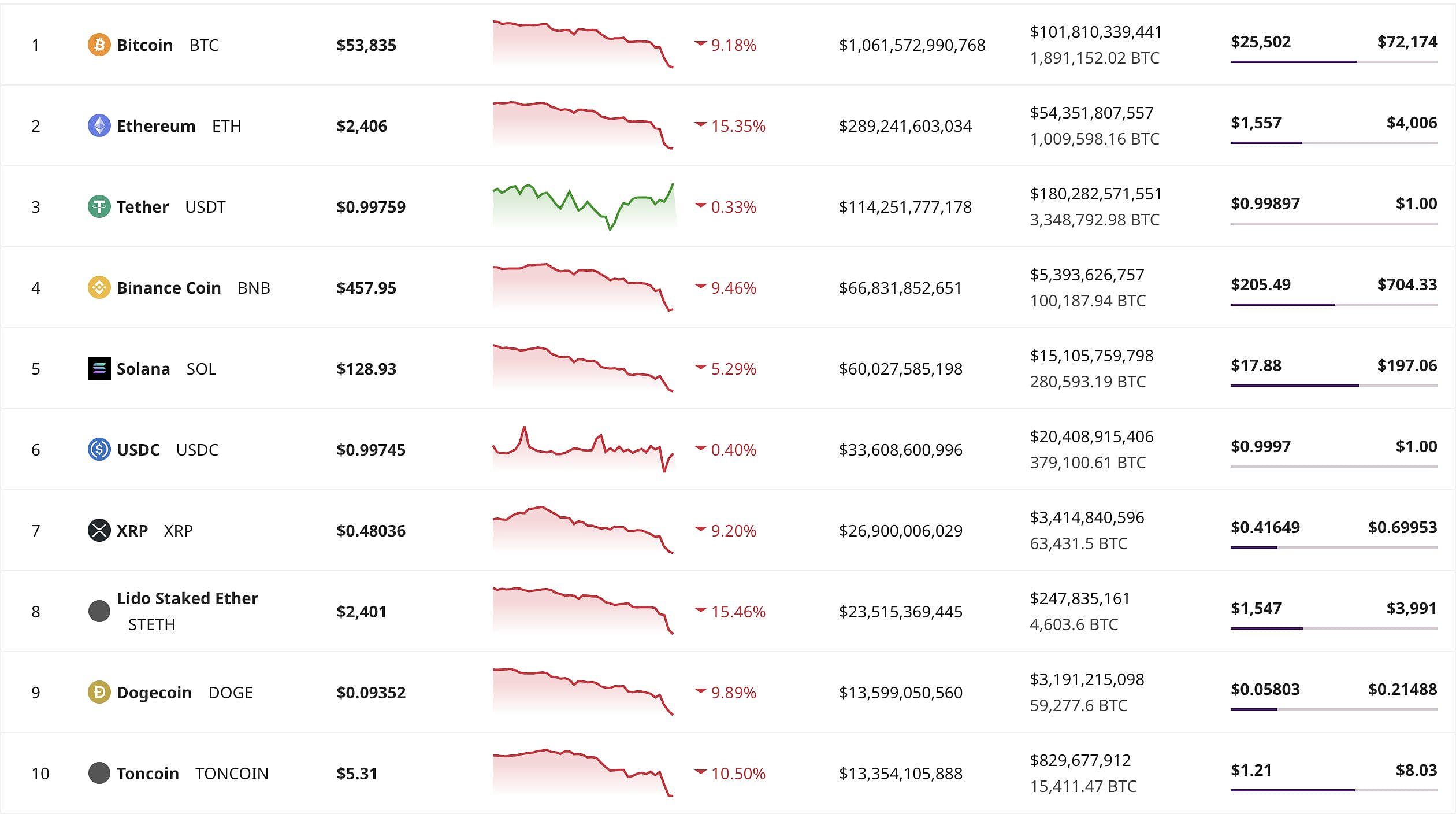

The recent turmoil in the cryptocurrency market, referred to as “Crypto Black Monday,” has left many investors reeling. This article delves into the multifaceted reasons behind this significant downturn and what it means for those holding crypto assets.

The Broader Economic Landscape

The upheaval in the crypto market did not arise in a vacuum; rather, it was exacerbated by global economic uncertainties. Concerns about a potential recession were magnified by a disappointing jobs report in July, which stoked fears and triggered a sell-off across various financial sectors. The tech-centric Nasdaq Composite index found itself in a correction phase, mirroring the growing unease among investors regarding the economic climate. Notably, the Japanese stock market faced its most severe single-day decline since 1987, illustrating the pervasive impact of these economic fears. Such interconnectedness among global markets means that negative sentiment in one sector can easily permeate others, including cryptocurrencies.

Unique Catalysts Within the Crypto Sphere

While the broader economic context laid the groundwork for the crash, specific developments within the crypto landscape intensified the downward spiral. The ongoing distribution of Bitcoin as a result of the Mt. Gox bankruptcy proceedings generated considerable selling pressure, further propelling prices downwards. In addition, Jump Crypto, a prominent player in the crypto realm, liquidated substantial amounts of Ethereum, a move that raised eyebrows and contributed to market instability. This liquidation, possibly linked to margin calls in traditional markets or looming regulatory issues, underscored the influence of institutional investors on crypto sentiment. Furthermore, the crash prompted a wave of liquidations in decentralized finance (DeFi) protocols, where heightened volatility and interconnected platforms led to a cascade of forced sales.

Consequences for Crypto Investors

The fallout from the “Crypto Black Monday” was felt acutely by investors, with impacts varying based on their investment approaches and risk appetites. Short-term traders, often operating with high leverage, found themselves particularly exposed to the swift price declines. Conversely, long-term holders, who typically adopt a buy-and-hold strategy, experienced a temporary setback in their portfolio valuations. However, their investment philosophy generally insulates them from the short-term fluctuations that can cause panic. DeFi participants also faced challenges, as the spike in liquidations revealed the vulnerabilities inherent in decentralized financial systems.

Strategies for Navigating Market Turbulence

The recent crash serves as a stark reminder of the volatility that defines the cryptocurrency market. To successfully navigate these turbulent waters, investors must take a proactive stance. Staying updated on market developments and economic indicators is essential for understanding the factors driving price shifts. Employing robust risk management techniques—such as diversification, implementing stop-loss orders, and judicious portfolio allocation—can help mitigate potential losses. Maintaining a long-term outlook is crucial; it allows investors to avoid the pitfall of panic selling during periods of market stress. Emotional discipline is equally vital, as hasty decisions made under duress can lead to regrettable financial consequences.

结论

The “Crypto Black Monday” event was a potent reminder of the volatility inherent in the cryptocurrency market. It was shaped by a combination of global economic anxieties and unique events within the crypto sphere, highlighting the intricate interdependencies of financial markets. Investors must remain vigilant in the face of market fluctuations, adopt effective risk management strategies, and cultivate a long-term perspective to thrive in the ever-evolving crypto landscape. While the recent crash may have been disconcerting, it is crucial to recognize that the crypto sector is still in its formative stages, presenting opportunities for substantial growth in the future.

比特币

比特币  以太坊

以太坊  拴

拴  XRP

XRP  索拉纳

索拉纳  狗狗币

狗狗币  USDC

USDC  丽都以太

丽都以太  卡达诺

卡达诺

+ 没有评论

添加您的