Is cryptocurrency the key to unlocking financial freedom for Millennials and Gen Z? As a young investor myself, I often find myself pondering this question. With student loans looming and the job market in constant flux, many of us are exploring alternatives to traditional investing. Cryptocurrency, with its enticing promise of high returns and autonomy, has become a captivating option for those of us eager to carve out our own financial paths.

Introduction

Imagine a recent college graduate, staring at their bank account and feeling a mix of anxiety and excitement. The world of finance can be daunting, especially with the weight of student debt on their shoulders. In this moment, they discover cryptocurrency—a digital realm that offers not just investment opportunities, but also a sense of empowerment.

Interestingly, a study I came across recently revealed that nearly half of Millennials and Gen Z are keen on investing in cryptocurrencies. This statistic defies the stereotype that younger generations shy away from traditional financial avenues, instead showcasing a shift towards embracing the digital asset revolution.

In 2021, the rise of decentralized finance (DeFi) marked a significant turning point, opening doors for young investors to access innovative financial services without the constraints of traditional banks. The implications of this shift are profound, especially for those of us who have grown up in an era of economic uncertainty.

Once viewed with skepticism, cryptocurrency has transitioned into a mainstream investment avenue. Today, young investors are not just passive observers; we are actively participating in a financial revolution that offers autonomy and the potential for significant returns.

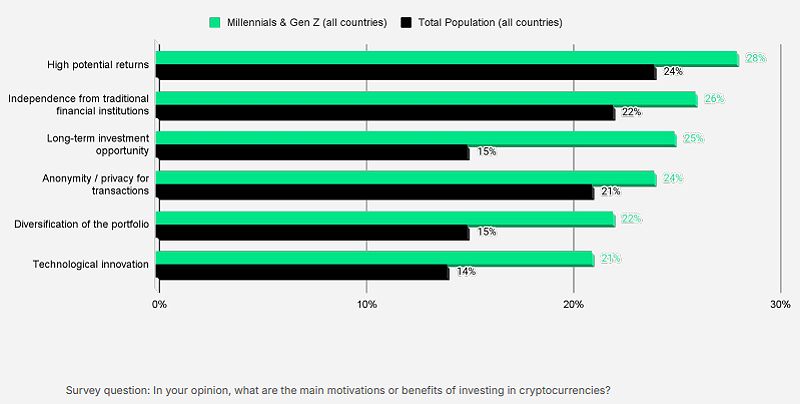

Why Cryptocurrency Appeals to Younger Generations

As a Millennial, I can relate to the growing desire for financial independence that my peers and I share. Many of us are entering the financial landscape at a time when traditional institutions often feel outdated and unresponsive to our needs. Cryptocurrency presents a refreshing alternative, offering a decentralized and transparent approach to managing our finances.

The appeal lies in the control it provides. By owning and managing digital assets, we can take charge of our financial futures, potentially reducing our reliance on conventional banking systems. This autonomy is especially enticing for a generation that has witnessed the fallout from economic crises and financial instability.

Cryptocurrency: Beyond Bitcoin

When most people think of cryptocurrency, Bitcoin usually comes to mind. However, the digital currency landscape is rich and diverse, encompassing a range of options that cater to various interests and needs.

Exploring Different Cryptocurrencies

-

Altcoins: These alternative cryptocurrencies expand beyond Bitcoin’s primary role as a digital currency. For instance, Ethereum is renowned for its smart contract functionality, while others focus on privacy features or scalability. Each altcoin presents unique opportunities for investors seeking to diversify their portfolios.

-

Stablecoins: Designed to maintain a stable value, stablecoins are often pegged to fiat currencies like the US dollar. They offer a layer of price stability that can be particularly appealing during periods of high market volatility, making them useful for transactions or as a safe haven for funds.

-

DeFi (Decentralized Finance): This burgeoning sector is revolutionizing traditional finance by utilizing blockchain technology. DeFi platforms enable decentralized lending, borrowing, and trading, democratizing access to financial products and services. For young investors, this represents a chance to engage with financial systems on our own terms.

Navigating the Crypto World: Key Considerations

Venturing into the cryptocurrency space can feel like stepping into uncharted waters. As someone who has dipped my toes into this world, I believe it’s crucial to approach it with a mix of enthusiasm and caution.

-

Education: Before making any investments, it’s essential to grasp the basics of cryptocurrency and blockchain technology. Understanding the risks involved is just as important as knowing the potential rewards.

-

Risk Management: The cryptocurrency market is notorious for its volatility. Prices can swing dramatically, so it’s wise to invest only what you can afford to lose. This mindset can help mitigate the emotional rollercoaster that often accompanies crypto trading.

-

Choosing the Right Platform: Selecting a reputable cryptocurrency exchange and wallet is vital for ensuring security and a positive user experience. Doing thorough research can save you from potential pitfalls down the road.

The Future of Cryptocurrency and Its Impact on Your Finances

While the future of cryptocurrency remains uncertain, its potential to reshape the financial landscape is undeniable.

-

Financial Inclusion: One of the most exciting prospects of cryptocurrency is its ability to enhance financial inclusion. By providing access to financial services for underserved populations, it can empower individuals who have been excluded from traditional banking systems.

-

New Investment Opportunities: The rise of DeFi and other crypto innovations is paving the way for fresh investment avenues. These developments could offer alternative pathways to wealth creation, especially for those of us who are willing to explore new frontiers.

-

The Potential for Disruption: Cryptocurrency has the power to disrupt traditional financial institutions by offering more efficient and transparent alternatives. As young investors, we have the opportunity to be at the forefront of this transformation.

Conclusion

As a young investor, I find myself drawn to the world of cryptocurrency for its promise of financial independence and potential for high returns. The evolving landscape presents both challenges and opportunities, and navigating it requires a solid understanding of the fundamentals, a commitment to risk management, and the ability to choose trustworthy platforms.

While the future of cryptocurrency is still unfolding, its capacity to reshape our financial realities is clear. For Millennials and Gen Z, embracing this digital revolution could be the key to unlocking a more empowered and financially secure future.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON