As the Crypto Sage, I’ve been closely following the rollercoaster ride that is the XRP cryptocurrency. With its price soaring to dizzying heights and then plummeting, many investors are left wondering if XRP is still a worthwhile investment in 2024. This analysis examines the factors that influence XRP’s price, the ongoing legal battle with the SEC, and the potential growth opportunities that lie ahead, ultimately addressing the question: is XRP a good investment?

Understanding XRP and Ripple

XRP is the native cryptocurrency of the Ripple payment protocol, a real-time gross settlement system developed by Ripple Labs. While the terms XRP and Ripple are often used interchangeably, it’s important to understand that they are distinct entities. Ripple is the company behind the technology, while XRP is the digital asset that powers the network.

Ripple’s payment protocol is designed to facilitate fast, low-cost, and efficient cross-border transactions. By leveraging blockchain technology, Ripple aims to disrupt the traditional financial system and provide a more streamlined solution for international money transfers. XRP’s role within the Ripple network is to act as a bridge currency, enabling seamless conversions between fiat currencies and other digital assets. This utility has attracted the interest of financial institutions, making XRP a key player in the cryptocurrency landscape.

Investor in suit with smartphone Image: Investor in suit with smartphone

Investor in suit with smartphone Image: Investor in suit with smartphone

XRP’s Price History and Current Market Performance

XRP’s journey has been marked by significant volatility. In 2017, the cryptocurrency experienced a meteoric rise, reaching an all-time high of $3.84. However, this was followed by a prolonged decline, with the price dropping below $0.20 in 2019. Throughout 2023, XRP has continued to face challenges, underperforming compared to other major cryptocurrencies like Bitcoin and Ethereum.

As of June 2024, XRP is trading at around $0.52, with a market capitalization of $29 billion, placing it as the 7th largest cryptocurrency. The factors influencing XRP’s price are varied and complex. Regulatory developments, market sentiment, and Ripple’s partnerships have all played a significant role in shaping the cryptocurrency’s trajectory. The ongoing legal battle between Ripple and the SEC has been a particular source of concern, creating uncertainty around the future of XRP.

Ripple’s Legal Battle with the SEC and Its Impact on XRP

In December 2020, the SEC filed a lawsuit against Ripple, alleging that the company’s sale of XRP constituted an unregistered securities offering. This legal battle has been a significant overhang on the XRP market, with many exchanges delisting the cryptocurrency due to regulatory concerns.

The outcome of this lawsuit will have a profound impact on XRP’s future. A favorable ruling for Ripple could pave the way for increased adoption and a potential price surge, while an unfavorable decision could lead to further regulatory challenges and price declines. As the case continues to unfold, the uncertainty surrounding XRP has made it a riskier investment proposition. Investors must closely monitor the developments and weigh the potential risks and rewards before deciding to invest in XRP.

Is XRP a Good Investment? A Comprehensive Analysis

When considering whether XRP is a good investment, it’s essential to weigh the potential pros and cons. On the positive side, XRP has several advantages that could drive its growth:

- Potential for Growth: XRP’s ties to the Ripple payment protocol and its adoption by financial institutions suggest it has significant growth potential as the cryptocurrency market continues to evolve.

- Technological Advantages: Ripple’s payment protocol offers faster, more efficient, and lower-cost cross-border transactions compared to traditional banking systems, making it an attractive option for financial institutions.

- Strong Community: XRP has a dedicated community of supporters who remain optimistic about the cryptocurrency’s future, which could contribute to its long-term success.

However, there are also several risks and drawbacks to consider:

- Regulatory Uncertainty: The ongoing legal battle with the SEC and the potential for future regulatory challenges pose a significant risk to XRP’s long-term viability.

- Volatility: XRP’s price has historically been highly volatile, making it a risky investment for those with a low-risk tolerance.

- Decentralization Concerns: Unlike other cryptocurrencies, XRP is more centralized, with Ripple Labs maintaining significant control over the network, which could impact its long-term sustainability.

Ultimately, whether XRP is a good investment depends on your individual investment goals, risk tolerance, and understanding of the cryptocurrency market. It’s essential to conduct thorough research, diversify your portfolio, and carefully manage your risk when considering an investment in XRP.

Future Prospects and Predictions for XRP

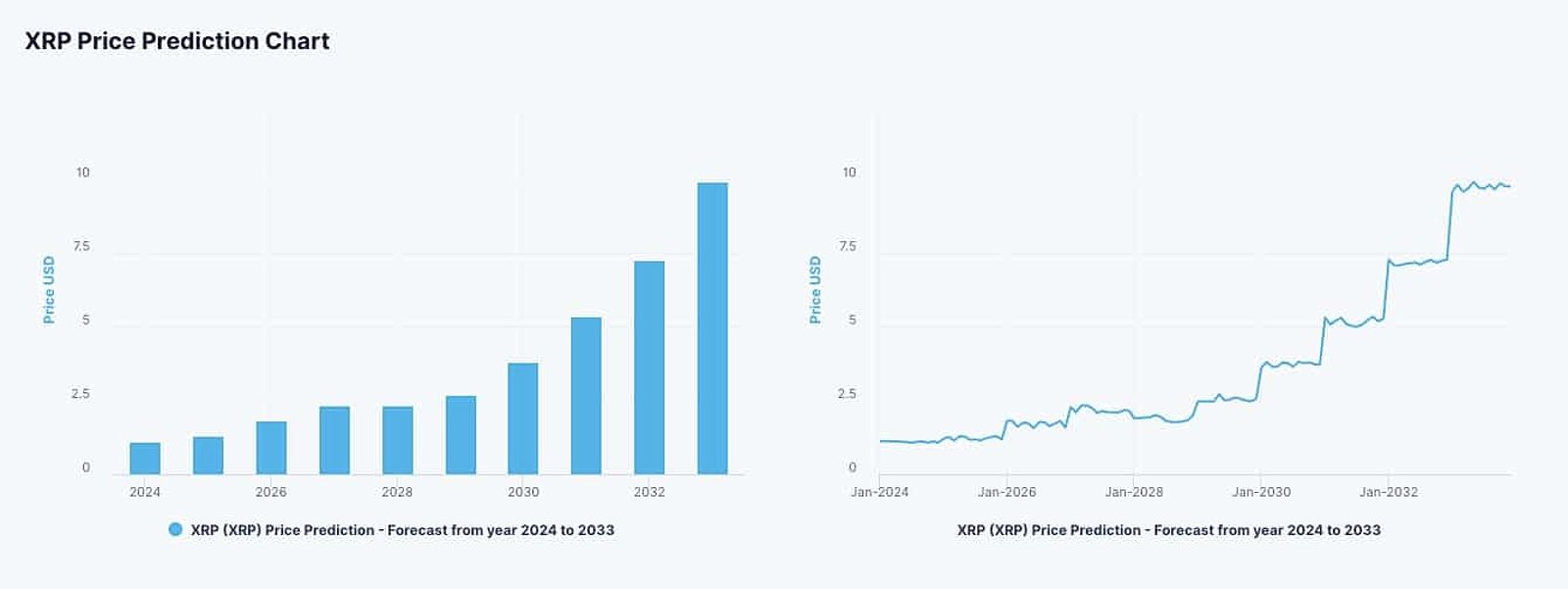

Analysts and industry experts have provided a range of predictions for XRP’s future performance. Some are optimistic about the cryptocurrency’s potential, while others remain cautious. According to cryptocurrency analysis platforms like CryptoPredictions and Crypto Ground, XRP could see steady growth in the coming years, with the potential to reach prices between $0.70 and $1.02 by the end of 2024. However, other forecasts, such as those from Wallet Investor and Long Forecast, suggest a more bearish outlook, with the possibility of XRP dropping to as low as $0.12 by 2025.

The key factors that could drive XRP’s future growth include increased adoption by financial institutions, regulatory clarity, and technological advancements within the Ripple ecosystem. Conversely, ongoing legal battles, competition from other cryptocurrencies, and broader market volatility could pose challenges to XRP’s price appreciation.

Investing in XRP: Risks and Considerations

When it comes to investing in XRP, it’s crucial to understand the risks and potential drawbacks. One of the primary concerns is the regulatory uncertainty surrounding the cryptocurrency. The ongoing lawsuit between Ripple and the SEC has created a cloud of uncertainty over XRP’s future, and an unfavorable outcome could severely impact its price and adoption.

Another significant risk is the high volatility associated with XRP. The cryptocurrency has experienced dramatic price swings in the past, and its value can be heavily influenced by market sentiment and external factors. This makes it a risky investment for those with a low-risk tolerance or a short-term investment horizon.

Additionally, the centralized nature of the Ripple network has raised concerns about the long-term decentralization and sustainability of the XRP ecosystem. While Ripple Labs has taken steps to address these concerns, the level of control the company maintains over the network could be a deterrent for some investors.

Future Prospects and Predictions for XRP

Analysts and industry experts have provided a range of predictions for XRP’s future performance. Some are optimistic about the cryptocurrency’s potential, while others remain cautious. According to cryptocurrency analysis platforms like CryptoPredictions and Crypto Ground, XRP could see steady growth in the coming years, with the potential to reach prices between $0.70 and $1.02 by the end of 2024. However, other forecasts, such as those from Wallet Investor and Long Forecast, suggest a more bearish outlook, with the possibility of XRP dropping to as low as $0.12 by 2025.

The key factors that could drive XRP’s future growth include increased adoption by financial institutions, regulatory clarity, and technological advancements within the Ripple ecosystem. Conversely, ongoing legal battles, competition from other cryptocurrencies, and broader market volatility could pose challenges to XRP’s price appreciation.

Investing in XRP: Risks and Considerations

When it comes to investing in XRP, it’s crucial to understand the risks and potential drawbacks. One of the primary concerns is the regulatory uncertainty surrounding the cryptocurrency. The ongoing lawsuit between Ripple and the SEC has created a cloud of uncertainty over XRP’s future, and an unfavorable outcome could severely impact its price and adoption.

Another significant risk is the high volatility associated with XRP. The cryptocurrency has experienced dramatic price swings in the past, and its value can be heavily influenced by market sentiment and external factors. This makes it a risky investment for those with a low-risk tolerance or a short-term investment horizon.

Additionally, the centralized nature of the Ripple network has raised concerns about the long-term decentralization and sustainability of the XRP ecosystem. While Ripple Labs has taken steps to address these concerns, the level of control the company maintains over the network could be a deterrent for some investors.

Ripple Price Predictions: 2024 and Beyond Image: Ripple Price Predictions: 2024 and Beyond

Ripple Price Predictions: 2024 and Beyond Image: Ripple Price Predictions: 2024 and Beyond

XRP (Ripple) price prediction graph by Digital Coin Price Image: XRP (Ripple) price prediction graph by Digital Coin Price

XRP (Ripple) price prediction graph by Digital Coin Price Image: XRP (Ripple) price prediction graph by Digital Coin Price

Investing in XRP: Risks and Considerations

When it comes to investing in XRP, it’s crucial to understand the risks and potential drawbacks. One of the primary concerns is the regulatory uncertainty surrounding the cryptocurrency. The ongoing lawsuit between Ripple and the SEC has created a cloud of uncertainty over XRP’s future, and an unfavorable outcome could severely impact its price and adoption.

Another significant risk is the high volatility associated with XRP. The cryptocurrency has experienced dramatic price swings in the past, and its value can be heavily influenced by market sentiment and external factors. This makes it a risky investment for those with a low-risk tolerance or a short-term investment horizon.

Additionally, the centralized nature of the Ripple network has raised concerns about the long-term decentralization and sustainability of the XRP ecosystem. While Ripple Labs has taken steps to address these concerns, the level of control the company maintains over the network could be a deterrent for some investors.

Tips for Investing in XRP

If you’re considering investing in XRP, here are some tips to keep in mind:

- Conduct Due Diligence: Thoroughly research XRP, Ripple, and the broader cryptocurrency market to understand the risks and potential rewards associated with this investment.

- Diversify Your Portfolio: Allocate only a portion of your investment portfolio to XRP, and maintain a balanced approach to mitigate the risks of volatility.

- Manage Risk: Implement risk management strategies, such as setting stop-loss orders and avoiding overexposure to XRP.

- Adopt a Long-Term Perspective: Recognize that cryptocurrency investments, including XRP, can be highly volatile in the short term, and be prepared to hold your investment for the long-term.

常见问题

Q: What is the difference between XRP and Ripple? A: XRP is the native cryptocurrency of the Ripple network, while Ripple is the company that developed the payment protocol and manages XRP’s distribution.

Q: Is XRP a good buy right now? A: Whether XRP is a good buy depends on your investment goals, risk tolerance, and understanding of the cryptocurrency market. It’s essential to conduct your own research and analysis before making an investment decision.

Q: How does the SEC lawsuit affect XRP? A: The SEC lawsuit has created regulatory uncertainty and impacted XRP’s trading on some exchanges. The outcome of the lawsuit could significantly influence XRP’s future price and adoption.

Q: What are some potential growth drivers for XRP? A: Increased adoption by financial institutions, regulatory clarity, and technological advancements within the Ripple ecosystem are some potential growth drivers for XRP.

结论

As the Crypto Sage, I’ve provided a comprehensive analysis of XRP and its investment potential. While the cryptocurrency offers promising growth opportunities, the risks and uncertainties surrounding XRP make it a complex investment proposition. Investors considering XRP must carefully weigh the pros and cons, conduct thorough research, and allocate their investments with a balanced and long-term perspective.

The future of XRP remains uncertain, but for those willing to navigate the risks, it may still hold promise. As the cryptocurrency market continues to evolve, it’s crucial to stay informed, diversify your portfolio, and make investment decisions that align with your personal goals and risk tolerance. By doing so, you can navigate the volatile world of XRP and potentially capitalize on its growth potential.

比特币

比特币  以太坊

以太坊  拴

拴  XRP

XRP  索拉纳

索拉纳  USDC

USDC  狗狗币

狗狗币  卡达诺

卡达诺  TRON

TRON