It’s June 2024, and the crypto landscape is ever-evolving. As an experienced cryptocurrency enthusiast, I’ve witnessed the industry’s highs and lows, from the exhilarating bull runs to the sobering failures of once-renowned institutions. Through it all, I’ve come to fully appreciate the power and responsibility of self-custody — the art of securely managing your own crypto assets.

In this article, I’ll share my personal insights and practical guidance on navigating the self-custody landscape, empowering you to take charge of your digital wealth. Understanding the nuances of private keys and choosing the right self-custody crypto wallet are crucial steps in this journey. Whether you’re a seasoned crypto veteran or a curious newcomer, my hope is that you’ll come away with a deeper understanding of the best practices for safeguarding your crypto assets.

Embracing the Power of Private Keys

At the heart of self-custody lies the concept of private keys — those unique digital codes that grant you unfettered access to your cryptocurrency holdings. As I’ve learned over the years, these keys are the digital equivalent of physical keys, and they unlock the door to your financial autonomy.

By taking responsibility for your private keys, you eliminate the need to rely on third-party custodians, ensuring that your funds are truly yours. This shift in mindset is empowering, as it allows you to exercise complete control over your assets, making decisions that align with your personal financial goals and priorities.

Navigating the Self-Custody Landscape

The crypto ecosystem offers a diverse array of self-custody wallet options, each with its own set of advantages and considerations. As an experienced user, I’ve explored and experimented with various solutions, and I’m excited to share my insights with you.

Hardware Wallets: The Fortress of Your Crypto Assets

Hardware Wallets

Hardware Wallets

Hardware wallets, such as the Ledger, Trezor, and Coldcard devices, have become the gold standard of self-custody security. By storing your private keys offline, these physical devices effectively isolate your funds from internet-connected threats, providing an unparalleled level of protection.

I’ve personally used a Ledger Nano X for several years, and I can attest to its robust security features and user-friendly interface. The peace of mind that comes with knowing my crypto assets are safeguarded in a hardware wallet is truly invaluable.

Software Wallets: Convenience and Accessibility

Software Wallets

Software Wallets

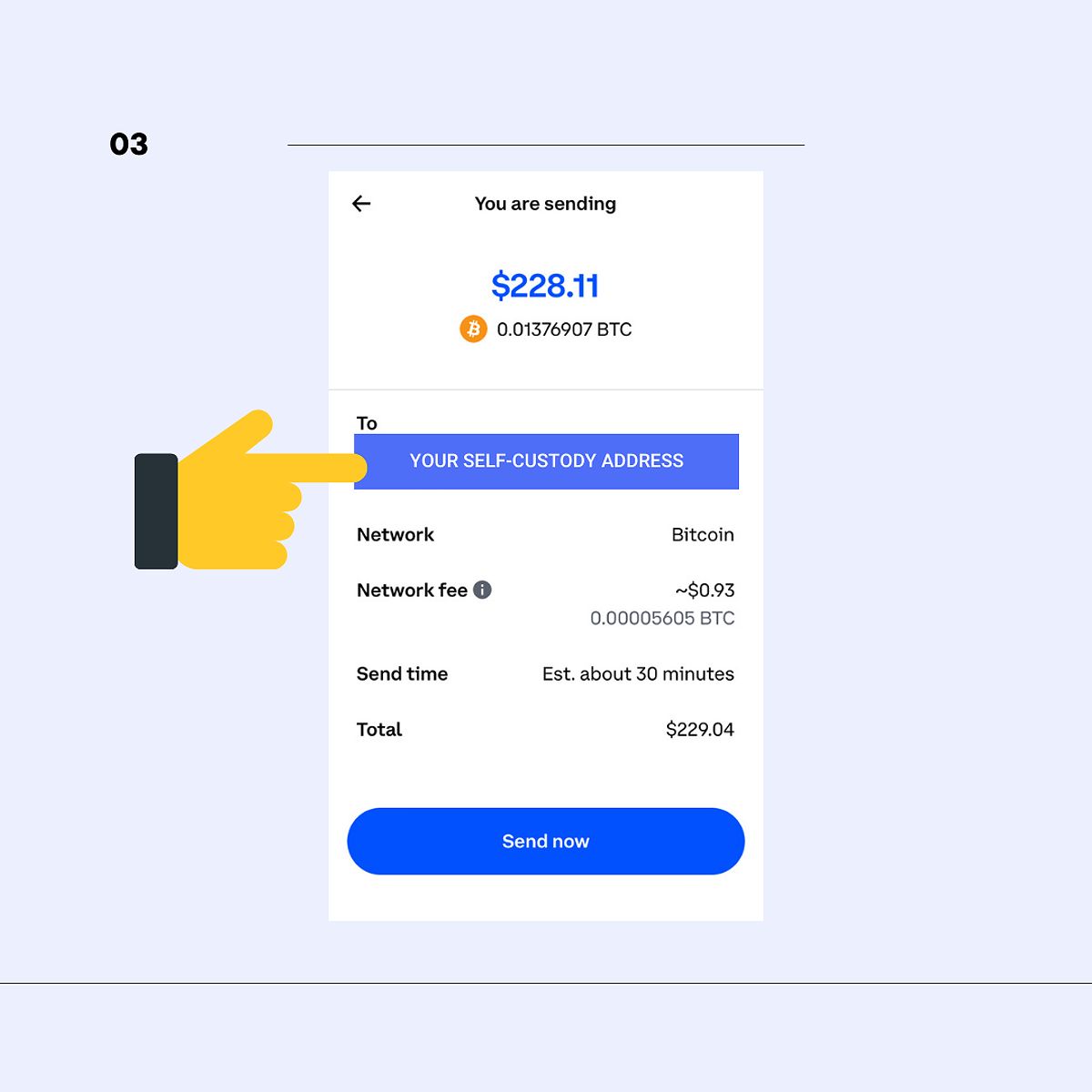

While hardware wallets offer the ultimate in security, software wallets can be a more accessible and user-friendly option for self-custody. Apps like Exodus, Electrum, and Mycelium provide a seamless interface for managing your crypto holdings, making it easier for those new to the self-custody space to get started.

I’ve found that software wallets can be a great gateway to self-custody, especially for those who are more comfortable with digital interfaces. However, it’s crucial to maintain vigilance and implement robust security measures to mitigate the inherent risks of internet-connected devices.

Multi-Signature Wallets: Sharing the Responsibility

For those seeking an even higher level of security, multi-signature wallets offer a unique solution. These wallets require multiple private keys to authorize transactions, effectively distributing the responsibility for securing your assets among trusted parties.

I’ve had the opportunity to collaborate with a small business group that utilizes a multi-signature wallet solution. The process of setting it up was slightly more complex, but the added layer of security and the ability to share the burden of custody have been invaluable.

Securing Your Self-Custody Crypto Wallet: Best Practices

As an experienced self-custody user, I’ve learned that the responsibility of safeguarding your private keys and seed phrases is paramount. By implementing robust security measures, you can ensure the long-term protection of your digital wealth.

Safeguarding Your Seed Phrase

Safeguarding Your Seed Phrase

Safeguarding Your Seed Phrase

The seed phrase, also known as the recovery phrase, is the key to recovering your private keys and accessing your crypto funds. I’ve taken great care to store my seed phrase in a secure, offline location, such as a fireproof and waterproof safe. This simple yet crucial step has provided me with the peace of mind that my assets are protected, even in the event of unforeseen circumstances.

Enhancing Security with Multi-Factor Authentication

Enhancing Security with Multi-Factor Authentication

Enhancing Security with Multi-Factor Authentication

In addition to securing my seed phrase, I’ve also implemented strong security measures, such as two-factor authentication (2FA), on all of my self-custody wallets. This extra layer of protection helps to mitigate the risk of unauthorized access, ensuring that my crypto holdings remain safe and secure.

Staying Vigilant Against Phishing Attacks

The crypto space has seen a rise in sophisticated phishing scams, and I’ve made it a priority to educate myself on the latest tactics used by cybercriminals. By learning to recognize the hallmarks of these attacks, such as suspicious links and requests for sensitive information, I’ve been able to navigate the self-custody landscape with heightened awareness and confidence.

Embracing the Evolving Crypto Landscape

As the crypto ecosystem continues to evolve, I’ve found it essential to stay informed and adaptable. By monitoring industry trends, regulatory changes, and emerging security innovations, I’ve been able to optimize my self-custody practices and ensure the long-term protection of my digital assets.

One of the most significant developments I’ve witnessed in recent years has been the growth of cold storage solutions, such as hardware security modules (HSMs) and multi-party computation (MPC) protocols. These advanced techniques have provided me with an even greater level of security, further safeguarding my crypto holdings from potential threats.

As I continue to explore the ever-changing crypto landscape, I’m excited to see what the future holds. By staying ahead of the curve and embracing new security advancements, I’m confident that I can maintain the highest level of protection for my digital wealth.

Conclusion: Empowering Your Crypto Future

In the ever-changing world of cryptocurrency, self-custody has become a crucial strategy for experienced users like myself. By taking control of our private keys, we can eliminate the risks associated with third-party custodians and maintain the sovereignty of our digital wealth.

As you embark on your own self-custody journey, I encourage you to explore the diverse range of wallet options, implement robust security measures, and stay vigilant against emerging threats. With the right knowledge and approach, you too can become a master of self-custody, empowering your crypto future and contributing to the resilience of the broader ecosystem.

Remember, the power of self-custody lies in your hands. Embrace this empowering path, and take the first step towards securing your digital assets and reclaiming your financial autonomy.

FAQ

Q: What happens if I lose my seed phrase? A: Losing your seed phrase means permanently losing access to your crypto funds. As the only way to recover your private keys, it is crucial to securely store and backup your seed phrase in a safe, offline location. This is one of the most important responsibilities of self-custody, and it’s a lesson I’ve learned firsthand through my own experiences.

Q: Is self-custody really necessary for experienced users? A: Absolutely. As an experienced cryptocurrency user, I firmly believe that self-custody provides the highest level of control and security over your digital assets. By taking full ownership of your private keys, you eliminate the risks associated with third-party custodians and can confidently navigate the crypto landscape with complete autonomy.

Q: What are some of the most common scams targeting self-custody users? A: The most prevalent scams targeting self-custody users include sophisticated phishing attacks, fake websites impersonating legitimate wallet providers, and social engineering tactics aimed at tricking users into revealing their private keys or seed phrases. Staying vigilant and educating yourself on the latest tactics used by cybercriminals is crucial to protecting your crypto holdings.

Q: What are the best resources for learning more about self-custody security? A: I’ve found that reputable security blogs, online forums, and communities dedicated to cryptocurrency security can be invaluable resources for learning more about self-custody best practices. By engaging with like-minded individuals and staying up-to-date on the latest developments, you can continuously enhance your self-custody strategies and keep your crypto assets safe.

Empowering Your Crypto Future

As I reflect on my journey as an experienced self-custody user, I’m reminded of the immense power and responsibility that comes with taking full control of your digital wealth. It’s a path that requires dedication, vigilance, and a deep understanding of the nuances of private keys and wallet management.

But the rewards of self-custody are truly transformative. By embracing this empowering approach, you not only safeguard your crypto assets but also contribute to the overall resilience and decentralization of the broader ecosystem. Your journey as a self-custody master can inspire others, paving the way for a future where individuals, not institutions, hold the keys to their financial sovereignty.

So, take the first step and embark on this transformative path. Explore the diverse landscape of self-custody wallets, implement robust security measures, and stay informed about the ever-evolving crypto landscape. Together, we can build a future where the power of cryptocurrency is truly in the hands of the people.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON