As a seasoned crypto cowboy, I’ve been keeping a close eye on Solana’s recent resurgence. It’s been quite a wild ride for this Ethereum killer, but I have to say, I’m pretty darn impressed with how it’s been lassoing up the competition lately.

Now, I know Solana has had its fair share of ups and downs – heck, it’s been through a real rodeo of a year. But let me tell you, this here crypto is starting to look like a real contender in the blockchain arena.

Why is Solana going up? Well, saddle up, partner, because I’m about to take you on a deep dive into the factors behind this cryptocurrency’s recent rise.

Solanas Rise: A Retrospective on the Ethereum Killer

Y’all might remember that Solana first burst onto the scene back in 2020, and let me tell you, it’s been turning heads ever since. This high-performance blockchain platform has been making waves with its lightning-fast transaction speeds and rock-bottom fees, and it’s really got folks wondering if it could be the one to finally knock Ethereum off its perch.

Now, I’ll admit, Solana’s journey hasn’t been all smooth sailing. Last year, we saw the platform take a real tumble, thanks in no small part to the collapse of the FTX exchange – a move that sent shockwaves through the entire crypto market. But, just like a seasoned rodeo rider, Solana has picked itself up, dusted off the dirt, and come roaring back stronger than ever.

As of June 2024, Solana’s market cap is sitting pretty at over $70 billion, making it the fifth-largest cryptocurrency out there. And let me tell you, this crypto cowboy has been keeping a close eye on its progress.

Why is Solana Going Up? The Factors Fueling Solanas Resurgence

So, what’s been driving Solana’s recent price surge, you ask? Well, partner, it’s a combination of some pretty impressive technical advancements, a rapidly growing ecosystem, and a whole lot of positive market sentiment.

Technological Advancements

Now, I know the ins and outs of blockchain tech can be a real head-scratcher for some folks, but let me break it down for you. Solana’s development team has been working overtime to fine-tune its Proof-of-History consensus mechanism, making it even faster and more efficient than before. They’ve also added some nifty new features, like the Sealevel transaction processor and the Turbine data distribution system, that have really amped up Solana’s performance.

Solana Technological Advancements Image: Solana Technological Advancements

Solana Technological Advancements Image: Solana Technological Advancements

And let me tell you, these technological upgrades have been catching the eye of developers far and wide. They’re flocking to Solana, eager to build their decentralized apps on a network that can keep up with the pace of modern life.

Growing Adoption and Ecosystem

As more and more folks saddle up and join the Solana rodeo, the platform’s ecosystem has been growing by leaps and bounds. We’re seeing a flood of new projects, applications, and even decentralized finance protocols integrating with Solana, and that’s really driving up user engagement and investor interest.

Solana Growing Adoption Image: Solana Growing Adoption

Solana Growing Adoption Image: Solana Growing Adoption

Plus, the rise of Solana-based non-fungible tokens (NFTs) and the increasing popularity of the platform’s decentralized apps have been adding even more momentum to Solana’s gallop. It’s like a wild mustang that just can’t be tamed!

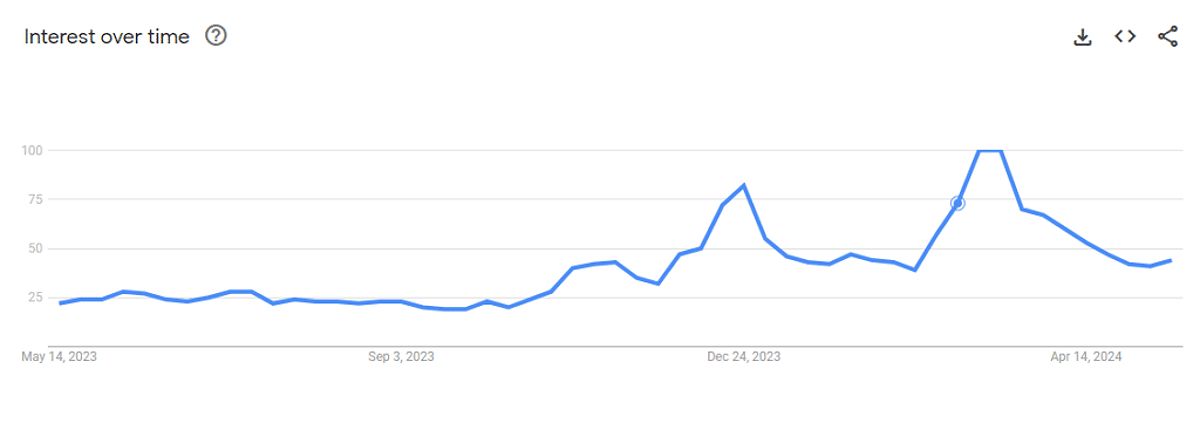

Positive Market Sentiment

Now, I know the broader crypto market can be a real bucking bronco, but lately, the mood has been downright chipper. The anticipation of a potential Bitcoin halving event has got a lot of investors feeling optimistic, and the growing interest in layer-1 blockchains like Solana has only added fuel to the fire.

Solana Price Analysis Image: Solana Price Analysis

Solana Price Analysis Image: Solana Price Analysis

And let’s not forget about Solana’s own track record. Despite the occasional stumble, this crypto has proven itself to be a real workhorse, and that’s got a lot of folks believing it’s got the chops to take on the competition.

Solanas Price Prediction: Saddle Up for the Long Haul

So, where does Solana go from here? Well, partner, that’s the million-dollar question, ain’t it?

Bullish Factors

I’ve got to say, I’m feeling pretty darn optimistic about Solana’s long-term prospects. The platform’s continued technological advancements, its rapidly expanding ecosystem, and the broader market’s positive sentiment all point to a bright future. Some analysts are even predicting that Solana could reach the $200-$300 range by the end of 2024, potentially even challenging its previous all-time high.

Bearish Factors

Of course, it ain’t all sunshine and rainbows. Solana has had its fair share of network outages in the past, which has raised some concerns about its reliability and stability. And let’s not forget, this crypto is facing some stiff competition from other layer-1 blockchains, like Ethereum, Cardano, and Avalanche, all of which are vying for a piece of the decentralized app and DeFi market.

There’s also the ever-present specter of regulatory uncertainty, which could throw a wrench in Solana’s gears if things take a turn for the worse.

Is Solana a Good Investment?

So, is Solana a good investment for us crypto cowboys? Well, as with any investment, there’s no one-size-fits-all answer. It all depends on your individual risk tolerance, your financial goals, and your appetite for a little rodeo-style excitement.

The way I see it, Solana’s got a lot going for it – the tech, the ecosystem, and the market sentiment. But you’ve also gotta be mindful of the risks, like the competition, the stability concerns, and the regulatory landscape.

My advice? Do your due diligence, partner. Saddle up and take a long, hard look at Solana’s fundamentals. Diversify your portfolio, invest only what you can afford to lose, and stay on top of the latest developments in the Solana ecosystem and the broader crypto market.

And remember, just like a wild mustang, Solana’s got a mind of its own. But if you play your cards right, you might just be able to ride this crypto all the way to the winner’s circle.

常见问题

Q1: What are the main advantages of Solana over Ethereum?

The primary advantages of Solana over Ethereum include its lightning-fast transaction speeds, rock-bottom fees, and more efficient Proof-of-History consensus mechanism. Solana can process over 50,000 transactions per second, leaving Ethereum’s Proof-of-Work model in the dust.

Q2: What are some of the biggest risks associated with investing in Solana?

The main risks associated with investing in Solana include its history of network outages, fierce competition from other layer-1 blockchains, and the ever-present regulatory uncertainty surrounding the crypto industry. Solana’s stability concerns and the potential for security vulnerabilities are also factors to consider.

Q3: How does Solana’s Proof-of-History consensus mechanism work?

Solana’s Proof-of-History (PoH) is a unique consensus mechanism that creates a verifiable passage of time within the network. By having validators generate a unique timestamp for each transaction, PoH allows Solana to order and validate transactions with lightning-fast speed, enabling the platform’s impressive transaction throughput.

Q4: What are some popular dApps built on the Solana network?

Some of the most prominent decentralized applications (dApps) built on the Solana network include the Serum decentralized exchange, the Audius music-sharing platform, and the Phantom cryptocurrency wallet.

Q5: What is the future of Solana in the long term?

The long-term future of Solana largely depends on its ability to address its past stability issues, fend off competition from other layer-1 blockchains, and continue innovating to stay ahead of the curve. If Solana can maintain its technological edge, expand its ecosystem, and attract a growing user base, it has the potential to cement its position as a leading player in the crypto space. But it’s going to take some real grit and determination to tame this wild crypto mustang.

结论

As a crypto cowboy, I’ve got to say, Solana’s been putting on quite a show lately. This “Ethereum killer” has weathered its fair share of storms, but it’s coming back stronger than ever, and I can’t help but be impressed.

From its lightning-fast transaction speeds and low fees to its rapidly growing ecosystem and positive market sentiment, Solana’s got a lot going for it. But let’s not forget, this crypto’s also got some real rodeo-style risks to contend with, from stability concerns to fierce competition.

So, if you’re thinking of saddling up and investing in Solana, my advice is to do your homework, diversify your portfolio, and be prepared for a wild ride. This crypto may just be the next big thing, but only time will tell if it can truly become the “Ethereum killer” it’s been billed as.

One thing’s for sure, though — with Solana in the saddle, the crypto rodeo is about to get a whole lot more exciting. So, what are you waiting for, partner? Let’s mosey on down to the crypto corral and see what this “Ethereum killer” has got up its sleeve.

比特币

比特币  以太坊

以太坊  拴

拴  XRP

XRP  索拉纳

索拉纳  USDC

USDC  狗狗币

狗狗币  Cardano

Cardano  TRON

TRON