As an avid NFT art collector, I’ve been fascinated by the rapid rise of this digital asset class and the dizzying fluctuations in their crypto prices. It’s like navigating a high-stakes treasure hunt, where every NFT holds the potential for extraordinary rewards or crushing disappointments. But fear not, my fellow collectors — I’m here to share the insights I’ve gained from delving into the complexities of this captivating market.

The NFT art landscape has truly revolutionized the way we perceive and value digital creations. Gone are the days when digital art was seen as ephemeral and lacking true ownership. These non-fungible tokens have ushered in a new era, where scarcity and provenance are redefined by the power of blockchain technology. It’s a world where a single JPEG can command millions in crypto, and the rules of traditional art collecting have been turned on their head. Understanding the factors that drive nft art crypto price fluctuations is crucial for navigating this dynamic market.

Demystifying the Factors that Drive NFT Art Crypto Prices

As I’ve explored this dynamic market, I’ve come to understand that the factors influencing “nft art crypto price” are as diverse as the artworks themselves. Let’s dive in and uncover the key elements that shape the value of these digital masterpieces.

The Artist’s Reputation and Pedigree

CryptoPunk #7804

CryptoPunk #7804

In the world of NFT art, the artist’s name carries immense weight. Just like in the traditional art world, collectors are drawn to the prestige and potential appreciation associated with owning works by renowned digital artists. Those with a strong track record of successful sales, innovative techniques, and a dedicated following often command the highest prices for their NFT creations. It’s like investing in the future of digital art — the more established the artist, the more their NFTs are likely to soar in value over time.

Rarity and Exclusivity

Bored Ape Yacht Club NFTs

Bored Ape Yacht Club NFTs

Scarcity is the name of the game in the NFT art crypto market. NFTs with unique traits, limited editions, or belonging to highly sought-after collections like CryptoPunks and Bored Ape Yacht Club are the holy grail for collectors. The principles of supply and demand are in full force here — the rarer the NFT, the more collectors are willing to pay a premium to own it. It’s like holding a digital Picasso in your virtual wallet, and the world is watching to see how high the prices can climb.

Community Hype and FOMO

The NFT art market is fueled by a palpable sense of excitement and FOMO (fear of missing out) among collectors. Projects that cultivate a strong, engaged community and generate buzz on social media tend to see their NFT prices skyrocket. When influential figures or tastemakers start to champion a particular NFT collection, it can trigger a frenzy of buying activity as collectors scramble to get in on the action. It’s like a digital gold rush, and the fear of being left behind can drive prices to dizzying heights.

Utility and Real-World Integration

As the NFT art ecosystem matures, we’re seeing a shift toward NFTs that offer more than just digital ownership. Projects that grant access to exclusive communities, virtual experiences, or future benefits are increasingly attracting collectors. These NFTs provide tangible utility, adding an extra layer of value beyond the artwork itself. It’s like investing in a digital membership club, where the NFT becomes a key to unlock a world of unique opportunities.

Market Volatility and Speculative Trading

Let’s not forget the inherent volatility of the cryptocurrency market, where NFTs are predominantly traded. This wild ride can significantly impact the prices of these digital assets. Speculative trading, driven by investor sentiment and market trends, can lead to rapid price fluctuations, both in the upward and downward directions. Navigating this volatile landscape requires a strategic and informed approach — it’s like surfing the crypto waves, and you need to have your wits about you to avoid getting caught in the undertow.

Strategies for Savvy NFT Art Collectors

As an experienced NFT art collector, I’ve learned that the key to success in this market is a comprehensive approach that combines meticulous research, clear investment goals, and effective portfolio management. Let me share with you the strategies that have served me well.

Dive Deep into Research and Due Diligence

Before diving into the NFT art crypto market, it’s crucial to do your homework. Familiarize yourself with the artists, their backgrounds, and the project’s roadmap. Analyze historical sales data, community engagement, and any unique features or utility that the NFTs may offer. Utilize specialized tools and resources to gain valuable insights into pricing trends and potential value. It’s like being an art detective — the more you uncover, the better equipped you’ll be to make informed decisions.

Align Your Investment Goals

Take the time to define your investment objectives and risk tolerance before committing your crypto. Are you in it for the long-term appreciation? Looking to flip NFTs for short-term gains? Or simply collecting digital art for the pure joy of it? Aligning your goals with your investment strategy will help you navigate the market with clarity and confidence.

Diversify and Manage Your Portfolio

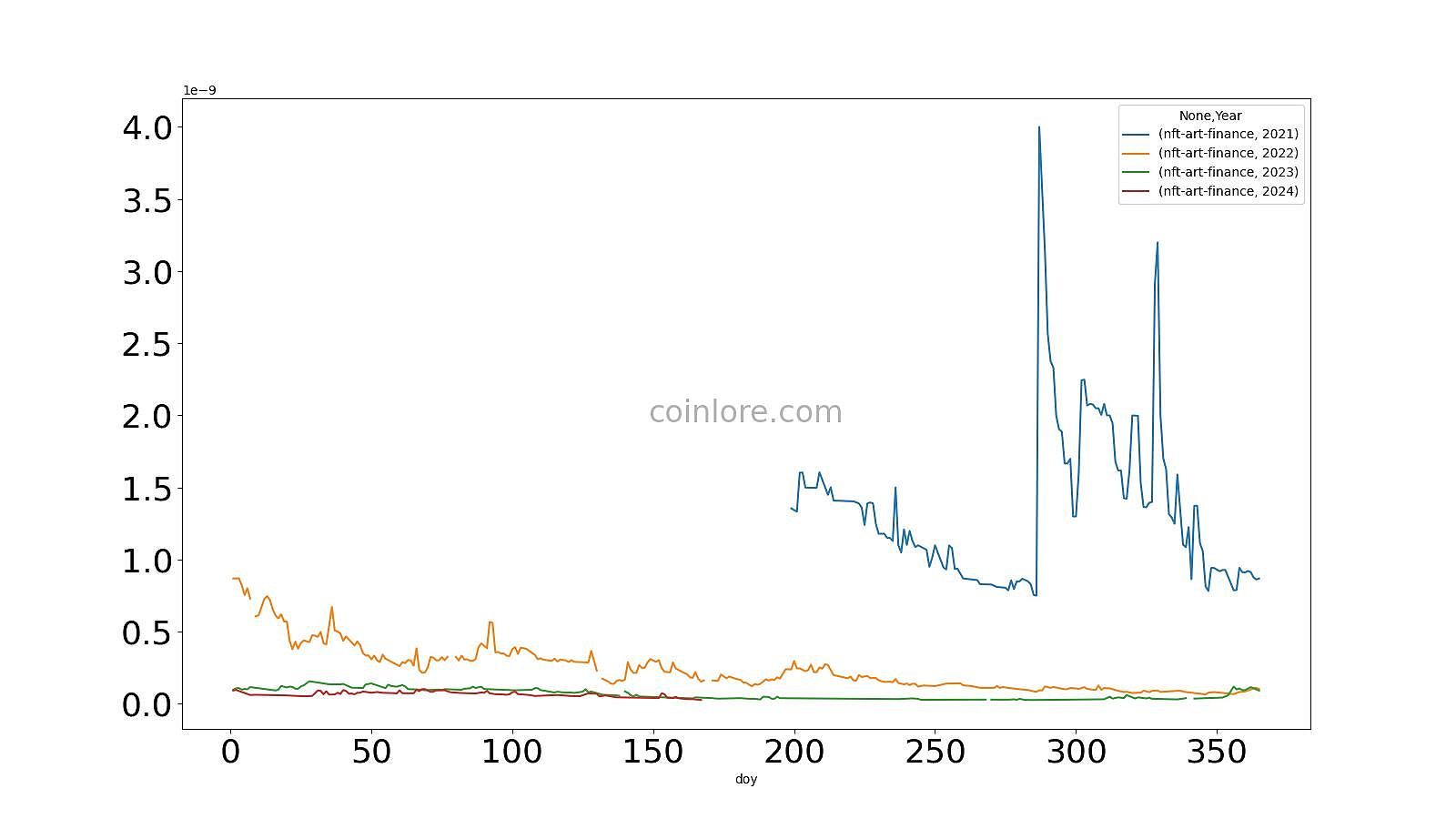

NFT Art Finance Historical year over year chart

NFT Art Finance Historical year over year chart

Don’t put all your digital eggs in one basket. Diversifying your NFT art portfolio across different artists, collections, and genres can help mitigate risk and exposure to market volatility. Effective portfolio management, including tracking your holdings and monitoring trends, will allow you to make agile decisions and capitalize on emerging opportunities.

Stay Informed and Engaged

Maintaining a pulse on the ever-evolving NFT art landscape is crucial. Subscribe to industry newsletters, follow influential voices on social media, and attend NFT-focused events. By staying informed and engaged, you’ll be better equipped to navigate the tides of this dynamic market and potentially ride the wave of the next big NFT trend.

The Future of NFT Art Crypto Prices: Trends and Predictions

As I gaze into my digital crystal ball, I see a future where the NFT art crypto market continues to captivate and surprise us. Let’s explore some of the trends and predictions that may shape the valuation of these digital masterpieces in the years to come.

Institutional Adoption and Legitimization

The growing interest from institutional investors, such as hedge funds and major corporations, in the NFT art market could have a significant impact on prices. As these deep-pocketed players enter the fray, the influx of large-scale capital and the legitimization of the market may further drive demand and fuel price appreciation.

Integration with the Metaverse

The emergence of the metaverse, a virtual shared space that blends physical and digital realms, presents new and exciting opportunities for NFT art. As these virtual worlds become more integrated into our everyday lives, the value of NFTs as digital assets within these immersive environments may soar. Collectors may find themselves bidding furiously for the right to display their digital masterpieces in the virtual galleries of the future.

Innovative Forms of NFT Art

The NFT art landscape is constantly evolving, with the emergence of new and innovative forms of digital art, such as generative art, interactive experiences, and AI-generated creations. These novel artistic expressions may reshape the perceived value and appeal of NFT art, leading to changes in their crypto pricing dynamics. Who knows, the NFT art of the future may be beyond our wildest imaginings, and the crypto values to match.

Regulation and Standardization

As the NFT art market matures, increased regulatory oversight and the establishment of industry standards may contribute to greater price stability and investor confidence. The clarification of legal frameworks and the implementation of best practices could help mitigate risks and provide a more robust foundation for the valuation of these digital assets. It’s like the digital art world growing up and finding its place in the mainstream, with the potential for more predictable and sustainable price movements.

So, my fellow NFT art collectors, keep your crypto wallets primed and your eyes peeled for the next big thing. The future of NFT art crypto prices is a captivating and ever-evolving landscape, and with the right strategies and insights, you just might uncover the digital masterpieces that will skyrocket in value and cement your place in the pantheon of NFT art connoisseurs.

FAQ

Q: What are some of the best resources for researching NFT art prices? A: When it comes to researching “nft art crypto price” data, I rely on a few go-to resources. Reputable NFT art marketplaces like OpenSea, CryptoSlam, and DappRadar offer comprehensive price data and historical sales information. Additionally, data aggregators such as NonFungible.com and CoinGecko provide in-depth analytics and insights into the broader NFT art market.

Q: How can I tell if an NFT art project is legitimate and worth investing in? A: Evaluating the legitimacy of an NFT art project is crucial before committing your “nft art finance crypto.” I always start by researching the artist’s background, the project’s community engagement, and the overall roadmap and utility. Verifying the project’s social media presence, community feedback, and any partnerships or collaborations can give you a good sense of its legitimacy and long-term potential.

Q: What are some common scams to watch out for in the NFT art market? A: The world of “nft art crypto” is not without its share of scams, so it’s important to be vigilant. Beware of “rug pull” scams, where project developers suddenly abandon the project and abscond with all the funds. Pump-and-dump schemes that artificially inflate prices are also something to watch out for. Additionally, phishing attempts and impersonation scams that aim to steal your digital assets are all too common. Conducting thorough due diligence is essential to avoid falling victim to these nefarious schemes.

Conclusion

As I reflect on my journey as an NFT art collector, I’m reminded of the thrill and challenge of navigating the ever-evolving “nft art crypto price” landscape. From the intriguing influence of artist reputation to the captivating power of rarity and community hype, the factors that shape the value of these digital masterpieces are truly captivating.

But the real reward lies in the strategic approach. By conducting rigorous research, aligning our investment goals, and diversifying our portfolios, we can unlock the true potential of the NFT art market and potentially capitalize on the growth of this fascinating digital art movement. And as the future unfolds, with trends like increased institutional adoption and the integration of the metaverse, the possibilities for “nft art token crypto” only seem to expand.

So, my fellow collectors, let’s embrace the excitement and the challenges of this dynamic market. With the right insights and strategies in our digital toolbox, we can navigate the “nft art finance crypto” landscape with confidence and uncover the digital treasures that will define the future of art in the crypto age.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano