Exploring the key differences between crypto wallets and exchanges can be crucial for both novice and experienced investors in the ever-evolving world of digital assets. This comprehensive guide will help you understand the intricacies of these two options, enabling you to make an informed decision that aligns with your investment goals and risk tolerance.

Crypto Wallets: The Keys To Your Digital Kingdom

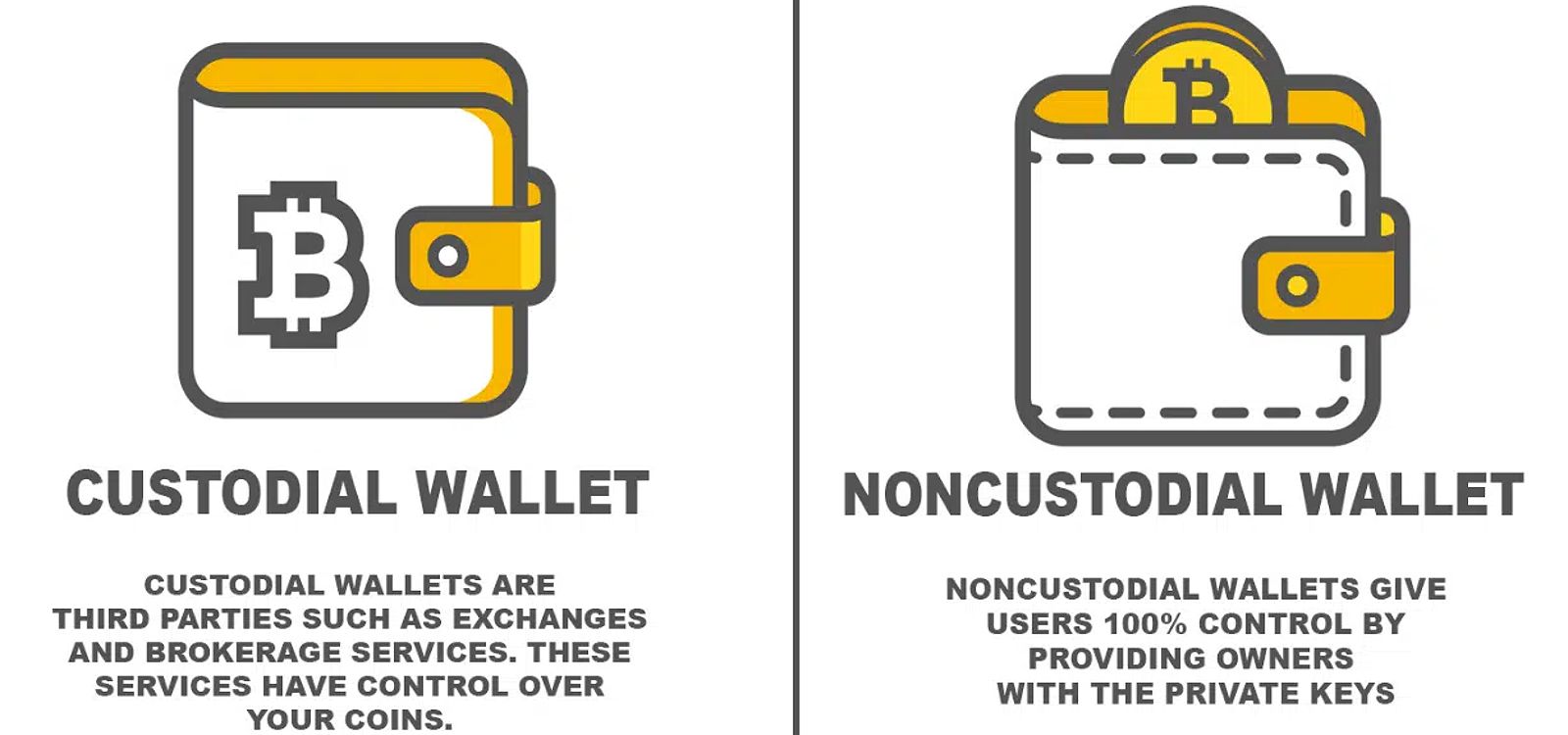

Crypto wallets are the digital safes that hold the keys to your cryptocurrency kingdom. These wallets don’t actually store your coins; instead, they keep the unique cryptographic keys that grant you access to your funds on the blockchain. This distinction is crucial, as it underscores the importance of maintaining control over your private keys.

I’ve had the opportunity to work with a variety of crypto wallet solutions, and I can attest to the unique advantages they offer. Software wallets, like MetaMask and Trust Wallet, provide a user-friendly experience, allowing you to manage your assets directly from your device. Hardware wallets, such as Ledger and Trezor, prioritize security by storing your private keys offline, shielding them from online threats. And while paper wallets are a less common option, they offer an even more secure offline storage solution, albeit with a steeper learning curve.

Crypto Exchanges: The Marketplaces Of The Digital Asset World

On the other hand, crypto exchanges are the digital marketplaces where users can buy, sell, and trade various cryptocurrencies. These platforms act as intermediaries, matching buyers and sellers and facilitating the exchange of digital assets. Exchanges can be categorized as centralized (CEXs) or decentralized (DEXs), each with their own unique advantages and drawbacks.

Centralized exchanges, like Coinbase and Binance, offer a user-friendly interface and a wide range of trading options. However, they also require users to entrust the exchange with the custody of their funds, meaning the exchange holds the private keys to your assets. Decentralized exchanges, such as Uniswap and Sushiswap, provide a more secure alternative by allowing users to trade directly from their own crypto wallets, maintaining control over their private keys.

Comparison between crypto wallets and exchange wallets

Comparison between crypto wallets and exchange wallets

Crypto Wallet Vs Exchange: A Comparison Of Security And Convenience

As I’ve navigated the crypto landscape, I’ve come to appreciate the distinct strengths and weaknesses of both crypto wallets and exchanges. The choice between the two ultimately depends on your investment strategy and personal preferences.

Crypto Wallets:

Pros:

- Security: Holding your private keys in a self-custody wallet gives you complete control over your assets, reducing the risk of third-party interference or theft.

- Privacy: Using a crypto wallet eliminates the need to share personal information with a third-party exchange, preserving your financial privacy.

- Control: Wallets allow you to manage your crypto holdings directly, without relying on an intermediary.

Cons:

- Security Responsibility: With self-custody, the responsibility for securing your private keys and protecting your assets lies solely with you.

- Complexity: Setting up and managing a crypto wallet may require a higher level of technical expertise compared to using an exchange.

Crypto Exchanges:

Pros:

- Ease of Use: Exchanges often provide a user-friendly interface, making it straightforward for beginners to buy, sell, and trade cryptocurrencies.

- Convenience: Exchanges may offer additional features, such as customer support and wallet services, which can be appealing for those new to the crypto space.

Cons:

- Security Concerns: By entrusting your funds to a centralized exchange, you’re relinquishing control of your private keys, making your assets vulnerable to potential hacks or mismanagement.

- Privacy Risks: Exchanges typically require users to provide personal information, which can compromise your financial privacy.

- Fees: Exchanges may charge various fees for transactions, which can eat into your profits.

Choosing The Right Crypto Wallet

If you’ve decided that a crypto wallet is the right choice for you, the first step is to evaluate your needs and select the type of wallet that best suits your requirements. As mentioned earlier, software wallets, hardware wallets, and paper wallets each offer their own unique advantages.

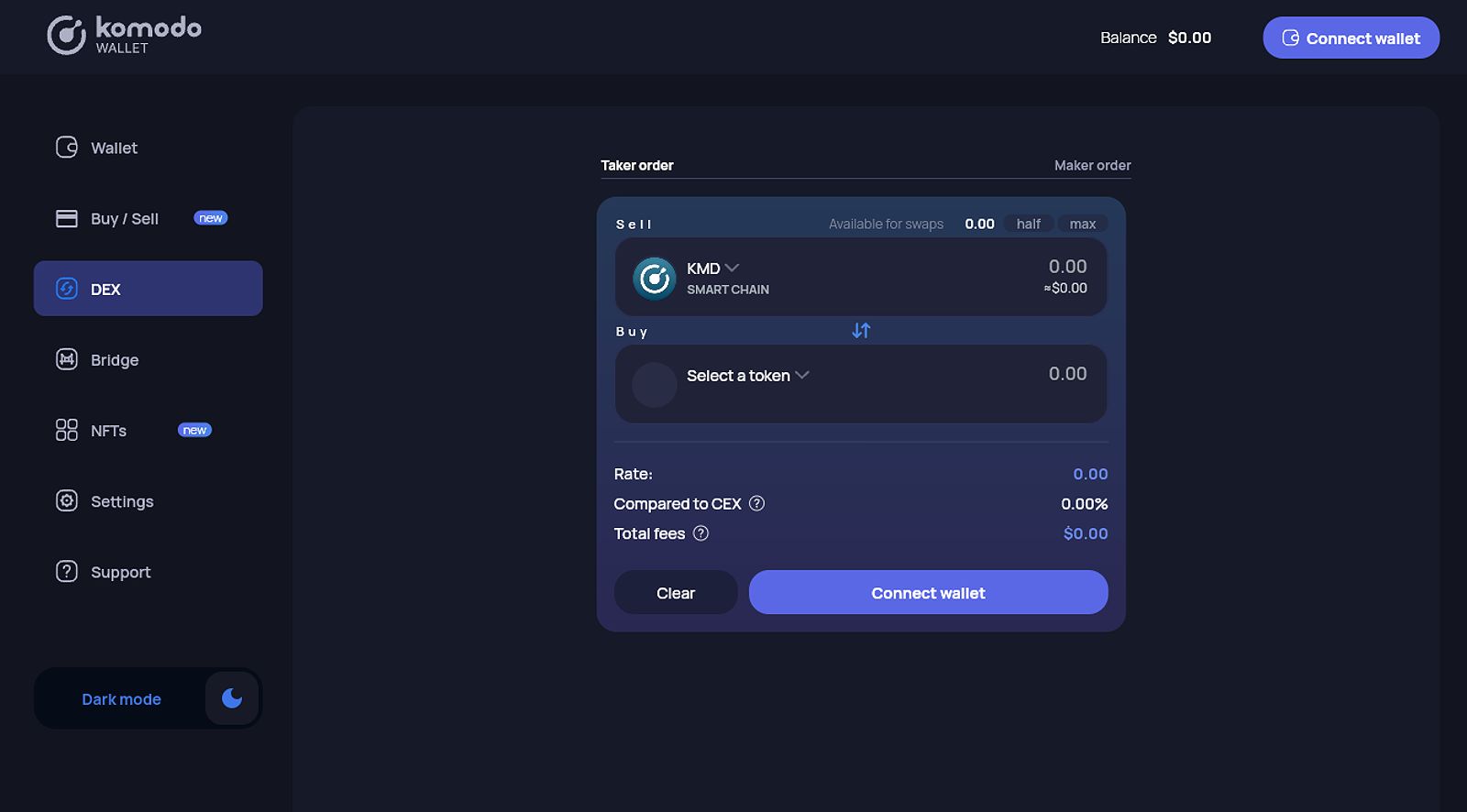

Komodo Wallet

Komodo Wallet

Personally, I prefer to use a hardware wallet like Ledger or Trezor for long-term storage of my crypto assets. The added security and peace of mind that comes with offline storage is worth the small investment in my opinion. However, I also maintain a software wallet like MetaMask for more frequent transactions and interactions with decentralized applications (dApps).

Regardless of the wallet type you choose, it’s crucial to securely back up your recovery phrase (a list of words that allows you to restore your wallet if needed) and store it offline in a safe place. This essential step can mean the difference between regaining access to your funds or losing them forever.

Navigating The Crypto Exchange Landscape

For those interested in using a crypto exchange, the process typically begins with creating an account and verifying your identity. This “know your customer” (KYC) procedure is a standard practice that exchanges use to comply with regulatory requirements.

Once your account is set up, you’ll need to deposit funds, either through a bank transfer or by using a credit/debit card. With your funds available, you can start exploring the exchange’s trading interface and select the cryptocurrencies you wish to buy, sell, or trade.

When choosing a crypto exchange, it’s important to consider factors such as security measures, user interface, the variety of cryptocurrencies supported, trading fees, and customer support. Additionally, researching the exchange’s reputation and regulatory compliance can help you make an informed decision.

Faq

Q: What is the difference between a “hot wallet” and a “cold wallet”? A: Hot wallets are crypto wallets that are connected to the internet, making them more convenient but potentially more vulnerable to online threats. In contrast, cold wallets are offline devices that store your private keys, offering a higher level of security but may be less accessible for frequent transactions.

Q: How do I choose the right crypto exchange for me? A: When selecting a crypto exchange, consider factors such as security measures, user interface, the variety of cryptocurrencies supported, trading fees, and customer support. It’s also important to research the exchange’s reputation and regulatory compliance.

Q: Is it safe to store my crypto on an exchange? A: While crypto exchanges provide a user-friendly platform for trading and managing your digital assets, they also come with inherent risks. Centralized exchanges hold custody of your private keys, making your funds vulnerable to potential hacks or mismanagement. For long-term storage, it’s generally recommended to keep your crypto in a self-custody wallet.

Conclusion

As we move deeper into the crypto era, the choice between using a crypto wallet or a crypto exchange has become a critical decision for both novice and experienced investors. Crypto wallets offer enhanced security and control over your assets, while exchanges provide a more convenient and user-friendly experience, especially for beginners.

By carefully weighing the pros and cons of each option, staying informed and adaptable as the crypto landscape continues to evolve, you can unlock the full potential of the decentralized financial future.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON