In the rapidly evolving world of decentralized finance (DeFi), navigating the complexities of tax reporting can feel like a daunting task. As the crypto landscape continues to expand, with an increasing number of investors diving into the lucrative world of yield farming, staking, and lending, the need for specialized tax software has become more crucial than ever.

In 2024, the total value locked (TVL) in DeFi protocols is expected to surpass $200 billion, highlighting the exponential growth of this dynamic ecosystem. For crypto enthusiasts and DeFi users, finding the right tax software to accurately track their transactions and calculate their tax liabilities has become a top priority.

Understanding the Tax Implications of DeFi

Before diving into the best crypto and NFT tax software for DeFi users, it’s essential to understand the unique tax challenges that come with participating in decentralized finance.

Yield Farming and Staking: Taxable Income

Gains from yield farming and staking activities are generally considered taxable income by tax authorities. Depending on your jurisdiction, these earnings may be subject to your marginal tax rate. In the United States, for example, DeFi rewards would typically be reported as “Other Income” on your tax return. Accurately tracking the fair market value of your rewards at the time of receipt is crucial for proper tax calculations.

Lending and Borrowing: Interest Income and Deductions

The tax implications of DeFi lending and borrowing activities can be more complex. Interest earned from lending crypto assets is typically treated as investment income, subject to capital gains tax. On the other hand, interest paid on borrowed crypto may be tax-deductible in certain situations. Navigating these nuances requires a deep understanding of the specific tax laws in your region.

Why Specialized DeFi Tax Software Is a Game-Changer

Traditional tax software often falls short when it comes to the unique demands of the DeFi ecosystem. These platforms may lack the specific features and support needed to handle the intricacies of DeFi transactions, leaving crypto enthusiasts vulnerable to potential tax compliance issues.

“As the DeFi space has grown exponentially in recent years, the need for specialized tax software has become more apparent,” explains Sarah, a DeFi trader based in Canada. “I’ve tried using generic tax software, and it just couldn’t keep up with the complexities of my crypto activities. That’s why I turned to a DeFi-focused solution that truly understands the nuances of this dynamic market.”

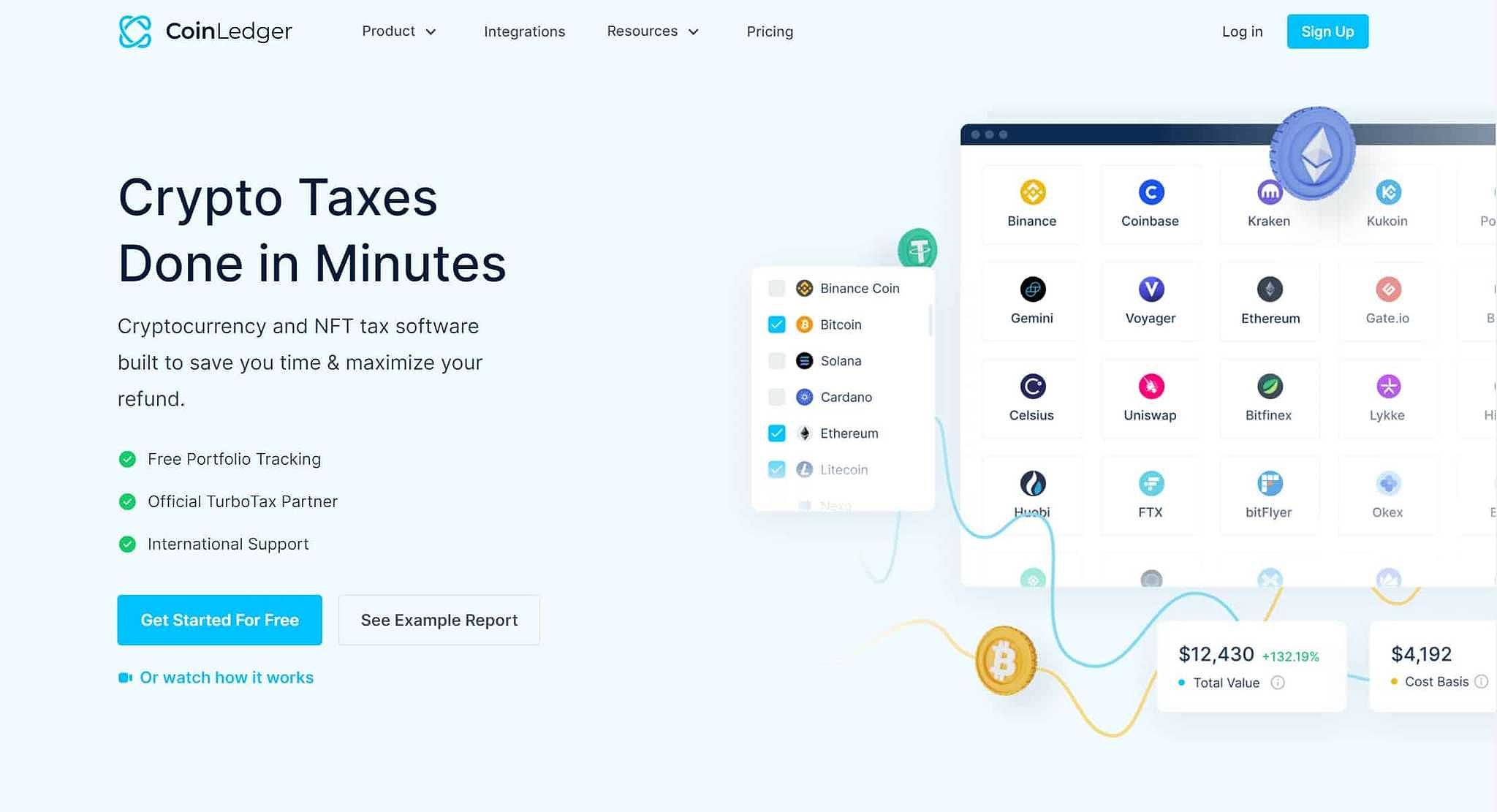

Unveiling the Top DeFi-Centric Crypto and NFT Tax Software

In the ever-evolving world of crypto taxation, a handful of standout solutions have emerged as the go-to options for DeFi users. Let’s explore the key features and benefits of these specialized tax software platforms:

CoinTracker: Comprehensive DeFi Support

CoinTracker has firmly established itself as a comprehensive solution for crypto investors and DeFi enthusiasts. With its robust support for a wide range of DeFi protocols, including yield farming, staking, and lending, CoinTracker makes it easy to track your transactions and calculate your tax liabilities.

“CoinTracker has been a game-changer for me,” says Jane, an active DeFi user. “The software’s intuitive interface and mobile app have helped me stay on top of my crypto portfolio, and the tax-loss harvesting feature has saved me thousands in taxes. I no longer have to worry about the complexities of DeFi taxation.”

ZenLedger: Seamless Integration and Reporting

For DeFi traders who prefer a more streamlined tax filing experience, ZenLedger offers a compelling solution. With its ability to seamlessly connect to multiple exchanges and wallets, ZenLedger can automatically generate comprehensive tax reports, saving users countless hours of manual data entry.

“As a busy DeFi trader, I needed a tax software that could keep up with my fast-paced activities,” explains Michael. “ZenLedger’s integration with TurboTax made the entire tax filing process a breeze, and I was able to ensure my DeFi-related transactions were accurately reported.”

ZenLedger crypto tax software

ZenLedger crypto tax software

Koinly: International DeFi Tax Support

Koinly stands out as a versatile crypto tax software that caters to an international audience, supporting over 20 countries. With its robust DeFi protocol coverage and intuitive user interface, Koinly has become a popular choice for crypto investors around the globe.

“As a DeFi user living in Canada, Koinly’s international tax reporting capabilities were a game-changer for me,” says Sarah. “The software’s comprehensive support for various DeFi activities gave me the confidence that my crypto-related taxes were being properly handled, no matter where I was in the world.”

Koinly homepage

Koinly homepage

TokenTax: Advanced DeFi and NFT Expertise

For DeFi users with more complex tax needs, TokenTax offers a specialized solution. This software excels at handling the nuances of DeFi and NFT transactions, providing advanced tax reporting capabilities and full-service accounting options.

“As my DeFi portfolio and NFT investments grew, I knew I needed a tax software that could handle the complexity,” shares John, a seasoned crypto trader. “TokenTax’s expertise in this space has been invaluable, and their team of tax professionals has provided me with personalized guidance to ensure I’m maximizing my tax deductions.”

Best crypto and NFT tax software

Best crypto and NFT tax software

Strategies for Minimizing Your DeFi Tax Liability

While the world of crypto taxation can be complex, there are several strategies DeFi users can employ to minimize their tax burden:

Tax-Loss Harvesting: Offsetting Gains with Losses

One effective approach is tax-loss harvesting, which involves strategically selling losing positions to offset your capital gains and reduce your overall tax liability. Many of the crypto tax software solutions mentioned in this article offer built-in tax-loss harvesting features to help you maximize your deductions.

![]() CoinTracking (1)

CoinTracking (1)

Leveraging Tax-Efficient DeFi Protocols

Certain DeFi protocols may offer more tax-efficient income streams than others. For instance, some stablecoin lending platforms may provide interest payments that are treated as investment income rather than ordinary income, potentially resulting in a lower tax burden. Researching and utilizing these tax-advantaged DeFi protocols can be a valuable strategy.

Consulting a Tax Professional

While crypto tax software can simplify the process, it’s always recommended to consult with a tax professional who specializes in cryptocurrency and DeFi. These experts can provide invaluable guidance on navigating the complex tax landscape, identifying legal strategies to minimize your taxes, and ensuring you comply with all applicable regulations.

Crypto tax

Crypto tax

FAQ

Q: What are the tax implications of earning interest from lending crypto assets on DeFi platforms? A: Interest earned from lending crypto assets on DeFi platforms is typically treated as investment income, which is subject to capital gains tax. The specific tax rate may vary depending on your jurisdiction and personal tax situation.

Q: How do I report my DeFi income on my tax return? A: The reporting requirements for DeFi income can vary, but in general, you’ll need to report your earnings from activities like yield farming, staking, and lending as either “Other Income” or “Capital Gains,” depending on the nature of the income. Using specialized crypto tax software can help ensure you properly categorize and report your DeFi-related income.

Q: Are there any tax-efficient DeFi strategies I can utilize? A: Yes, some strategies like tax-loss harvesting and utilizing certain DeFi protocols that offer more favorable tax treatment (e.g., stablecoin lending) can help minimize your DeFi tax liability. Consulting with a tax professional can provide personalized guidance on the best approaches for your specific situation.

Q: What are the best resources for learning more about DeFi taxes? A: In addition to this article, there are several online resources that can provide more information on DeFi taxes, including educational articles, forums, and communities focused on cryptocurrency and decentralized finance. Reputable tax software providers and crypto news publications are also great sources for staying up-to-date on the latest developments in the DeFi tax landscape.

Conclusion: Unlocking the Full Potential of DeFi with the Right Tax Software

As the crypto and DeFi markets continue to evolve, the importance of using the right tax tools has become increasingly evident. By leveraging specialized DeFi-focused tax software, crypto enthusiasts can simplify the process of tracking their transactions, calculating their tax liabilities, and ensuring compliance with ever-changing regulations.

Whether you’re a seasoned DeFi trader or just starting to explore the world of decentralized finance, taking the time to understand the tax implications and utilizing the best crypto and NFT tax software can help you navigate the complexities, minimize your overall tax burden, and unlock the full potential of your DeFi investments. With the right tools and strategies in your arsenal, you can confidently embrace the exciting opportunities that the DeFi ecosystem has to offer.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON