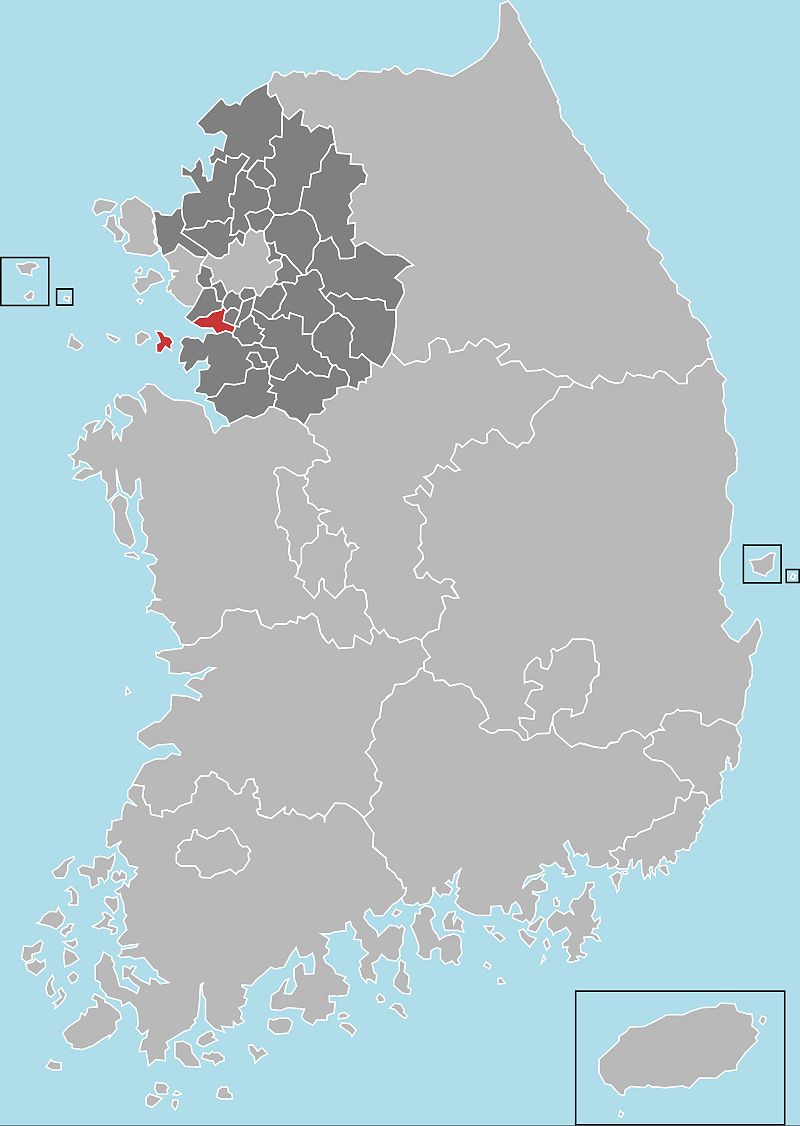

The landscape of cryptocurrency in South Korea is undergoing a significant transformation, particularly in Ansan City, where local authorities have introduced a robust system aimed at confiscating digital assets from individuals neglecting their tax obligations. This initiative signals a critical shift towards stringent regulatory oversight of crypto transactions and emphasizes the necessity of tax adherence among investors.

Examining Ansan’s Crypto Asset Confiscation Framework

Ansan’s newly established “virtual asset platform seizure system” is a pioneering effort to recover unpaid local taxes by meticulously monitoring the cryptocurrency holdings of its residents. The local government utilizes data sourced from prominent South Korean cryptocurrency exchanges to track digital asset transactions, thereby identifying individuals with outstanding tax liabilities. If a resident’s crypto wallet is found to be associated with unpaid taxes, the authorities possess the power to freeze that wallet and mandate payment. Should individuals fail to resolve their tax dues, the city is authorized to liquidate the corresponding crypto assets and redirect the proceeds to its treasury.

Consequences for Cryptocurrency Investors in South Korea

This enforcement mechanism serves as a stark reminder of the escalating importance of tax compliance for cryptocurrency investors in South Korea. It is imperative for investors to ensure that their digital asset portfolios are accurately reported and that all pertinent taxes are remitted punctually. Noncompliance could lead to severe consequences, including the potential seizure of assets. Additionally, this system is likely to enhance the scrutiny surrounding cryptocurrency transactions, necessitating that investors maintain meticulous records and uphold transparent financial practices.

The Evolving Legal and Regulatory Framework for Crypto in South Korea

The regulatory environment governing cryptocurrency in South Korea is rapidly adapting to the changing landscape. The government is actively engaged in formulating clear guidelines for the taxation of digital assets while simultaneously striving to combat financial malfeasance associated with cryptocurrencies. The implementation of Ansan’s asset seizure system exemplifies the ongoing efforts to regulate the cryptocurrency sector and promote its responsible evolution.

Strategies for Navigating the New Cryptocurrency Environment

In light of these developments, it is crucial for cryptocurrency investors in South Korea to remain vigilant regarding the latest regulatory changes and ensure their investment strategies align with compliance requirements. This involves gaining a comprehensive understanding of the tax implications tied to cryptocurrency transactions and seeking expert guidance when necessary. Furthermore, utilizing reputable cryptocurrency exchanges and wallets that prioritize security and regulatory compliance is essential for safeguarding assets.

Conclusion

Ansan City’s introduction of a crypto asset confiscation system marks a decisive shift in South Korea’s approach to regulating the cryptocurrency market. Investors are urged to prioritize tax compliance and adopt responsible investment practices to successfully navigate this evolving regulatory landscape. By staying informed and taking appropriate precautions, they can effectively protect their assets and ensure a compliant and secure experience within the South Korean cryptocurrency ecosystem.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON