In the ever-evolving world of cryptocurrency, the saga of Terra Classic (LUNC) has captivated the attention of investors and enthusiasts alike. From its meteoric rise to its dramatic collapse, this once-prominent token has been on a rollercoaster journey that has left many wondering: Will Luna Classic reach $1?

As we delve into the factors that could influence LUNC’s price trajectory, it’s essential to understand the context that has shaped its past and continues to mold its future. The Terra ecosystem, of which LUNC was a crucial part, had a promising start, with the token serving as a governance token within the network. However, the devastating de-pegging of the TerraUSD (UST) stablecoin, and the subsequent collapse of the entire Terra ecosystem, sent shockwaves through the cryptocurrency market and plunged LUNC into a state of disarray.

LUNC’s Journey: From Boom to Bust and Beyond

The rise and fall of LUNC have been nothing short of captivating. At its peak in April 2022, the token reached an all-time high of $119.01, showcasing its immense potential. However, the fallout from the UST crisis proved to be a crushing blow, as LUNC plummeted to an all-time low of just $0.00001651 in May 2022. The sheer scale of this decline left many investors reeling, questioning whether LUNC could ever regain its former glory.

In the aftermath of the collapse, the Terra community rallied together to salvage the situation. A new chain, Terra Classic, was born, with LUNC as the native token. This move, akin to the Ethereum hard fork in 2017, was a testament to the community’s determination to revive the network and potentially resurrect LUNC.

Factors Influencing LUNC’s Price

As the Terra Classic community embarks on its journey of revival, several key factors come into play that could shape the future trajectory of LUNC’s price.

Terra Classic price prediction: will LUNA Classic reach $1? – 1

Terra Classic price prediction: will LUNA Classic reach $1? – 1

Supply and Demand

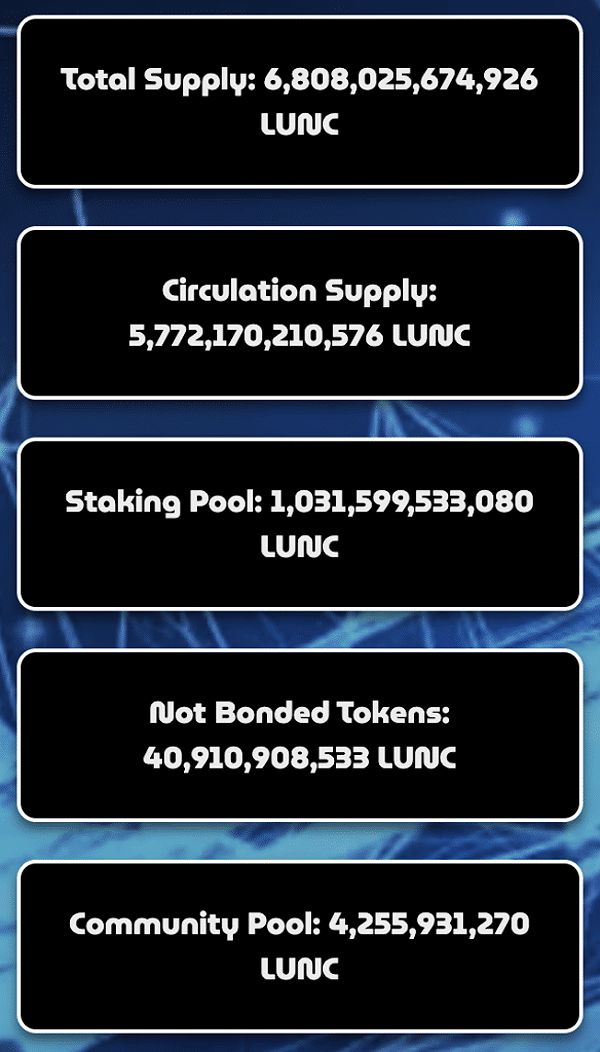

One of the most significant factors is the ongoing burn campaign initiated by Binance, which has already seen the destruction of over 50 billion LUNC tokens. This concerted effort to reduce the circulating supply of LUNC could prove pivotal in driving up the token’s value. As the burn campaign progresses towards the ambitious goal of eliminating 100 billion LUNC, the decreased supply may catalyze a surge in demand, potentially propelling LUNC towards the $1 mark.

Market Sentiment

Similar to the observed effects of Bitcoin halving events, where a reduction in supply typically leads to price surges, LUNC may experience a similar phenomenon. As the next BTC halving event approaches, the resulting increase in investor interest and overall market momentum could have a positive ripple effect on LUNC’s performance, potentially fueling its ascent.

Ecosystem Development

The Terra Classic community has shown a steadfast commitment to enhancing the network’s infrastructure and user experience. Initiatives such as the Enterprise and Foundation projects, spearheaded by industry leaders Vlad and Eduardo, demonstrate a dedication to driving innovation and fostering confidence in the ecosystem. If these efforts are executed successfully, they could further bolster investor sentiment and contribute to LUNC’s resurgence.

监管环境

The evolving regulatory landscape surrounding the cryptocurrency market may also have a significant impact on LUNC’s future. As policymakers worldwide grapple with the challenges posed by digital assets, the decisions they make could either hinder or accelerate LUNC’s progress. Closely monitoring these regulatory developments will be crucial in assessing LUNC’s long-term potential.

Will Luna Classic Reach $1? A Realistic Assessment

While the factors mentioned above offer glimmers of hope for LUNC’s revival, the path to reaching the $1 mark is fraught with challenges. One of the primary obstacles is the network’s hyperinflated supply, a consequence of the collapse of the Terra ecosystem and the subsequent transition to LUNC.

This oversupply of LUNC tokens has undoubtedly dampened the token’s performance, making it an uphill battle to increase its value. The community’s ongoing burn campaign is a step in the right direction, but the impact has been limited so far, as the burn rate needs to be significantly higher to make a meaningful dent in the hyperinflated supply.

Price predictions for LUNC vary, with some analysts forecasting prices ranging from $0.000111 in 2024 to $0.000148 in 2030, while others suggest a more conservative average price of $0.00010884 in 2024, indicating a potential ROI of -26% for investors in 2024 based on the current price of LUNC. These projections underscore the challenges LUNC faces in reclaiming the $1 threshold.

LUNC’s Future: A Path to Revival

Despite the obstacles, the Terra Classic community remains steadfast in its efforts to revive the network and potentially propel LUNC towards the $1 mark. Key strategies and initiatives that could contribute to this goal include:

Terra Classic price prediction: will LUNA Classic reach $1? – 2

Terra Classic price prediction: will LUNA Classic reach $1? – 2

Continued Burn Campaign

Intensifying the burn campaign and significantly increasing the burn rate could be a crucial step in reducing LUNC’s hyperinflated supply and driving up its price. Sustained efforts in this direction could help restore investor confidence and catalyze a positive price trajectory.

Ecosystem Growth

Ongoing development and innovation within the Terra Classic ecosystem, such as the introduction of new projects and partnerships, could enhance LUNC’s adoption and perceived value. As the ecosystem grows and becomes more robust, it may attract increased investor interest and capital, potentially boosting LUNC’s price.

Community Engagement

The active involvement and support of the Luna Classic community will be pivotal in shaping the network’s future. Continued engagement, advocacy, and innovative ideas from the community can play a vital role in LUNC’s revival.

Innovation and Development

Consistent efforts to improve the Terra Classic protocol, enhance user experiences, and address the network’s challenges could be instrumental in reigniting investor confidence and driving LUNC’s growth. Adapting to market demands and addressing the root causes of the network’s previous downfall will be crucial.

LUNC Market Performance Chart

LUNC Market Performance Chart

常见问题

Q1: What is the burn campaign and how does it affect LUNC’s price?

The burn campaign is an initiative by the Luna Classic community to reduce the circulating supply of LUNC tokens. By burning a portion of the tokens generated from transactions, the program aims to increase the scarcity of LUNC and potentially drive up its price. However, the impact of this campaign has been limited so far, and a significantly higher burn rate is necessary to make a noticeable difference in LUNC’s hyperinflated supply.

Q2: What are the potential benefits of Bitcoin halving events for LUNC?

Similar to the observed effects on the broader cryptocurrency market, Bitcoin halving events, which reduce the supply of new BTC entering the market, could have a positive impact on LUNC’s price. As the reduced BTC supply typically leads to increased investor interest and market momentum, LUNC may also benefit from this phenomenon, potentially contributing to its price appreciation.

Q3: What are the biggest challenges facing LUNC’s revival?

The primary challenges facing LUNC’s revival are its hyperinflated supply, lack of widespread adoption, and the ongoing uncertainty surrounding the Terra Classic ecosystem. Overcoming these obstacles will require sustained efforts to significantly reduce the circulating supply through an effective burn campaign, drive increased adoption and usage of the network, and instill confidence in the Luna Classic community and the broader cryptocurrency market.

Q4: Is LUNC a good investment?

The decision to invest in LUNC should be based on thorough research, understanding of the risks, and alignment with one’s investment goals and risk tolerance. While LUNC has the potential for growth, its future remains highly uncertain, and the cryptocurrency market, in general, is known for its volatility. Investors should carefully consider the various factors discussed in this article and make an informed decision based on their own financial circumstances and investment strategies.

结论

The journey for Luna Classic (LUNC) to reach the $1 mark is fraught with volatility and challenges. While recent positive indications suggest potential, the longer-term trend paints a more sobering picture, with LUNC experiencing significant declines over the past year. The key factors that could influence LUNC’s price, including supply and demand, market sentiment, ecosystem development, and the regulatory landscape, present both opportunities and risks.

Achieving the $1 milestone remains an ambitious goal, and price predictions from various sources indicate a more conservative outlook for LUNC’s potential. However, the Luna Classic community’s determination to revive the network through initiatives like the burn campaign, ecosystem growth, community engagement, and ongoing innovation offers glimmers of hope.

As the cryptocurrency market continues to evolve, LUNC’s future remains uncertain. Investors interested in LUNC should conduct thorough research, consider their risk tolerance, and make informed decisions based on the available information and their investment objectives. The path to LUNC’s resurgence is not an easy one, but with sustained efforts and strategic adaptations, the network may one day recapture the imagination of the crypto community.

比特币

比特币  以太坊

以太坊  拴

拴  XRP

XRP  索拉纳

索拉纳  USDC

USDC  狗狗币

狗狗币  Cardano

Cardano  TRON

TRON