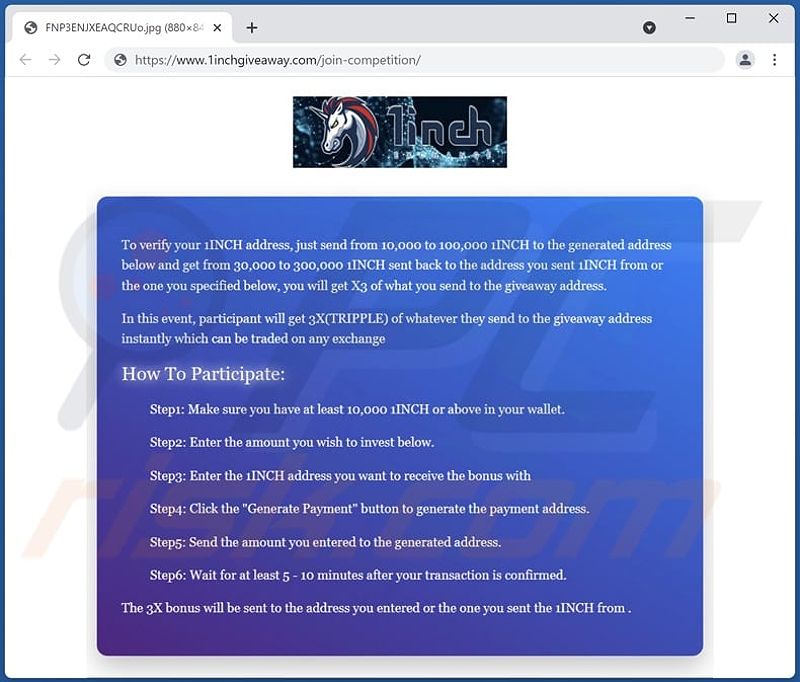

The “1inch Giveaway” scam is a deceptive scheme that preys on the growing popularity of the 1inch decentralized exchange, a leading DeFi platform. Scammers create fake websites or social media accounts impersonating the 1inch project, and then lure unsuspecting users into sending their 1inch tokens to a specified wallet address, promising an unrealistic payout in return.

The scammers’ modus operandi is simple yet effective: they convince victims that by sending a certain amount of 1inch tokens, they will receive triple the amount in return. Sounds too good to be true? That’s because it is. Once the tokens are sent, the scammers simply keep them, leaving the victims with nothing.

The devastating impact of this scam is staggering — in 2023 alone, cryptocurrency investors lost nearly $1 billion to similar schemes. The transactions are irreversible, and the victims are left with a crushing financial loss, often without any recourse.

Recognizing the Red Flags

To avoid falling victim to the 1inch crypto DeFi wallet scam, it’s essential to be vigilant and recognize the telltale signs of a fraudulent scheme. Keep a keen eye out for the following red flags:

Unrealistic Promises

Any offer that promises an outrageous return on your investment, such as tripling your 1inch tokens, should immediately raise a red flag. Legitimate DeFi projects simply do not make such outlandish claims.

Unrealistic Promises

Unrealistic Promises

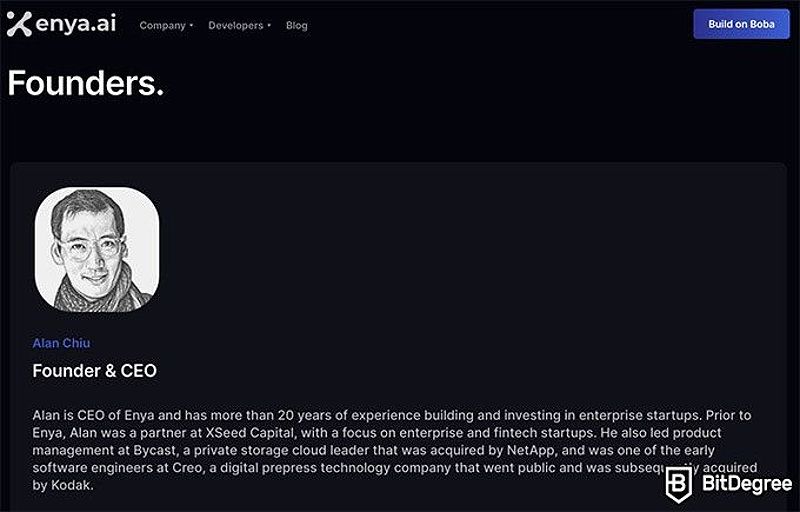

Anonymous or Unverified Developers

Reputable DeFi projects will have a transparent team with verifiable identities and backgrounds. If the individuals behind the 1inch project you’re considering are anonymous or their credentials cannot be verified, it’s a clear indication of potential deception.

Lack of Transparency

Legitimate DeFi projects should have a detailed whitepaper, openly available code, and a track record of independent audits. If the 1inch project you’re evaluating lacks these crucial elements, it’s a strong sign of a scam.

Pressure to Invest Quickly

Scammers often create a sense of urgency, pressuring you to send your 1inch tokens immediately. Legitimate projects will never rush you to make a decision without proper research and consideration.

Social Media Hype

Be wary of 1inch-related projects that rely heavily on social media influencers or celebrities to promote their offerings. These endorsements may be paid for, and the projects themselves may be nothing more than a scam.

Safeguarding Your 1inch Wallet

To protect your 1inch tokens and other cryptocurrency holdings, it’s essential to take proactive measures and adopt best practices for DeFi security. Here’s what you can do:

Utilize a Secure Wallet

Store your 1inch tokens in a reputable hardware wallet or a non-custodial software wallet, where you have full control over your private keys. Avoid keeping your funds in online exchanges or hot wallets, which are more vulnerable to hacks and theft.

Utilize a Secure Wallet

Utilize a Secure Wallet

Implement Two-Factor Authentication

Enable two-factor authentication (2FA) on your 1inch wallet and any other cryptocurrency-related accounts you have. This simple yet effective measure adds an extra layer of security, making it much harder for scammers to gain access to your funds.

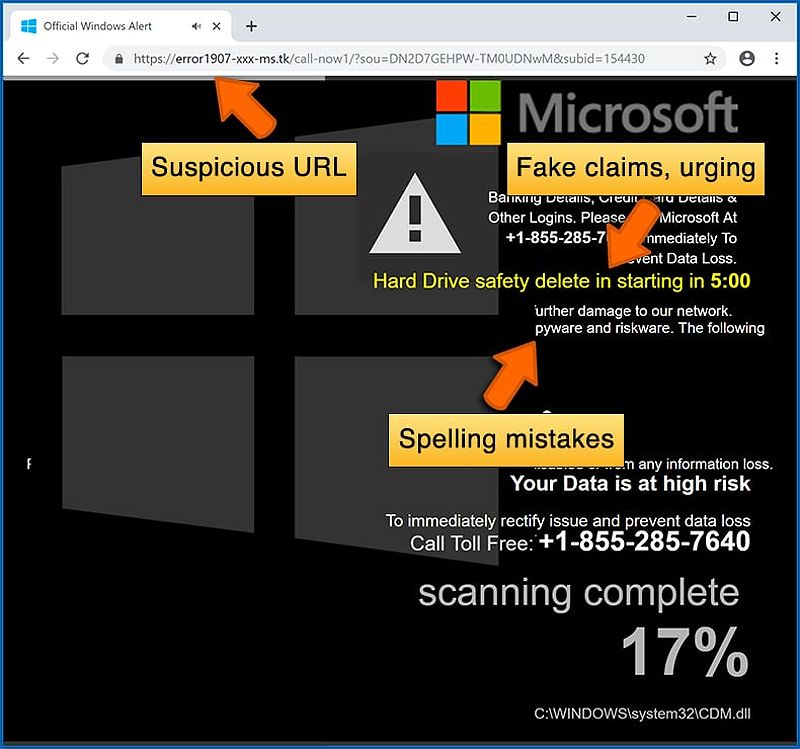

Be Vigilant Against Phishing Attacks

Scammers may try to trick you into revealing your private keys or wallet recovery phrases through fake websites or unsolicited messages. Always double-check the legitimacy of any communication or website before providing any sensitive information.

Be Vigilant Against Phishing Attacks

Be Vigilant Against Phishing Attacks

Maintain Absolute Secrecy

Under no circumstances should you share your 1inch wallet’s private keys or seed phrase with anyone, even if they claim to be from the 1inch project or a support representative. Your private information is the key to your digital assets, and you must guard it zealously.

Stay Skeptical

Approach any unsolicited offers, promises, or opportunities related to 1inch tokens or other cryptocurrencies with a healthy dose of skepticism. If it seems too good to be true, it most likely is.

Going Beyond the 1inch Wallet: Additional DeFi Security Measures

To further fortify your DeFi investments, consider implementing the following security measures:

Verify Smart Contract Audits

Before interacting with any DeFi project, including 1inch, ensure that the underlying smart contracts have been audited by reputable third-party security firms. This step helps identify potential vulnerabilities or weaknesses in the code, mitigating the risk of exploitation.

Verify Smart Contract Audits

Verify Smart Contract Audits

Analyze Tokenomics

Closely examine the token distribution and allocation of any DeFi project you’re considering. Be wary of projects where a large portion of the tokens is held by a few wallets, as this could indicate a potential rug pull or insider manipulation.

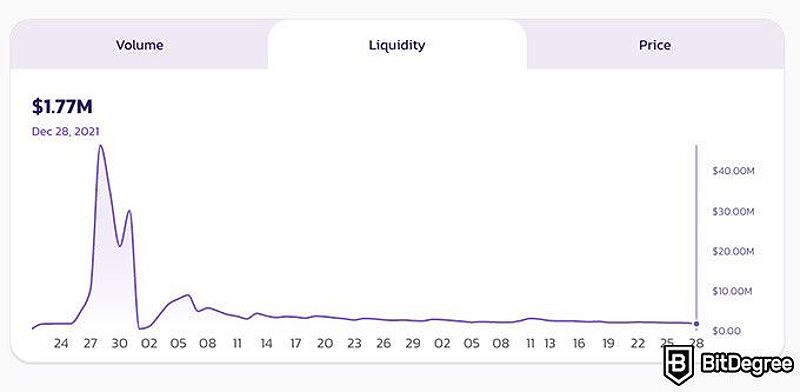

Assess Liquidity Pool Stability

When providing liquidity to DeFi protocols, evaluate the overall health and stability of the liquidity pools. Look for projects with deep liquidity and a well-diversified pool of assets to minimize the risk of sudden price fluctuations or drains.

Assess Liquidity Pool Stability

Assess Liquidity Pool Stability

Explore DeFi Insurance

Investigate the availability of DeFi insurance products that can provide coverage for your investments in case of hacks, exploits, or other unexpected events. While not a guaranteed protection, DeFi insurance can help mitigate some of the risks associated with this rapidly evolving space.

Explore DeFi Insurance

Explore DeFi Insurance

Stay Vigilant, Stay Secure

As the crypto and DeFi landscape continues to evolve, the tactics of scammers are becoming increasingly sophisticated. It’s crucial for you, as a cryptocurrency investor, to stay informed and vigilant to protect your hard-earned digital assets.

One effective way to stay ahead of the curve is to regularly follow reputable industry news sources and cryptocurrency-focused security blogs. These resources can provide valuable insights into the latest scams, hacks, and best practices for securing your investments.

Additionally, consider joining online communities of experienced DeFi enthusiasts and security professionals. These groups can be an invaluable source of information, advice, and real-time alerts about emerging threats. By actively engaging with the community, you can expand your knowledge and stay one step ahead of the scammers.

Remember, the key to navigating the DeFi space safely is to approach every opportunity with a critical eye, conduct thorough research, and never compromise the security of your digital assets. Stay vigilant, trust your instincts, and prioritize the protection of your 1inch wallet and other cryptocurrency holdings.

As the DeFi ecosystem continues to expand, it’s essential to remain informed and proactive in safeguarding your investments. By staying ahead of the curve and adopting best practices for DeFi security, you can enjoy the benefits of this innovative financial landscape while minimizing the risks posed by scammers and malicious actors.

FAQ

Q: How can I recover my 1inch tokens if I’ve been scammed?

A: Unfortunately, once you’ve sent your 1inch tokens to a scammer’s wallet, the transaction is typically irreversible due to the decentralized nature of cryptocurrencies. Your best course of action is to report the incident to the authorities and the 1inch support team, but the chances of recovering your funds are quite low.

Q: Are all DeFi projects scams?

A: No, not all DeFi projects are scams. The DeFi space is rapidly evolving, and there are many legitimate and innovative projects. However, the lack of regulation and the ease of creating new tokens have made the DeFi ecosystem a prime target for scammers. Thorough research and due diligence are crucial before investing in any DeFi project.

Q: What should I do if I see a suspicious 1inch offer on social media?

A: If you encounter a suspicious 1inch-related offer on social media, the best course of action is to report the account or post to the platform and avoid engaging with it further. Never click on any links or provide personal information, as this could lead to further exploitation.

Conclusion

The 1inch crypto DeFi wallet scam is a prime example of the growing threats that cryptocurrency investors face in the rapidly evolving DeFi landscape. By understanding the mechanics of this scam, recognizing the red flags, and implementing robust security measures, you can significantly reduce the risk of falling victim to such fraudulent schemes.

Remember, the key to navigating the DeFi space safely is to approach every opportunity with a critical eye, conduct thorough research, and never compromise the security of your digital assets. Stay vigilant, trust your instincts, and prioritize the protection of your 1inch wallet and other cryptocurrency holdings.

As the DeFi ecosystem continues to expand, it’s essential to remain informed and proactive in safeguarding your investments. By staying ahead of the curve and adopting best practices for DeFi security, you can enjoy the benefits of this innovative financial landscape while minimizing the risks posed by scammers and malicious actors.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON