Could the European Union be gearing up for a game-changer in the financial scene? Regulators are seriously weighing the idea of allowing crypto assets in UCITS funds, which is a whopping €12 trillion market for investment products. This could be a golden ticket for institutional investors looking to shake things up and dive into the burgeoning world of crypto.

Crypto Fever: Institutions Are Getting Involved

There’s a buzz in the air, and it’s all about crypto. Institutional investors are increasingly eyeing digital assets, recognizing the potential for diversification and impressive returns. As the acceptance and regulation of crypto gain momentum, more players are hopping on this train.

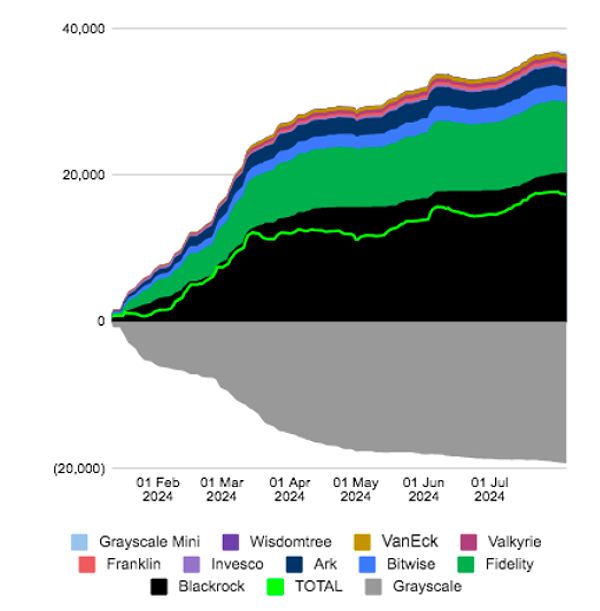

Sure, the current market slump has thrown a wrench in Bitcoin ETF inflows, but that hasn’t dampened the long-term optimism. Many institutional investors are still viewing these funds as their gateway to Bitcoin, the heavyweight champion of cryptocurrencies.

UCITS Funds: A New Playground for Crypto

So, what’s the deal with UCITS funds? These are regulated investment vehicles designed to keep investors safe. Think mutual funds, exchange-traded funds (ETFs), and money market funds, all wrapped up in EU regulations and open to global investors. If crypto assets get the green light for inclusion in these funds, it could shake things up for both traditional finance and the crypto space.

Imagine the benefits! For institutional investors, having access to crypto investments could mean easier entry, better diversification, and the potential for fatter returns. But, let’s not kid ourselves—there are risks. The crypto market is notorious for its wild swings, and there’s still a cloud of regulatory uncertainty along with the ever-present threat of fraud. Institutional investors need to tread carefully.

The Regulatory Tightrope

Enter the European Securities and Markets Authority (ESMA), the body that’s stepping up to shape the crypto regulatory landscape in the EU. Their “Call for Evidence” is aimed at clearing up the murky waters surrounding which crypto assets could fit into the UCITS framework. What ESMA concludes could be pivotal for the future of crypto in these funds.

A solid regulatory framework is key to keeping investors protected and ensuring market stability. Clear-cut regulations can help mitigate risks, paving the way for a safer playground for institutional investors eager to explore crypto opportunities.

Conclusion

The potential for integrating crypto assets into UCITS funds is a big deal for the EU’s financial landscape. This move could bring both exciting opportunities and notable challenges, showcasing the increasing acceptance of crypto assets among institutional investors. As the regulatory environment evolves, it’s crucial for these investors to weigh the potential upsides against the risks of adding crypto to their investment portfolios.

Feeling curious about the future of crypto in investment strategies? Stay tuned and keep your eyes peeled—this is just the beginning!

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON