As a seasoned cryptocurrency investor, I’ve been closely following the rollercoaster ride of XRP ever since the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Ripple, the company behind XRP, back in December 2020. The legal battle has been a tumultuous one, but I must say, the resilience and recent surge in XRP’s price have piqued my interest. This article will examine xrp price prediction after lawsuit, explore its potential to become the next Bitcoin, and analyze the factors that could drive its value upwards.

The Ripple vs- SEC Lawsuit: A Pivotal Moment for XRP

The SEC’s lawsuit against Ripple was a game-changer, alleging that the company’s sale of XRP was equivalent to an unregistered securities offering exceeding $1.3 billion. This sent shockwaves through the cryptocurrency market, with many exchanges delisting XRP in response. However, the initial legal victories for Ripple have been a glimmer of hope for XRP investors like myself.

In July 2023, the court issued a mixed verdict, ruling that XRP sales on exchanges and through algorithms weren’t considered securities, but the judge saw things differently when it came to Ripple’s direct sales to institutions. The SEC’s subsequent move to seek over $2 billion in fines and penalties from Ripple in March 2024 only added to the ongoing uncertainty.

As of June 2024, a crucial court case is underway, determining Ripple’s access to its legal records pertaining to XRP transactions. The outcome of this hearing could significantly impact the trajectory of the case. Despite the regulatory ambiguity surrounding Ripple and the SEC’s criticism of the company’s unreleased stablecoin as an “unregistered crypto asset,” the initial success in the court case has undoubtedly boosted investor sentiment, leading to a surge in XRP’s price.

XRP Price Prediction after Lawsuit: Navigating the Uncertainty

XRP Price Prediction after Lawsuit: Navigating the Uncertainty

Analyzing the price predictions for XRP in the aftermath of the lawsuit has been a fascinating exercise. Experts and analysts have provided a diverse range of forecasts, some brimming with optimism, while others remain cautiously skeptical.

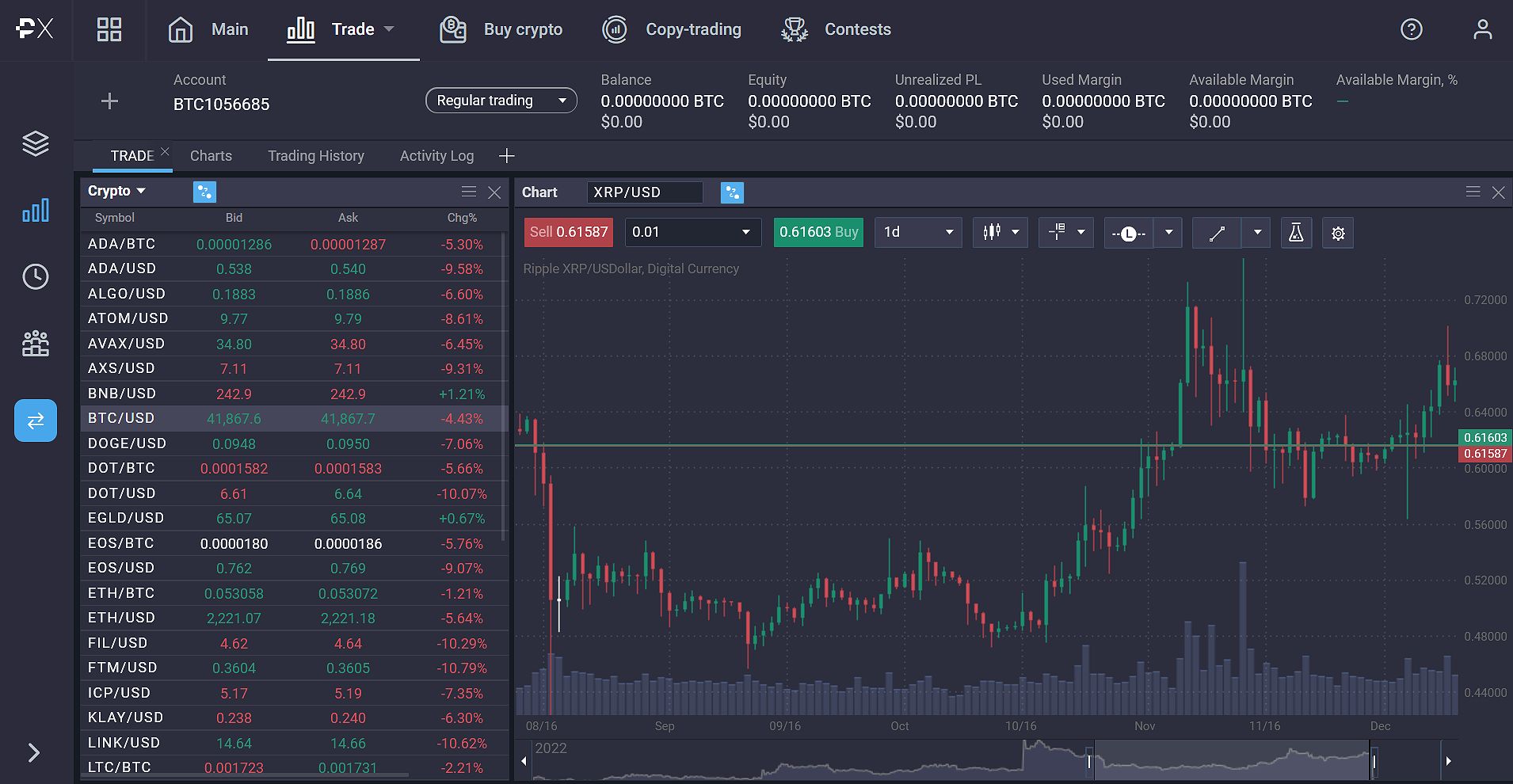

According to the consensus of Binance users, the projected XRP price for June 2024 was $0.519. However, by March 2024, XRP had already surpassed that mark, reaching $0.745. Coinpedia, on the other hand, has warned of a potential bearish trend within a weekly triangle pattern, with a chance of a breakout reaching as high as $2.23.

Techopedia’s analysis suggests that a Ripple win in the lawsuit could significantly boost XRP’s price, with an average of $1.80 by the end of 2024. However, they caution that the price could swing between $0.30 and $3.10, depending on the court’s ruling.

Looking ahead to 2025, the predictions offer an even wider range of possibilities. Optimists like Coinpedia and YouTube analyst Zach Humphries envision significant growth, with forecasts reaching as high as $3.38 or even $3.81. Techopedia takes a more moderate approach, predicting an average price of $3 based on a Fibonacci retracement forecast.

Tokenmetrics provides a data-driven perspective, outlining a bearish scenario with a price near $0.31 if market dominance shrinks, and a bullish scenario with a price reaching $0.64 if market cap expands significantly. Coincodex presents a range between $0.34 and $1.67, with a more conservative technical analysis suggesting a price settling around $1.20 by 2025.

Is XRP the Next Bitcoin?

As an investor, I can’t help but draw comparisons between XRP and the granddaddy of cryptocurrencies, Bitcoin. Both cryptocurrencies aim to revolutionize the financial industry, but they have distinct use cases and technological approaches.

Bitcoin is widely regarded as digital gold, a store of value and a hedge against traditional financial markets. XRP, on the other hand, is focused on facilitating cross-border payments, with the potential to disrupt the traditional SWIFT system used by banks.

In terms of technology, XRP utilizes the XRP Ledger, a blockchain-based network designed for quick and reliable transactions. Bitcoin, however, is built on the original blockchain technology, known for its decentralization and energy-intensive mining process.

When it comes to market capitalization and adoption, Bitcoin undoubtedly holds the upper hand. As the largest cryptocurrency by market cap, Bitcoin has gained widespread recognition and a dedicated community of supporters. XRP, while making strides in the cross-border payments sector, has faced challenges due to the ongoing SEC lawsuit and regulatory uncertainty.

However, I can’t help but feel that XRP’s potential for growth shouldn’t be underestimated. The cryptocurrency’s near-instantaneous settlement times and low transaction costs make it an attractive option for financial institutions looking to streamline their cross-border payment processes. Moreover, Ripple’s partnerships with over 100 financial institutions across the globe indicate a growing interest in the technology.

Factors Influencing XRPs Price

As I delve deeper into the factors that could influence XRP’s price in the coming years, several key elements stand out.

Regulatory Clarity: The resolution of the SEC lawsuit and increased regulatory clarity could have a significant impact on XRP’s price. A favorable outcome for Ripple would remove a major source of uncertainty and potentially boost investor confidence, driving the price higher.

Adoption and Partnerships: The continued expansion of Ripple’s partnerships with financial institutions and the increasing adoption of XRP in cross-border payments could be a game-changer. As more institutions integrate XRP into their payment systems, the demand for the cryptocurrency could surge.

Technological Advancements: Ripple’s ongoing development and integration of new technologies, such as stablecoins and AI, could enhance the functionality and appeal of the XRP ecosystem, potentially attracting more users and investors.

Market Sentiment: The overall sentiment in the cryptocurrency market, including the performance of Bitcoin and Ethereum, can undoubtedly influence the price of XRP. Positive market conditions and increased interest in the crypto space could lead to increased investment in XRP.

When Will XRP Go Up?

As an experienced cryptocurrency investor, I know that predicting the exact timing of XRP’s price movements is no easy feat. The short-term outlook largely depends on the resolution of the ongoing SEC lawsuit. A favorable outcome for Ripple could provide a significant boost to the cryptocurrency’s price, as it would remove a major source of uncertainty and regulatory risk.

In the long term, the potential for XRP to experience substantial price growth is tied to its adoption, technological advancements, and the emergence of new use cases. As Ripple continues to expand its partnerships and integrate XRP into various financial systems, the demand for the cryptocurrency could increase, driving its price higher.

It’s important to note that investing in cryptocurrencies, including XRP, carries inherent risks. The market is highly volatile, and unexpected regulatory changes or news could significantly impact the price. As an investor, I always recommend carefully assessing your risk tolerance and diversifying your portfolio to mitigate the risks associated with the cryptocurrency market.

FAQ

Q: What are the biggest risks associated with investing in XRP? A: The primary risks associated with investing in XRP include regulatory uncertainty, ongoing legal battles, and the potential for large-scale sell-offs by key figures within the Ripple ecosystem. Investors should closely monitor developments in the SEC lawsuit and be aware of the impact they could have on the cryptocurrency’s price.

Q: How does XRP compare to other cryptocurrencies like Ethereum? A: While both XRP and Ethereum aim to revolutionize the financial industry, they have distinct use cases and technological approaches. Ethereum is a more decentralized platform that enables the creation of decentralized applications and smart contracts, while XRP is focused on cross-border payments and integration with traditional financial institutions.

Q: What are some of the potential use cases for XRP beyond payments? A: Beyond its primary use case in cross-border payments, XRP has the potential to be integrated into various applications, including digital wallets, gaming, and the broader digital economy. Ripple’s recent plans to launch a USD-backed stablecoin on the XRP Ledger and Ethereum blockchain may also expand the utility of the cryptocurrency.

Q: Will the SEC lawsuit ultimately be good or bad for XRP? A: The outcome of the SEC lawsuit against Ripple will have a significant impact on the future of XRP. A favorable ruling for Ripple could provide a significant boost to the cryptocurrency’s price and regulatory clarity, potentially driving greater adoption. However, an unfavorable outcome could further hamper XRP’s growth and lead to continued uncertainty in the market.

Conclusion

As a seasoned cryptocurrency investor, I’ve been closely following the rollercoaster ride of XRP in the aftermath of the SEC lawsuit against Ripple. While the future remains uncertain, the recent legal victories and Ripple’s continued technological advancements have provided a glimmer of hope for XRP investors like myself.

While XRP may not be the next Bitcoin, it has the potential to carve out a niche in the cross-border payments sector, particularly if it can overcome the regulatory challenges it currently faces. As I evaluate the range of price predictions and the factors that could influence XRP’s value, I remain cautiously optimistic about the cryptocurrency’s long-term prospects.

Investing in XRP, or any cryptocurrency for that matter, requires careful consideration and a long-term perspective. Investors should always diversify their portfolios, assess their risk tolerance, and stay informed on the latest developments in the rapidly evolving cryptocurrency market. As the battle between Ripple and the SEC continues to unfold, the role of XRP in the broader financial landscape will likely become clearer in the years to come.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON