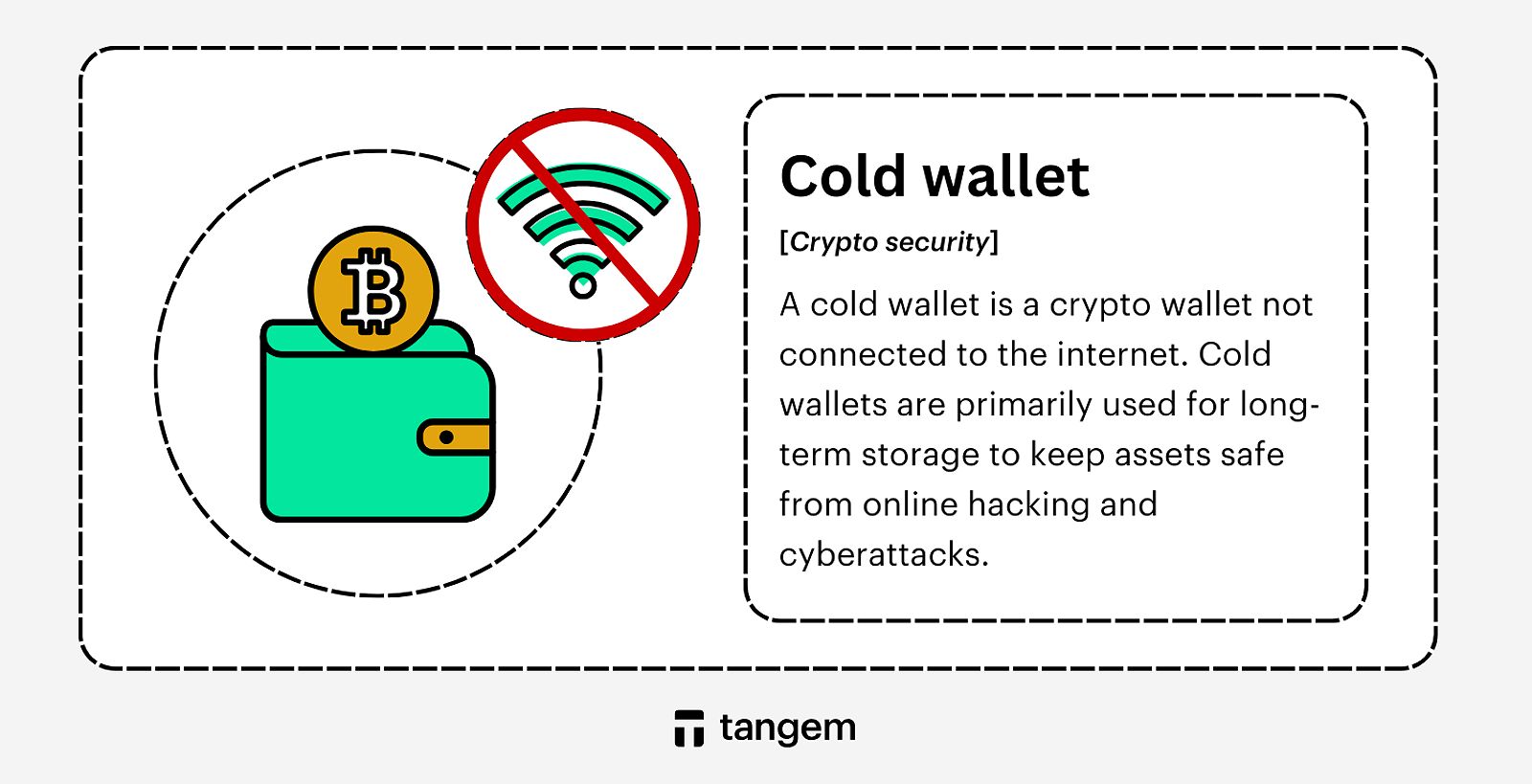

In the ever-evolving world of digital assets, safeguarding your cryptocurrency investments has become a crucial priority, especially for those new to the crypto landscape. As you venture into this dynamic realm, understanding the concept of cold wallets – the most secure way to store your virtual coins – is paramount. This comprehensive guide will delve into the fundamentals of what is a cold wallet crypto, equipping you with the knowledge to make informed decisions and protect your digital wealth.

Unlocking the Power of Cold Wallets: A Beginners Perspective

Imagine entrusting your life savings to a stranger – that’s the equivalent of storing your cryptocurrencies on an online exchange or in a “hot wallet” connected to the internet. The phrase “not your keys, not your coins” underscores a fundamental principle in the crypto world: if you don’t have direct control over your private keys, you don’t truly own your digital assets.

Cold wallets offer a solution to this dilemma by storing your private keys offline, shielding them from the vulnerabilities of the online realm. This offline storage significantly reduces the risk of unauthorized access, malware, phishing attacks, and other online threats that can jeopardize your cryptocurrency holdings. As a beginner in the crypto space, embracing the enhanced security of cold wallets can provide you with the peace of mind and confidence to navigate this dynamic landscape.

Understanding What is a Cold Wallet Crypto: Types and Advantages

When it comes to securing your digital assets, the world of cold wallets presents several options, each with its own set of advantages and considerations.

Hardware Wallets: The Gold Standard of Cold Storage

Hardware wallets, such as Ledger and Trezor, are physical devices designed to store your private keys offline. These compact, portable gadgets create a secure environment for your cryptocurrencies, effectively isolating them from the internet and online threats. By physically separating your private keys from your computer or mobile device, hardware wallets offer robust security features, user-friendly interfaces, and support for a wide range of digital assets.

The primary benefit of hardware wallets is their exceptional security, providing an extra layer of protection for your investments. However, this enhanced security does come with a price tag, with hardware wallets typically ranging from $50 to $200 or more. Additionally, like any physical device, there is a risk of loss or damage, though most hardware wallets come with backup and recovery mechanisms to help you regain access to your funds.

Paper Wallets: The Low-Cost Cold Storage Option

Paper wallets present a simple and cost-effective way to store your cryptocurrencies offline. This method involves printing your public and private keys on a piece of paper, often in the form of QR codes. By keeping your private keys completely disconnected from the internet, paper wallets offer a high level of security, provided that the printed paper is kept safe and secure.

The primary advantage of paper wallets is their low cost, as they can be created for free using various online tools. However, this simplicity also comes with its own set of challenges. Paper wallets are susceptible to physical damage or loss, and recovering your private keys can be a more complex process compared to other cold wallet options.

Sound Wallets: An Innovative Approach to Offline Storage

In the realm of cold wallets, sound wallets represent a less common, yet intriguing option. These wallets encode your private keys into a series of tones or QR codes that can be stored on physical media, such as CDs or vinyl records. This innovative approach to offline storage offers a unique level of security, as the private keys are not directly accessible through digital means.

While sound wallets present an interesting alternative, they can be more complex to use and may require specialized equipment for decoding the audio files. Additionally, like paper wallets, sound wallets are also vulnerable to physical damage or loss, which can make accessing your cryptocurrency holdings a challenging endeavor.

Choosing the Right Cold Wallet for Your Crypto Needs

When selecting a cold wallet, it’s crucial to consider a range of factors to ensure it aligns with your specific cryptocurrency holdings and requirements.

Key considerations include:

-

Supported Cryptocurrencies: Ensure the cold wallet supports the digital assets you own or plan to invest in, as not all wallets are compatible with every cryptocurrency.

-

Security Features: Look for robust security measures, such as secure element chips, biometric authentication, and tamper-resistant designs, to safeguard your private keys.

-

User Interface: Opt for a cold wallet with an intuitive and user-friendly interface, especially if you’re a beginner in the crypto space.

-

Price: Determine your budget and find a cold wallet that offers the best value for your money, balancing security and functionality.

-

Compatibility: Make sure the cold wallet is compatible with your devices and the software you use to manage your cryptocurrencies.

For cryptocurrency beginners, hardware wallets like Ledger and Trezor are generally recommended due to their balance of security and user-friendliness. Paper wallets can also be a cost-effective option for smaller cryptocurrency holdings, but they require more technical knowledge to set up and use.

Setting Up Your First Cold Wallet: A Step-by-Step Guide

Embarking on your cold wallet journey is a straightforward process, but it’s essential to follow the instructions carefully to ensure the security of your digital assets.

Here’s a step-by-step guide to setting up your first cold wallet:

-

Choose a Reputable Cold Wallet Provider: Research and select a well-known and trusted cold wallet manufacturer, such as Ledger or Trezor.

-

Acquire the Cold Wallet Device: Purchase the cold wallet device, either directly from the manufacturer or through an authorized reseller.

-

Follow the Setup Instructions: Carefully follow the setup instructions provided by the wallet manufacturer. This typically involves generating a secure recovery phrase (also known as a seed phrase) and setting a PIN.

-

Secure Your Recovery Phrase: Meticulously write down the recovery phrase and store it in a secure, offline location, such as a fireproof safe or a safe deposit box. This phrase is the key to accessing your funds, so it’s crucial to keep it safe and private.

-

Transfer Your Cryptocurrencies: Once the wallet is set up, you can begin transferring your digital assets to the public address generated by the cold wallet.

Remember, your recovery phrase is the gateway to your cryptocurrency holdings, so it’s essential to guard it with the utmost care and never share it with anyone.

Maintaining the Security of Your Cold Wallet

Utilizing a cold wallet for your cryptocurrency storage is a straightforward process, but ensuring its ongoing security is crucial. To keep your digital assets safe, adhere to these best practices:

-

Update Your Wallet’s Firmware: Regularly check for and install the latest firmware updates to benefit from the latest security improvements.

-

Use a Strong PIN Code: Set a unique and robust PIN code to protect your cold wallet from unauthorized access.

-

Beware of Phishing Scams: Be vigilant and never share your recovery phrase or private keys with anyone, as they can be used to gain full control over your cryptocurrency holdings.

-

Store Your Recovery Phrase Securely: Keep your recovery phrase in a physically secure, offline location, away from any internet-connected devices.

By following these guidelines, you can effectively manage your cold wallet and maintain the highest level of security for your cryptocurrency investments.

FAQ

What is the difference between a cold wallet and a hot wallet? The primary distinction lies in the storage of your private keys. A cold wallet keeps your private keys offline, while a hot wallet stores them online, exposing them to potential online threats. Cold wallets offer enhanced security, while hot wallets are more convenient for frequent transactions.

Are cold wallets safe? Cold wallets are generally considered one of the safest methods for storing cryptocurrencies, as they isolate your private keys from the internet and online threats. However, they are not completely immune to all risks, such as physical damage or loss. Following security best practices is essential to protect your digital assets.

Can I lose my cryptocurrency if I lose my cold wallet? Yes, if you lose your cold wallet and don’t have a backup of your recovery phrase, you may lose access to your cryptocurrency holdings. The private keys stored on the cold wallet are the only way to regain control of your funds, so it’s crucial to keep your recovery phrase safe and secure.

How do I choose the right cold wallet? When selecting a cold wallet, consider factors such as the supported cryptocurrencies, security features, user-friendliness, price, and compatibility with your devices and software. Hardware wallets like Ledger and Trezor are often recommended for beginners due to their balance of security and ease of use.

Conclusion: Embrace the Security of Cold Wallets for Your Crypto Journey

As you navigate the dynamic world of cryptocurrency, safeguarding your digital assets should be a top priority, especially as a beginner. Cold wallets offer a robust solution, providing the highest level of security by keeping your private keys offline and shielding them from online threats.

By understanding the different types of cold wallets, their advantages and considerations, and following best practices for setup and maintenance, you can confidently take control of your cryptocurrency investments and protect your digital wealth. Embrace the security of cold wallets and embark on your crypto journey with the peace of mind that your digital assets are safe from harm.

Remember, the world of cryptocurrency is constantly evolving, and staying informed is key. Continue exploring, experimenting, and staying vigilant as you navigate the exciting and ever-changing landscape of digital finance.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON