The cryptocurrency market faced a seismic shift on August 5th, 2024, a day that would come to be known as “Crypto Black Monday.” This day marked a significant downturn in digital asset prices, prompting many investors to reassess their strategies and the factors behind such a dramatic plunge. This article will dissect the elements that led to this market upheaval and offer insights into its implications for investors navigating the crypto landscape.

Understanding the Causes of Crypto Black Monday

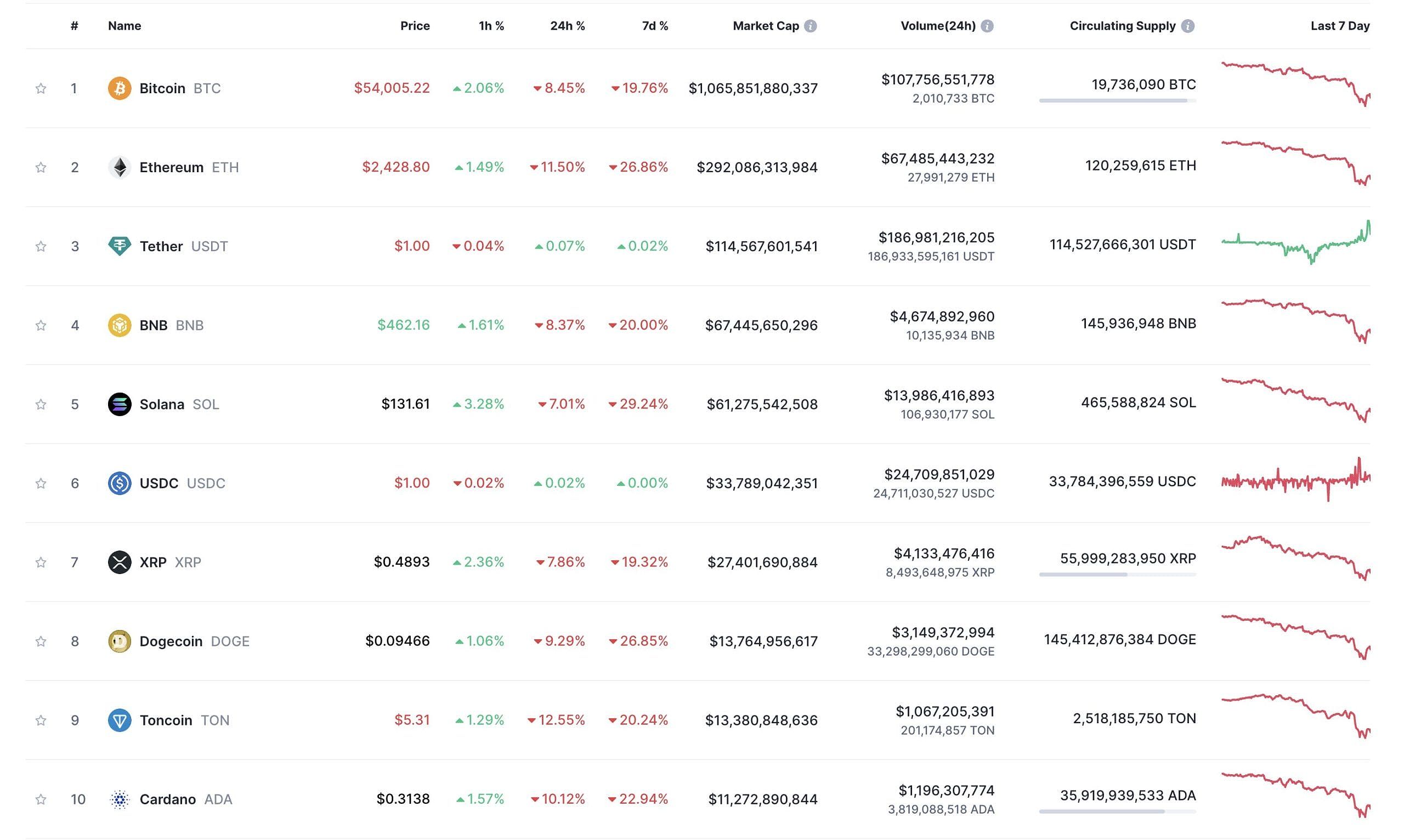

Crypto Black Monday was marked by a widespread sell-off affecting major cryptocurrencies, with Bitcoin experiencing a staggering decline of nearly 20% within just one week. This sharp downturn can be attributed to a combination of unsettling factors, chief among them being a “U.S. growth scare.” Concerns regarding an impending recession in the United States created an atmosphere of uncertainty, leading investors to reevaluate their positions in high-risk assets, including cryptocurrencies.

Further complicating the market’s response was the political climate, particularly the narrowing lead of Donald Trump in the presidential election polls. This increase in political uncertainty further dampened investor sentiment, prompting many to seek refuge in more stable asset classes. Additionally, the Bank of Japan’s transition towards policy normalization added pressure on global markets, exacerbating investor anxiety and contributing to the sell-off.

Strategies for Navigating Market Volatility

The recent turbulence in the cryptocurrency market highlights the critical importance of robust risk management strategies. While the long-term outlook for cryptocurrencies remains bright, the reality of short-term volatility cannot be ignored. Investors are encouraged to adopt a variety of strategies to effectively navigate these fluctuations.

One prudent approach is to consider reducing risk exposure rather than amplifying it during periods of heightened market uncertainty. Investors may find it beneficial to capitalize on price recoveries to strategically trim their holdings. Diversifying investments across a spectrum of cryptocurrencies and asset classes can also serve as a buffer against market volatility. It’s crucial to resist the temptation to engage in panic selling, as such actions rarely yield positive outcomes. Instead, maintaining focus on long-term investment objectives can help investors weather the storm.

The Future of Cryptocurrency: Looking Ahead

Despite the recent downturn, the long-term potential of cryptocurrencies remains promising. The ongoing evolution of blockchain technology continues to foster innovation across diverse sectors. As the cryptocurrency ecosystem evolves, further advancements and wider adoption are anticipated, creating pathways for future growth.

For investors, staying abreast of market trends, regulatory changes, and the dynamic landscape of blockchain technology is vital for making informed decisions in the crypto market. Understanding these elements will not only help in navigating current challenges but also in positioning for potential opportunities as the market matures.

Conclusion

Crypto Black Monday serves as a stark reminder of the inherent volatility that characterizes the cryptocurrency market. By comprehending the factors that drive these fluctuations and implementing sound risk management practices, investors can better navigate this ever-changing environment. Staying informed, diversifying portfolios, and maintaining a long-term perspective will be crucial for achieving success in the evolving world of cryptocurrencies. As the landscape continues to shift, those who remain vigilant and adaptable will be better equipped to seize opportunities in this dynamic market.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON