Is Russia poised to become a cryptocurrency mining superpower? This question hangs in the air as the nation witnesses a remarkable surge in mining activities, fueled by recent legal reforms and a complex geopolitical backdrop. As a potential investor, one must ponder not just the immediate gains but also the broader implications of engaging in this rapidly evolving sector.

Factors Driving the Growth of Crypto Mining in Russia

The current transformation of Russia’s cryptocurrency landscape is not merely a result of technological advancements; it is deeply intertwined with recent legislative changes that have reshaped the mining environment. A pivotal law now allows individuals and enterprises to mine cryptocurrency legally, provided they remain within a specified energy consumption limit of 6,000 kWh monthly. This shift has essentially converted what was once a gray area into a recognized domain of entrepreneurship, thereby widening the pool of participants eager to explore this newfound avenue.

Moreover, President Vladimir Putin’s endorsement of crypto mining has injected a sense of legitimacy into the sector. His calls for regions with surplus energy to delve into mining opportunities have not only encouraged local investments but also attracted interest from foreign entities, particularly from fellow BRICS nations. This combination of legal endorsement and governmental support creates a fertile ground for the mining industry to flourish, yet it also invites scrutiny regarding the long-term sustainability of such growth.

The geopolitical context cannot be overlooked either. As Western sanctions tighten their grip on the Russian economy, local enterprises are increasingly turning to cryptocurrencies as alternative financial channels. This pivot toward digital currencies serves as both a survival strategy and an opportunity for investors looking to establish a presence in this dynamic market.

Evaluating the Profitability of Mining Investments

Navigating the profitability of investing in crypto mining in Russia requires a thoughtful examination of various factors. One of the most critical elements is the cost of electricity, which fluctuates significantly across the vast expanse of the country. Regions blessed with cheaper energy sources stand to offer higher profit margins, rendering them attractive for mining ventures. Conversely, areas with elevated electricity costs could diminish potential returns, emphasizing the need for a meticulous location assessment prior to investment.

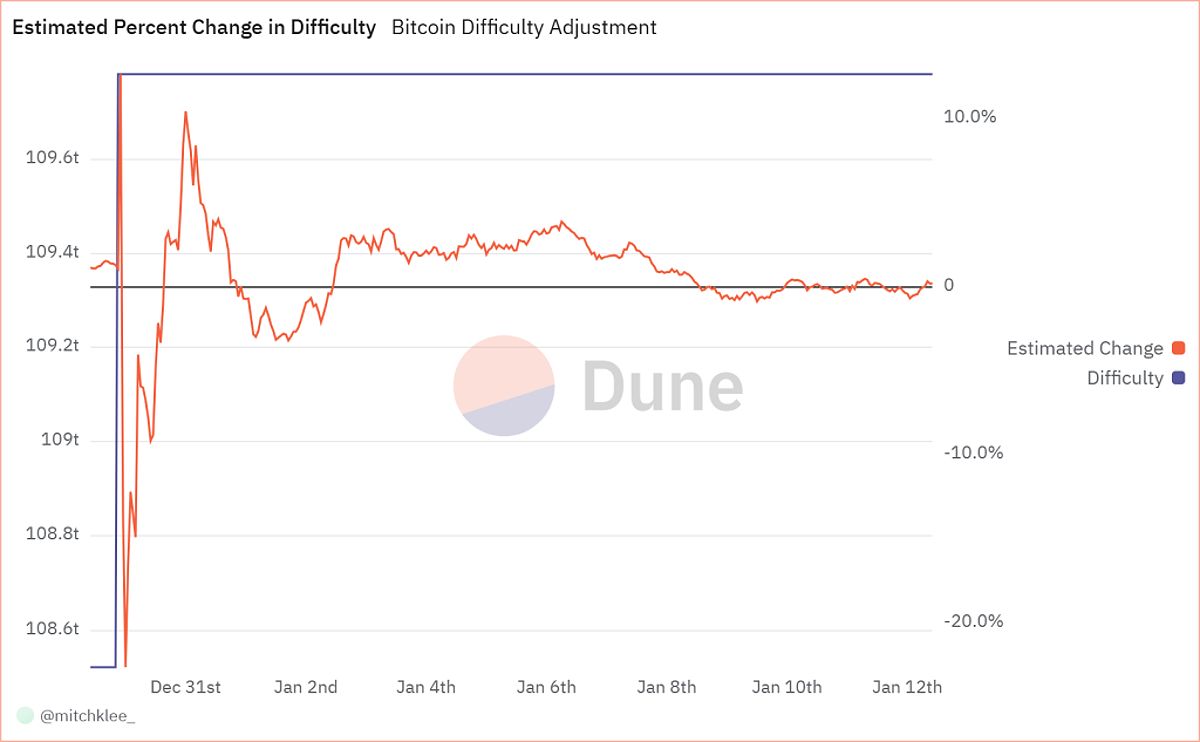

The dynamics of mining hardware prices and the associated difficulties in mining specific cryptocurrencies further complicate the profitability landscape. With an influx of new miners entering the fray, the complexity of mining Bitcoin and other cryptocurrencies typically escalates, which can adversely affect returns. Consequently, a comprehensive market analysis becomes imperative for investors aiming to identify the most favorable conditions for their operations.

Conducting a thorough cost-benefit analysis can unveil valuable insights into the potential returns on investment. For instance, large-scale mining operations may enjoy economies of scale, allowing them to operate more efficiently than smaller, individual setups. By juxtaposing various mining scenarios—ranging from extensive operations to home-based initiatives—investors can better gauge potential ROI and make informed decisions.

Understanding the Regulatory Environment

The regulatory environment surrounding crypto mining in Russia is both intricate and continually evolving. Miners are presently required to register their activities and adhere to specific tax obligations, particularly if they exceed the energy consumption threshold of 6,000 kWh. A nuanced understanding of these regulations is essential for investors seeking to navigate the complexities of the Russian crypto mining landscape.

The Central Bank of Russia, in conjunction with the State Duma, plays a pivotal role in shaping the nation’s crypto policy. While the current environment appears conducive to growth, there is an undercurrent of uncertainty regarding potential future regulatory modifications. The introduction of a regulatory “sandbox” aims to experiment with new frameworks for crypto transactions, which could either facilitate progress or impose additional constraints on market participants.

Additionally, the specter of sanctions adds layers of complexity to the investment landscape. Investors must weigh the geopolitical risks inherent in engaging with a nation under international scrutiny. The potential for regulatory crackdowns in response to such sanctions necessitates a careful analysis of risks, especially in comparison to more stable jurisdictions.

Investment Strategies and Due Diligence

When contemplating investments in the Russian crypto mining arena, various strategies can be employed to mitigate risks while enhancing potential returns. Direct investments in mining operations can offer considerable upside, yet they demand thorough due diligence to ensure compliance with local regulations and a comprehensive understanding of operational costs.

Alternatively, investing in mining companies may provide a more diversified approach, granting exposure to the market without the need for direct management of mining operations. This strategy allows investors to leverage the expertise of established entities while distributing risk across a portfolio of assets. Another avenue worth exploring is participation in mining pools, where miners amalgamate their resources to bolster their chances of earning rewards. Each of these strategies carries its own unique risks and rewards, underscoring the importance of assessing personal risk tolerance and investment objectives.

The process of conducting diligent research is crucial before committing to any investment. This exploration should encompass a thorough evaluation of potential partners, focusing on their financial stability and operational capabilities. Additionally, an understanding of the sustainability of energy sources and the environmental ramifications of mining activities is vital for making informed investment choices.

Conclusion

The burgeoning crypto mining sector in Russia presents a multifaceted investment opportunity, driven by favorable legislative reforms and a supportive regulatory framework. However, as potential investors navigate this complex landscape, they must remain acutely aware of the inherent rewards and risks involved. By engaging in thorough research and due diligence, investors can position themselves to harness the growth of this dynamic market while maintaining a keen awareness of the geopolitical and regulatory challenges that may emerge. In this evolving sector, adaptability and informed decision-making will be paramount to achieving success in the long run.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON