As the Crypto Queen, I’m thrilled to share my insights on navigating the dynamic world of cryptocurrency investments. In recent years, the crypto market has witnessed unprecedented growth, drawing in a flood of new investors seeking to capitalize on this exciting frontier. However, as this ecosystem evolves, savvy investors like myself are increasingly turning to crypto wallet analytics to unlock a wealth of valuable insights and make informed decisions.

Unraveling the Power of On-Chain Data

The transparent nature of blockchain technology is a double-edged sword — while it provides unparalleled visibility into the movement of digital assets, it can also be overwhelming for the uninitiated. But as a seasoned crypto enthusiast, I’ve learned to harness the power of on-chain data to my advantage.

Crypto wallet analytics platforms leverage this transparency, transforming raw blockchain data into actionable insights that can inform my investment strategies and identify emerging opportunities. By delving into the intricate workings of the blockchain, I’m able to gain a deeper understanding of the market’s underlying trends and make more informed decisions.

Tracking Whales and Predicting Market Sentiment

One of the key aspects of crypto wallet analytics that I find particularly captivating is the ability to monitor the behavior of large-volume “whale” wallets. By observing the activity of these influential players, I can gain valuable insights into the overall market sentiment.

Sudden shifts in the holdings or transaction patterns of these whales can signal potential price fluctuations, allowing me to anticipate and capitalize on market movements. I closely watch for clues about their investment strategies, risk appetite, and the broader market mood, which helps me stay one step ahead of the curve.

Uncovering Token Adoption and Emerging Trends

Crypto wallet analytics also sheds light on the real-world adoption and utilization of various digital assets. By tracking the flow of tokens across different wallets, I can uncover which projects are gaining traction, which tokens are being actively used, and which platforms are attracting the most user engagement.

This information is invaluable for identifying emerging trends, popular use cases, and potential investment opportunities. As an experienced crypto investor, I’m always on the lookout for the next big thing, and wallet analytics has become an indispensable tool in my arsenal.

Assessing Project Credibility and Managing Risk

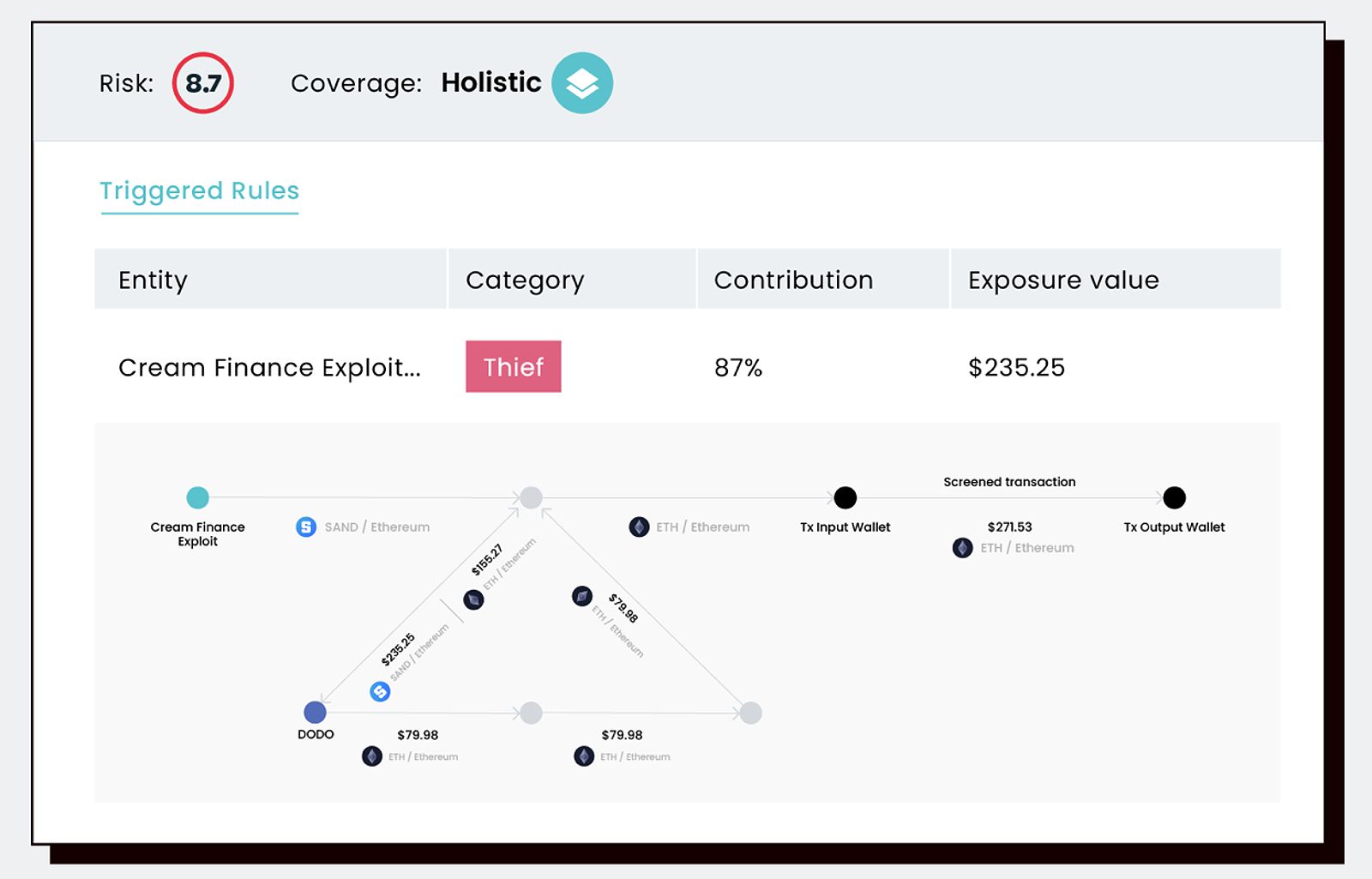

Delving into the on-chain activity of a project’s team members and associated wallets can provide critical insights into the credibility and long-term viability of a cryptocurrency venture. Suspicious wallet activity, such as frequent token liquidations by the project’s founders, can serve as warning signs for potential investors like myself.

By analyzing the on-chain behavior of a project’s key stakeholders, I can better assess the team’s commitment, transparency, and the overall health of the project. This level of due diligence helps me identify potential risks and make more informed investment decisions, protecting my crypto assets from potential scams or hacks.

Navigating the Crypto Wallet Analytics Landscape

The world of crypto wallet analytics is vast and rapidly evolving, with a diverse array of tools and platforms catering to the needs of various investors and stakeholders. From blockchain explorers to specialized analytics platforms, each option offers unique features and capabilities.

Blockchain Explorers: Accessing Raw On-Chain Data

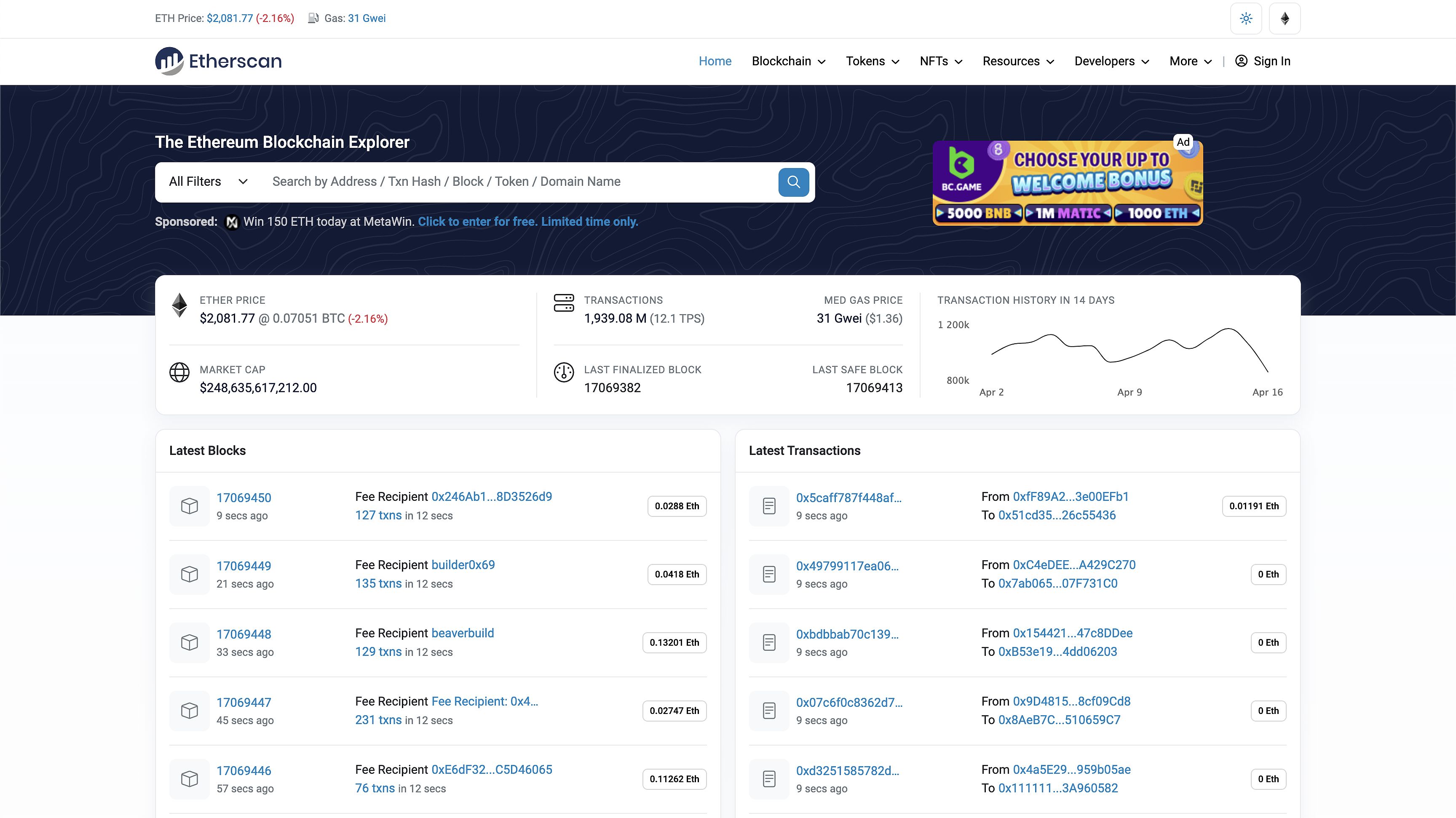

Blockchain explorers, such as Etherscan and BscScan, provide direct access to the underlying blockchain data, allowing users to explore transaction histories, wallet balances, and token movements. While these platforms offer a comprehensive view of on-chain activity, they may require a certain level of technical expertise to navigate and interpret the data effectively.

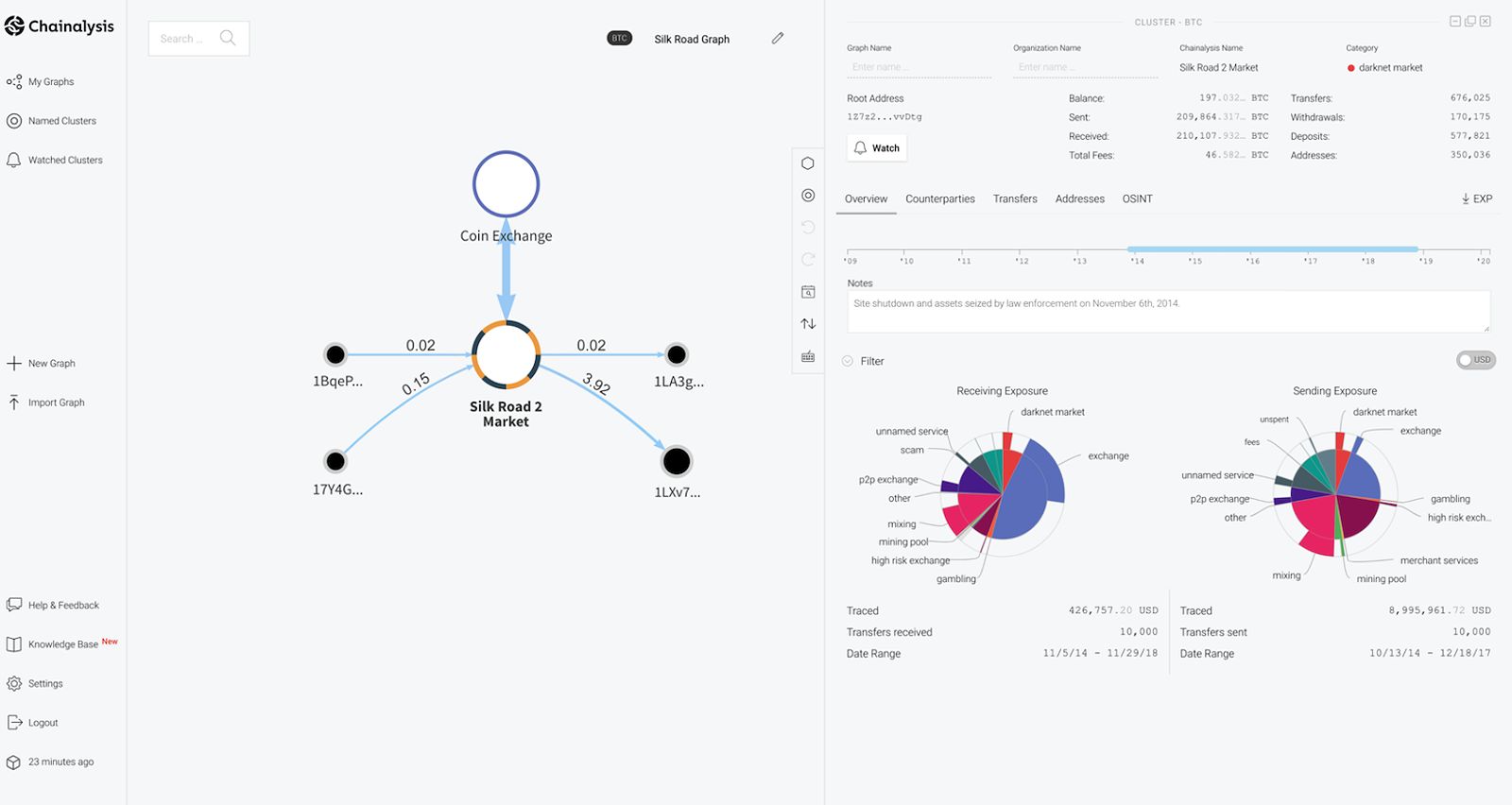

Specialized Analytics Platforms: Uncovering Deeper Insights

In contrast, specialized crypto wallet analytics platforms like Glassnode, CoinMetrics, and Nansen offer user-friendly interfaces and advanced data visualization tools. These platforms often provide a wealth of on-chain metrics, market sentiment indicators, and even DeFi and NFT-specific analytics, making it easier for investors like myself to identify trends, track whale activity, and assess project fundamentals.

DeFi-Focused Analytics: Unlocking the Potential of Decentralized Finance

For those interested in the rapidly evolving world of decentralized finance (DeFi), dedicated platforms like DeFiLlama and DappRadar offer specialized tools to monitor key metrics such as total value locked (TVL), liquidity pool sizes, and yield farming opportunities. As a crypto investor, I find these insights invaluable in navigating the ever-changing DeFi landscape and capitalizing on emerging opportunities.

Leveraging Crypto Wallet Analytics for Investment Decisions

By incorporating crypto wallet analytics into my investment strategies, I’ve been able to uncover a wealth of insights that have transformed the way I approach the crypto market. As a Crypto Queen, I’m always on the lookout for the next big thing, and these powerful tools have been instrumental in my quest.

Identifying Promising Projects

Analyzing on-chain data, such as token distribution, user activity, and developer engagement, has helped me identify projects with strong fundamentals and growth potential. This level of due diligence has been a game-changer, allowing me to spot emerging opportunities and allocate my resources accordingly.

Managing Risk and Detecting Potential Scams

Crypto wallet analytics has also served as an early warning system, helping me detect suspicious activity, potential scams, or hacks that could put my investments at risk. By closely monitoring whale wallets and unusual transaction patterns, I’m able to make more informed decisions and protect my crypto assets. This vigilance is crucial in a market where bad actors can quickly exploit vulnerabilities.

Optimizing Trading Strategies

By combining on-chain metrics with traditional technical analysis, I’ve been able to gain a more comprehensive understanding of market dynamics. I use this information to identify trading opportunities, spot potential support and resistance levels, and time my entry and exit points more effectively. Integrating crypto wallet analytics into my trading strategies has given me a competitive edge and improved my overall investment performance.

The Crypto Queen’s Outlook on the Future

As the blockchain ecosystem continues to mature, the importance of crypto wallet analytics is expected to grow exponentially. Institutional investors, regulators, and businesses are increasingly adopting these tools to gain a deeper understanding of the crypto market, enhance risk management, and ensure regulatory compliance.

Furthermore, the integration of on-chain data with traditional financial analysis is expected to drive greater transparency and accountability within the crypto industry. As the technology behind these analytics platforms becomes more sophisticated, I anticipate even more powerful insights and decision-support tools to navigate the dynamic world of cryptocurrencies.

One particularly exciting development in the field of crypto wallet analytics is the potential for real-time monitoring and predictive capabilities. As blockchain networks become more scalable and efficient, the ability to analyze transaction data in near real-time can enable investors like myself to spot market trends, detect anomalies, and respond to evolving market conditions more quickly. This level of agility and responsiveness could be a game-changer for crypto traders and institutional investors alike.

Another area of growth is the integration of crypto wallet analytics with other emerging technologies, such as artificial intelligence and machine learning. By leveraging advanced data analysis techniques, these platforms can uncover deeper insights, identify complex patterns, and make more accurate predictions. This could lead to the development of even more sophisticated investment strategies and risk management tools, further empowering crypto investors like myself.

As the crypto ecosystem continues to evolve, the role of crypto wallet analytics is poised to become increasingly vital. By providing investors with unparalleled visibility into the inner workings of the blockchain, these powerful tools will continue to shape the way we understand, invest, and navigate the dynamic world of cryptocurrencies. And as the Crypto Queen, I’m excited to be at the forefront of this innovative and rapidly changing landscape.

FAQ

Q: What are some of the best free crypto wallet analytics tools?

A: Blockchain explorers like Etherscan and BscScan offer free access to raw on-chain data, providing a comprehensive view of transaction histories and wallet activities. These platforms serve as a valuable starting point for investors like myself who are looking to explore the blockchain data without a financial commitment.

Q: How can I use crypto wallet analytics to identify a potential rug pull?

A: Monitor the token flow for sudden and large transfers from project wallets, especially to unknown addresses. Significant outflows from the project’s main wallets can be a red flag for potential rug pulls. Additionally, look for sudden drops in the total value locked (TVL) of a DeFi protocol, as this could indicate that the developers have withdrawn funds and abandoned the project.

Q: What are some key on-chain metrics to track for DeFi projects?

A: Some essential metrics to monitor for DeFi projects include total value locked (TVL), liquidity pool sizes, transaction volumes, and governance token activity. These can provide insights into the overall health and adoption of a DeFi protocol, as well as the level of user engagement and the protocol’s ability to attract and retain capital.

Conclusion

As the Crypto Queen, I’ve been on a journey of discovery, exploring the transformative power of crypto wallet analytics. By leveraging the transparency of blockchain technology, these powerful analytics platforms have provided me with unparalleled insights into market trends, whale activity, token usage, and project credibility.

In a rapidly evolving crypto ecosystem, the integration of on-chain data into my investment strategies has become increasingly crucial for making informed decisions and managing risk. Savvy investors who embrace the power of crypto wallet analytics, like myself, will be well-positioned to navigate the challenges and capitalize on the opportunities that lie ahead in the world of digital assets.

With the constant evolution of these analytics tools and the growing adoption of blockchain technology, the future of crypto wallet analytics is poised to become an indispensable component of any successful investment portfolio. As the Crypto Queen, I’m excited to continue exploring this dynamic landscape and sharing my insights with fellow crypto enthusiasts.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON